Advertisement

Weekly Rice Market

(Indicative Quotes)

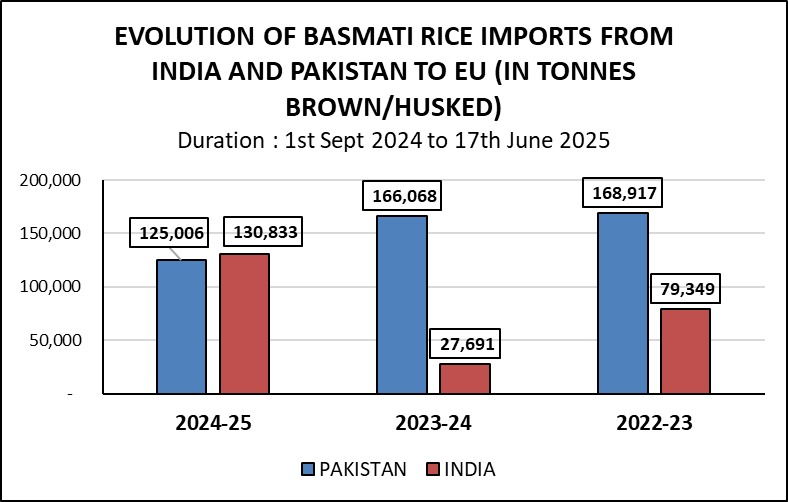

Basmati Rice

Basmati Rice | Indicative Quotes | Updated Weekly

Global Market | White Rice

White Rice | Indicative Quotes | Updated Weekly

| Origin | Type of Rice | Variety Name | Broken | Price | Change | High | Low |

|---|---|---|---|---|---|---|---|

| India | Milled White Rice | Long Grain | 5% | $383 | -2 | $496 | $380 |

| Pakistan | Milled White Rice | Long Grain | 5% | $394 | -2 | $640 | $381 |

| Pakistan | Milled White Rice | Long Grain | 5% | $590 | -2 | $613 | $488 |

| Thailand | Milled White Rice | Long Grain | 5% | $406 | -10 | $669 | $399 |

| Thailand | Milled White Rice | Long Grain | 5% | $596 | -10 | $659 | $469 |

| U.S | Milled White Rice | Long Grain | 4% | $662 | -3 | $818 | $662 |

| U.S | Milled White Rice | Long Grain | 4% | $798 | -3 | $798 | $708 |

| Vietnam | Milled White Rice | Long Grain | 5% | $387 | -4 | $657 | $387 |

| Vietnam | Milled White Rice | Long Grain | 5% | $579 | -4 | $667 | $445 |

News

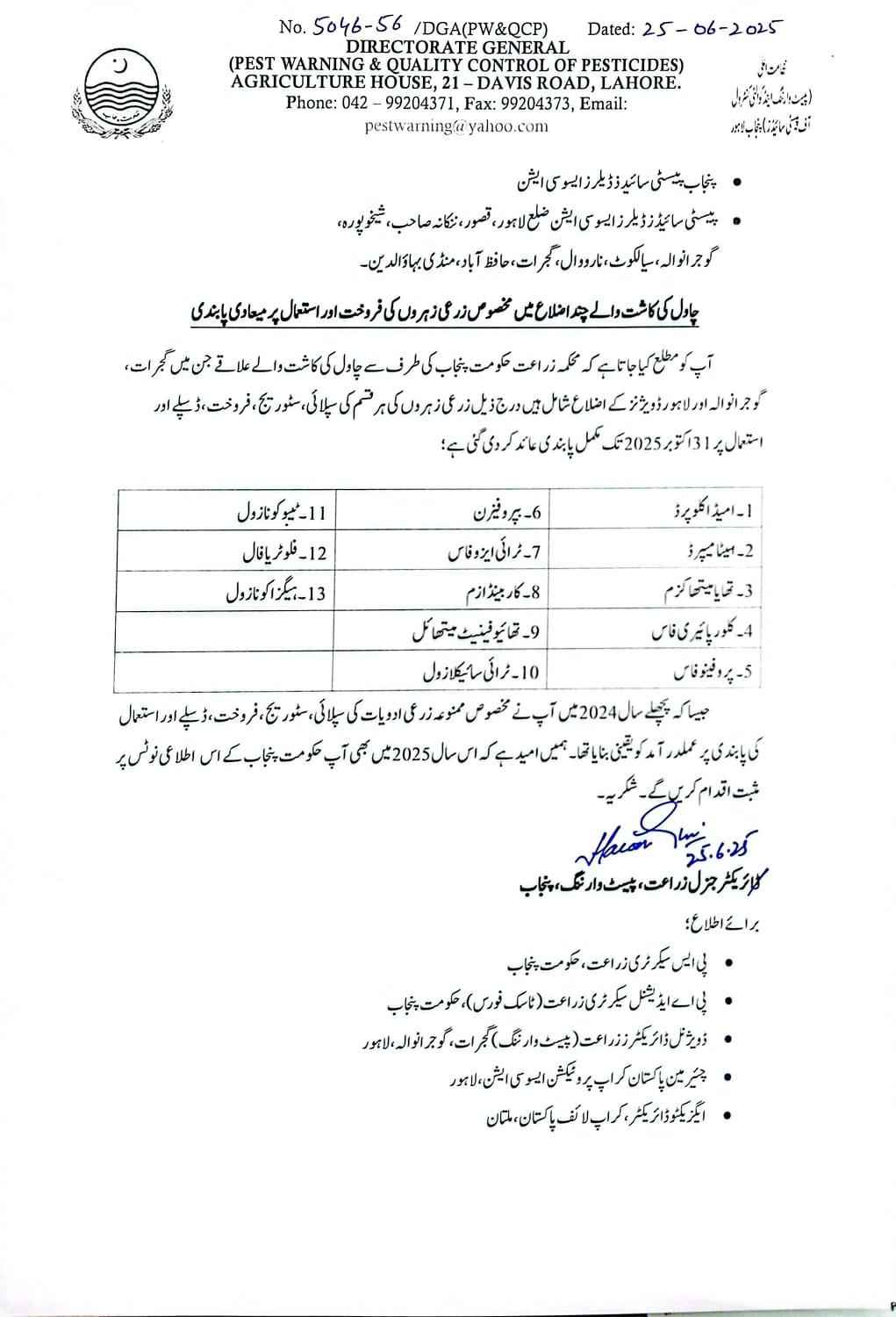

Pesticide registra...

Large number of registration cases remain pending with regulatory authority. By Ghulam Abbas ISLAMABAD: Pakistan’s agriculture sector is facing growing uncertainty as

Minister Admits No...

Reporter Alfitria Nefi P TEMPO.CO, Jakarta – Indonesia’s Minister of Agriculture Amran Sulaiman admitted that not all rice distributed by the Bulog (National

Mukul Agrawal port...

Shares of LT Foods, which own flagship rice brand ‘Daawat’, hit a new high of ₹509 today. The stock has rallied 26% in the past eight trading days after Iran-Israel

N. Korean rice pri...

“With rice prices skyrocketing when nobody can make money in the markets, many people complain they can’t put food on the table,” a source told Daily NK. By

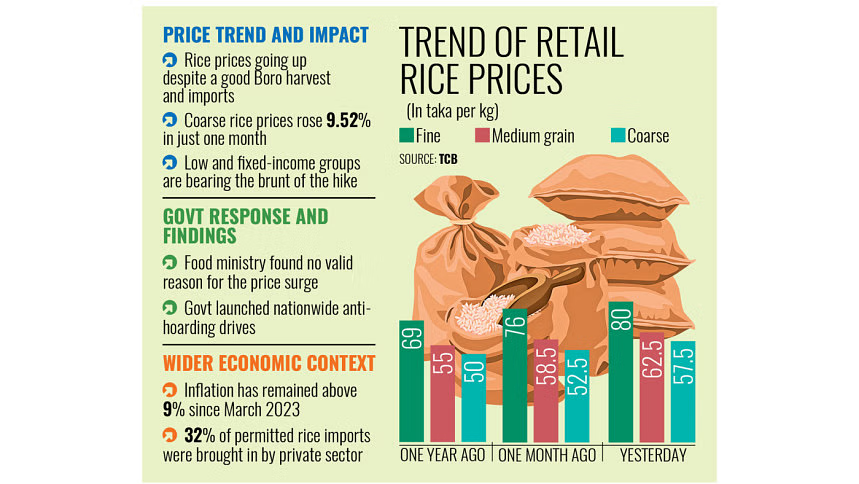

Rice prices rise d...

Sukanta Halder Rice prices have increased by Tk 3 to Tk 5 per kilogramme across all categories over the past month, despite the recent Boro harvest and continuing imports of the

Indian govt to hik...

The Committee of Secretaries has decided to increase the prices of wheat and rice to be sold via the open market sale scheme. By Subramani Ra Mancombu The Indian government has

Govt imports recor...

8.30 lakh tonnes of rice, 4.66 lakh tonnes of wheat imported last fiscal. Shaikh Abdullah The government imported a record 12.96 lakh tonnes of food grains in the just concluded

Total sown area th...

TOI Business Desk India’s Kharif crop sowing surged by 11.3% year-on-year as of June 27, 2025, propelled by a strong southwest monsoon and 9% above-average rainfall. Pulses and

Committee endorses...

NEWSPAPER SECTION: Business / WRITER: Wichit Chantanusornsiri The National Rice Policy and Management Committee has approved four projects worth more than 50 billion baht to

Featured Registered Companies

RNT Tube

Pakistan’s Rice Exports Resilient Amid India’s Subsidized Competition | Dawn News English

June 25, 2025

Statistics

Sustainable Rice

Farmers Place

Forex Rates

Open Market Forex Rates

Updated at:

From | ||

|---|---|---|

To | ||

| Countries | Currency | Spot Rate |

Enjoyed the read?

Join our monthly newsletter for helpful tips on how to run your business smoothly