Tags

Rice stockpiling under scrutiny

Policy seen as buffer against price swings

NEWSPAPER SECTION: Business, WRITER: Wichit Chantanusornsiri and Somhatai Mosika

Rice experts say the stockpile requirement is reasonable for exports, boosts the quality of rice, and ensures the country’s food security.

Somporn Isvilanonda, an independent academic in agricultural economics and a rice expert, said requiring stocks for export helps improve rice quality and the country’s reputation.

In some cases, such a stockpile requirement can also serve as a buffer to absorb surplus rice, helping to prevent farmers’ rice prices from falling too rapidly.

“The regulation requiring rice exporters to hold at least 100 tonnes of rice in stock is intended to prevent traders from ‘catching a tiger with bare hands’ — having no rice in stock. If exporters receive overseas purchase orders without holding inventory, they may abandon those orders if they anticipate losses. Order cancellations can occur during both rising and falling rice price cycles,” Mr Somporn said.

He added that in the past, the Thai government required rice exporters to maintain no less than 500 tonnes of rice in stock, along with a financial deposit, to prevent order cancellations.

Stockpiling rice also enables the state to oversee the quality of rice for export, as historically some rice shipments were rejected and returned due to poor quality. Even today, some small rice traders and SME operators selling rice domestically still fail to meet quality standards, with impurities such as gravel and sand found mixed in the rice.

Regarding stockholding costs, Mr Somporn said medium-sized rice mills naturally maintain rice stocks as part of their normal trading operations.

“The cost of holding rice stocks is not very high because exporters normally need to keep a certain amount of milled rice in stock. Having no stock at all would amount to ‘catching a tiger with bare hands’, ” Mr Somporn said.

According to Mr Somporn, if the government wants to support SMEs when it comes to rice exports, it may need to create new channels for small and medium-sized operators.

At present, some mid-sized businesses are already exporting high-quality organic rice to overseas buyers, such as members of the Progressive Organic Agriculture Association in Ubon Ratchathani, which exports organic rice to Switzerland.

In addition, the requirement to maintain rice stocks helps create a buffer stock during years of abundant production. Such stocks act as a reservoir to absorb excess rice, preventing market prices from falling too sharply.

“Those who do not truly understand this issue, or the history behind it, and insist on changing policies based only on the present situation will create problems down the line,” Mr Somporn warned.

FREE TRADE FOR RICE

Chookiat Ophaswongse, honorary president of the Thai Rice Exporters Association, said rice exporters have to ensure adequate rice for customers while safeguarding the country’s food security.

“Typically, medium-sized and large exporters have about 1,000 tonnes in stock to guarantee they can meet customer demands. This stock is also essential to ensuring sufficient domestic supplies and reinforcing the country’s food security,” he pointed out.

The Ministry of Commerce introduced new measures in 2025 to support small rice exporters. The legally mandated rice stocks have been reduced from 500 tonnes to 100 tonnes to help reduce costs for these exporters.

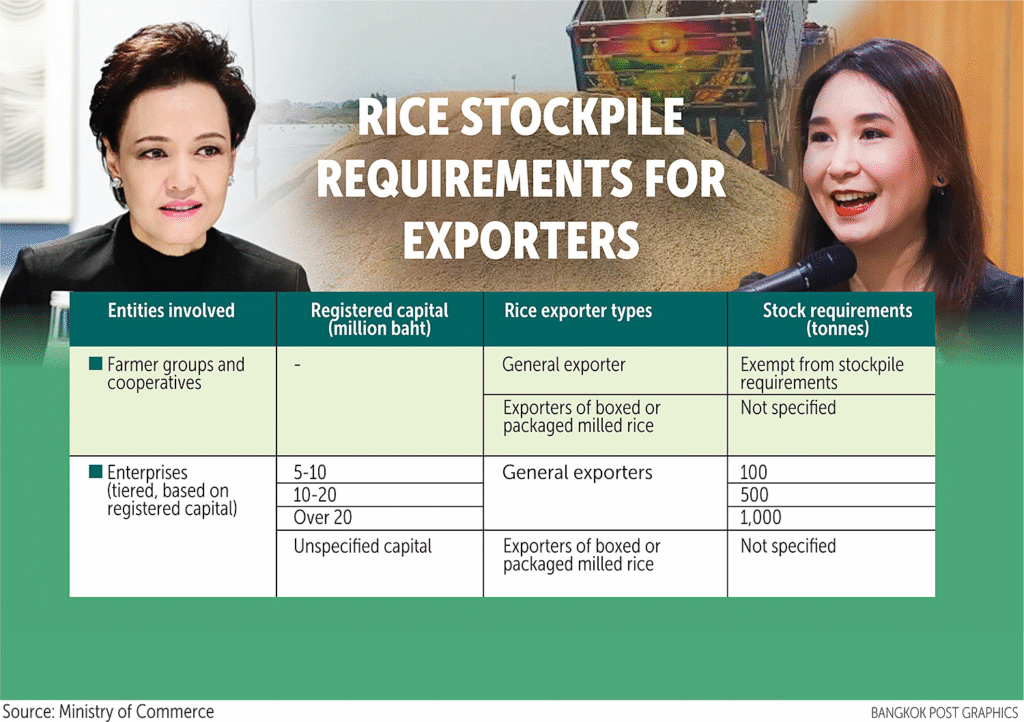

The new regulation requires enterprises with registered capital of 5-10 million baht to maintain a stock of 100 tonnes.

Those with capital of 10-20 million baht must meet the 500-tonne requirement, while firms with capital exceeding 20 million baht must maintain a 1,000-tonne stockpile.

Small exporters, including farmer groups and cooperatives, are not required to comply with this mandate.

“Small exporters handling 100-200 tonnes can sell rice. The rice trade is accessible to exporters of all sizes,” Mr Chookiat said.

He also highlighted several key challenges that hinder the competitiveness of Thai rice exports, including higher costs relative to competitors, lower productivity, and the appreciation of the baht.

The Department of Foreign Trade expects rice exports to decline to 7 million tonnes in 2026, down from nearly 8 million tonnes last year.

In the first 11 months of 2025, rice exports declined 21% year-on-year to 7.3 million tonnes, with the value falling 30.3% to US$4.16 billion.

The rice stockpiling requirement has been under the spotlight following a debate between caretaker Commerce Minister Suphajee Suthumpun and Sirikanya Tansakun, deputy leader of the People’s Party, over whether the requirement should be abandoned.

Speaking recently on a TV programme, Ms Sirikanya argued that the 100-tonne requirement is a burden for small enterprises which have a limited budget and do not own storage facilities, according to media reports.

These businesses have no potential to stockpile a large amount of rice for export, so the requirement can hinder their entry to global trade, she said.

Mrs Suphajee insisted that the government’s decision to reduce the requirement from 500 to 100 tonnes was appropriate as it paves the way for small companies to trade rice internationally.

Rice exports usually involve high fixed costs, which include operational and logistics expenses. These costs do not decrease as the amount of rice falls.

In fact, if the amount of rice exports is too low, cost per unit will increase immediately, which will not be cost-effective, said Mrs Suphajee.

https://www.bangkokpost.com/business/general/3178919/rice-stockpiling-under-scrutinyPublished Date: January 20, 2026