Weekly Rice Market

(Indicative Quotes)

Basmati Rice

Basmati Rice | Indicative Quotes | Updated Weekly

Global Market | White Rice

White Rice | Indicative Quotes | Updated Weekly

| Origin | Type of Rice | Variety Name | Broken | Price | Change | High | Low |

|---|---|---|---|---|---|---|---|

| India | Milled White Rice | Long Grain | 5% | $355 | +1 | $380 | $348 |

| India | Milled White Rice | Long Grain | 5% | $381 | +1 | $496 | $379 |

| Pakistan | Milled White Rice | Long Grain | 5% | $366 | -3 | $374 | $334 |

| Pakistan | Milled White Rice | Long Grain | 5% | $380 | -3 | $640 | $380 |

| Pakistan | Milled White Rice | Long Grain | 5% | $590 | -3 | $613 | $488 |

| Thailand | Milled White Rice | Long Grain | 5% | $404 | -6 | $430 | $351 |

| Thailand | Milled White Rice | Long Grain | 5% | $387 | -6 | $669 | $387 |

| Thailand | Milled White Rice | Long Grain | 5% | $596 | -6 | $659 | $469 |

| U.S | Milled White Rice | Long Grain | 4% | $565 | -1 | $622 | $565 |

| U.S | Milled White Rice | Long Grain | 4% | $654 | -1 | $818 | $654 |

| U.S | Milled White Rice | Long Grain | 4% | $798 | -1 | $798 | $708 |

| Vietnam | Milled White Rice | Long Grain | 5% | $363 | -4 | $403 | $360 |

| Vietnam | Milled White Rice | Long Grain | 5% | $386 | -4 | $657 | $382 |

| Vietnam | Milled White Rice | Long Grain | 5% | $579 | -4 | $667 | $445 |

News

Rice exports up 83...

Chea Vanyuth / Khmer Times Synopsis: Cambodia exports to 51 international markets across Asia, Europe and other regions. Cambodia exported 247,822 tonnes of milled rice in the

Indonesia holds 32...

Jakarta (ANTARA) – Agriculture Minister Andi Amran Sulaiman ensured that Indonesia had secured rice stocks for the next 324 days, or nearly 11 months, with monthly

Rice exports for I...

observerid.com Jakarta, IO – Sacks of rice are carried at a warehouse of Perum Bulog in Kelapa Gading, Jakarta (Mar. 4). The Indonesian Government has begun exporting rice to

February rice expo...

Global New Light of Myanmar According to records from the Myanmar Rice Federation (MRF), Myanmar earned US$55 million from the export of 178,191.5 tonnes of rice and broken rice

0.5 MT rice cargoe...

As regional conflict intensifies and shipping routes through the Strait of Hormuz face severe disruptions, India’s rice exporters are grappling with skyrocketing ocean

Iran crisis leaves...

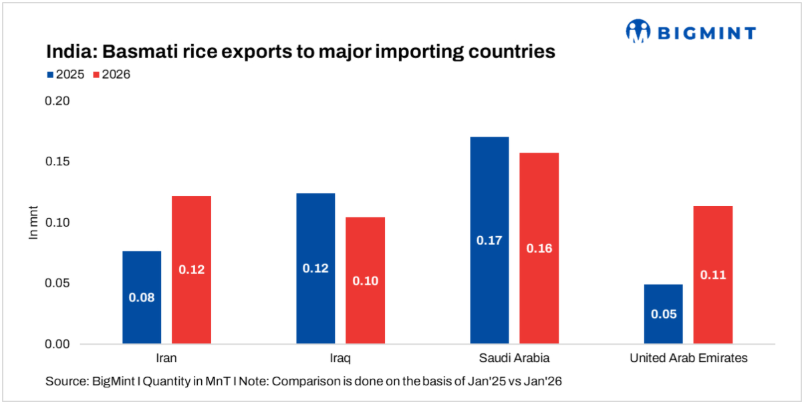

India’s basmati rice export trade has encountered a logistical bottleneck after escalating geopolitical tensions in the Middle East disrupted shipping routes to Iran,

Iran crisis: 60,00...

Exporters ask Centre to recognise current logistics disruption as a force majeure type; close to 90% of total rice exports to West Asia, worth about ₹25,000 crore annually, is

Indonesia launches...

Indonesia launches first rice exports for Hajj Pilgrims. Jakarta (ANTARA) – Indonesia has begun exporting 2,280 tonnes of rice to Saudi Arabia, marking the first time the

Basmati rice price...

Jayashree Bhosale, ET Bureau Synopsis Basmati rice prices have dropped locally due to disruptions in exports to the Middle East. This key market accounts for half of

Featured Registered Companies

RNT Tube

India-EU FTA Sparks Alarm In Pakistan As Export Edge Fades And 10 Million Jobs Face Uncertain Future

February 10, 2026

Statistics

Sustainable Rice

Farmers Place

Upcoming Events

Forex Rates

Open Market Forex Rates

Updated at:

From | ||

|---|---|---|

To | ||

| Countries | Currency | Spot Rate |

Enjoyed the read?

Join our monthly newsletter for helpful tips on how to run your business smoothly