Weekly Rice Market

(Indicative Quotes)

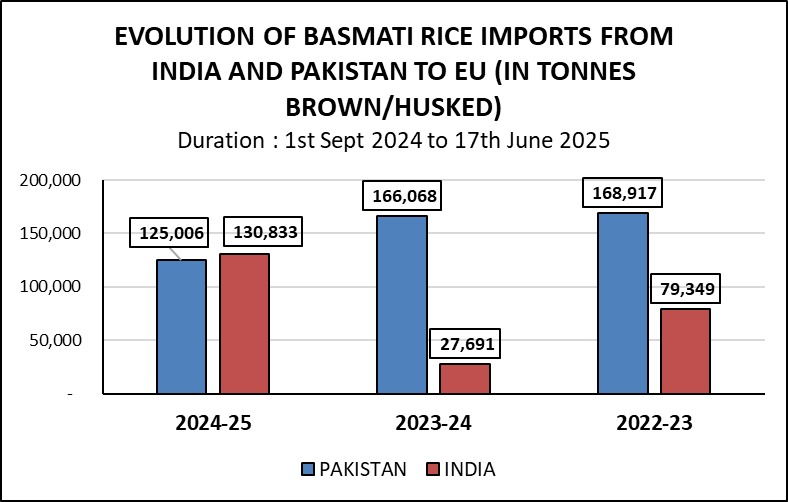

Basmati Rice

Basmati Rice | Indicative Quotes | Updated Weekly

Global Market | White Rice

White Rice | Indicative Quotes | Updated Weekly

| Origin | Type of Rice | Variety Name | Broken | Price | Change | High | Low |

|---|---|---|---|---|---|---|---|

| India | Milled White Rice | Long Grain | 5% | $376 | 0 | $380 | $376 |

| India | Milled White Rice | Long Grain | 5% | $381 | 0 | $496 | $379 |

| Pakistan | Milled White Rice | Long Grain | 5% | $346 | -11 | $360 | $346 |

| Pakistan | Milled White Rice | Long Grain | 5% | $380 | -11 | $640 | $380 |

| Pakistan | Milled White Rice | Long Grain | 5% | $590 | -11 | $613 | $488 |

| Thailand | Milled White Rice | Long Grain | 5% | $355 | -7 | $379 | $355 |

| Thailand | Milled White Rice | Long Grain | 5% | $387 | -7 | $669 | $387 |

| Thailand | Milled White Rice | Long Grain | 5% | $596 | -7 | $659 | $469 |

| U.S | Milled White Rice | Long Grain | 4% | $606 | 0 | $622 | $600 |

| U.S | Milled White Rice | Long Grain | 4% | $654 | 0 | $818 | $654 |

| U.S | Milled White Rice | Long Grain | 4% | $798 | 0 | $798 | $708 |

| Vietnam | Milled White Rice | Long Grain | 5% | $379 | 0 | $403 | $378 |

| Vietnam | Milled White Rice | Long Grain | 5% | $386 | 0 | $657 | $382 |

| Vietnam | Milled White Rice | Long Grain | 5% | $579 | 0 | $667 | $445 |

News

ASIA RICE-Thai pri...

ASIA-RICE/ (REPEAT):RPT-ASIA RICE-Thai prices extend slump to 18-year low as demand falters. Reuters By Anushree Mukherjee Oct 16 (Reuters) – Thailand’s rice export

Africa emerges as ...

As the Philippines and Indonesia tighten rice imports, Vietnamese exporters are expanding into Africa, where demand for the grain is rising rapidly. Vietnam’s rice industry

Thai rice exports ...

ANN/THE NATION – Thailand’s rice export industry has raised concerns following the signing of a new trade agreement between the United States and Japan, which could see

Race to secure 202...

With early shipments of rice from the 2025 harvest having reached the market, attention is turning to supply, demand and prices amid uncertainty over how this summer’s

Cibus, AgVayã part...

By Susan Reidy SAN DIEGO, CALIFORNIA, US — Cibus, which specializes in development and licensing of gene-edited plant traits, and AgVayā, a strategic growth advisory firm,

Agriculture depart...

By: Jordeene B. Lagare MANILA, Philippines — The Department of Agriculture (DA) has earmarked P3.3 billion to improve rice yield and reduce postharvest losses over the next

US-Japan Trade Dea...

Thailand’s rice export sector is expressing alarm after a new trade agreement between the United States and Japan was sealed, potentially cutting Thailand’s rice quota

Why are Punjab ric...

Experts and farmer unions demand a consistent and science-backed policy on hybrid paddy rather than reactive bans and sudden market shifts that leave both farmers and millers in

Global Rice Prices...

Plenty of supply and hesitant buyers are dragging down rice prices across Asia, while Bangladesh faces rising costs at home despite a healthy harvest. Finimize Newsroom What’s

Featured Registered Companies

RNT Tube

Rice Farmers in Crisis Huge Losses as Costs Soar & Prices Crash Buyers Exploit Market

October 6, 2025

Statistics

Sustainable Rice

Farmers Place

Forex Rates

Open Market Forex Rates

Updated at:

From | ||

|---|---|---|

To | ||

| Countries | Currency | Spot Rate |

Enjoyed the read?

Join our monthly newsletter for helpful tips on how to run your business smoothly