Weekly Rice Market

(Indicative Quotes)

Basmati Rice

Basmati Rice | Indicative Quotes | Updated Weekly

Global Market | White Rice

White Rice | Indicative Quotes | Updated Weekly

News

Qatar keen on boos...

Projects such as Karachi port expansion and other strategic initiatives were highlighted as potential areas for collaboration BR Web Desk Pakistan and Qatar have discussed

PM requires action...

Chu Minh Khôi Increasingly complex and unpredictable global and regional developments could affect global rice supply, demand and prices. Prime Minister Pham Minh Chinh issued an

Indian rice export...

By Rajendra Jadhav MUMBAI, March 12 (Reuters) – Rice exports from India are slowing as the U.S.-Israeli war on Iran pushes up freight and insurance costs, making it

Rice Summit Streng...

ROATÁN, HONDURAS – Ten USA Rice staff and members participated in the 2026 Rice Summit here hosted by the National Association of Honduran Rice Millers (ANAMH), where USA Rice

India’s rice...

By: 101 finance India’s Rice Export Ambitions Face Geopolitical Headwinds India’s rice export campaign remains robust, yet the journey toward its ambitious annual target

Doha interested in...

Pakistan, Qatar ministers agree to enhance economic ties, food security partnership. APP ISLAMABAD: Federal Minister for Commerce Jam Kamal Khan held a virtual meeting with

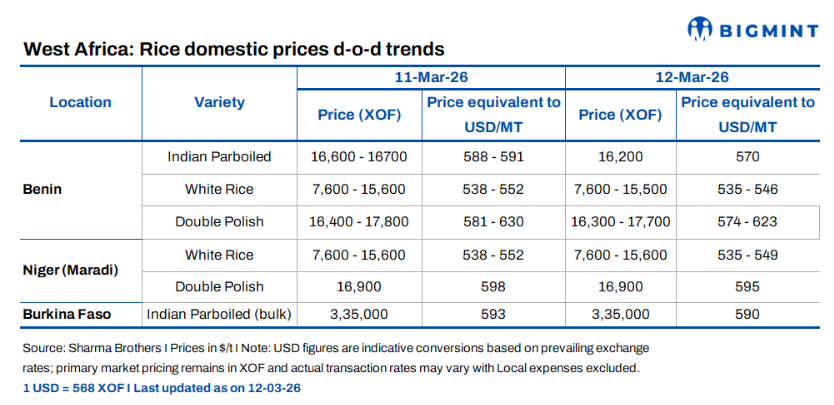

West African rice ...

Domestic rice prices in key West African markets showed modest declines from 11 to 12 March 2026, reflecting ample Indian parboiled imports and stable local supplies. At 1 USD =

APEDA facilitates ...

TNM (With ANI Inputs) The Agricultural and Processed Food Products Export Development Authority (APEDA), under the Ministry of Commerce and Industry, facilitated the first export

PM orders coordina...

Prime Minister Pham Minh Chinh has called for coordinated actions to ensure stable rice production and sale amid evolving domestic and global conditions, according to an official

Featured Registered Companies

RNT Tube

India-EU FTA Sparks Alarm In Pakistan As Export Edge Fades And 10 Million Jobs Face Uncertain Future

February 10, 2026

Statistics

Sustainable Rice

Farmers Place

Upcoming Events

Forex Rates

Open Market Forex Rates

Updated at:

From | ||

|---|---|---|

To | ||

| Countries | Currency | Spot Rate |

Enjoyed the read?

Join our monthly newsletter for helpful tips on how to run your business smoothly