Tags

Rice prices plunge to 8-year low after record harvests

India and other countries have ended export restrictions, flooding the market with supply.

Susannah Savage in London

Global rice prices have tumbled to their lowest level in eight years, in a blow to many farmers across Asia, as record harvests and the ending of export bans in India flood the market with supply.

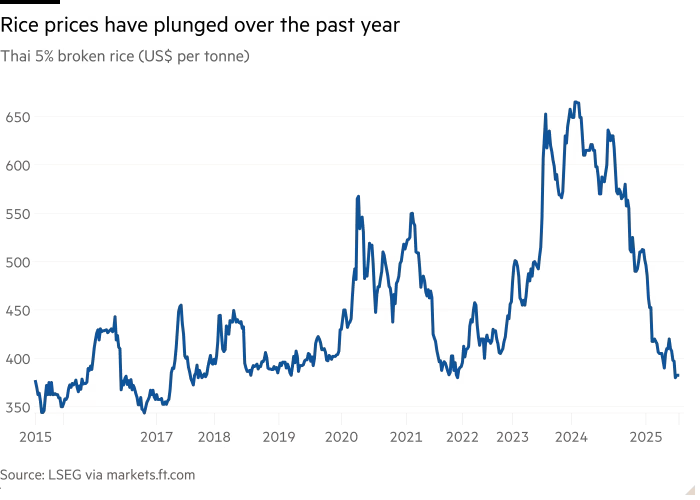

Export prices for Thai 5 per cent broken white rice, the global benchmark, have dropped to $372.50 per tonne in recent days, a 26 per cent decline since late last year and their lowest level since 2017. That extends a slide that began after India, the world’s largest exporter, started lifting restrictions on shipments in September 2024.

The UN’s All Rice Price index is down 13 per cent this year, according to the body’s Food and Agriculture Organization.

“It’s that simple: there’s just too much stock,” said Samarendu Mohanty, director of the Centre for Sustainable Agriculture and Development Studies at Professor Jayashankar Telangana State Agricultural University. “India’s rice production last year was a record . . . The crop they just planted is going to be another record crop.”

The price decline marks a sharp reversal from early last year, when rice soared to its highest level since 2008 after India introduced a series of export curbs. That sparked a wave of panic buying among consumers and prompted protectionist measures in other producing countries.

India’s policy shift late last year, following a record harvest in 2023-24 that swelled government inventories, was “the main reason” for the dramatic drop in prices, said Oscar Tjakra, senior analyst at Rabobank.

“This comes on top of strong production in Thailand and Vietnam, which has taken global rice output to a record high this marketing year,” he added.

Demand, meanwhile, has fallen. Indonesia, one of the biggest buyers, frontloaded imports last year and has not re-entered the market in 2025. The Philippines has banned imports until October to protect domestic prices during its main harvest.

“Indonesia is out, the Philippines is out — there’s no demand for white rice right now,” Mohanty said.

India’s unusually strong supply position reflects advances in the country’s agriculture, he said. Almost all the farms in the country’s main rice-growing regions have irrigation systems now, making production more resilient to drought and increasingly erratic monsoons, he said. “India has monsoon-proofed rice production.”

Farmers are also increasingly buying new seeds each season, which boosts yields, and expanding acreage of rice, thanks to the country’s minimum support price system and state bonuses, which helps shield farmers from global price swings. “Farmers know paddy is the most attractive crop. You get an MSP, you get a bonus, and it’s less risky,” said Mohanty.

Growers in most other Asian countries have no such protection as global prices plunge, said Tjakra. “Low prices will erode farm earnings, which is particularly challenging with higher input costs and inflation.”

For consumers, however, the slump offers welcome relief after several years of high food prices. In countries that depend on rice imports, cheaper prices can help ease headline inflation and household budget pressures.

Despite the sharp price fall so far this year, there could be further to go, said Mohanty. “I see another 10 per cent downside,” he said. “There are no buyers out there.”

He estimates the Indian government’s warehouses held as much as 60mn tonnes of rice in May — up to 15mn above the average for recent years. With another bumper crop under way, New Delhi has been offloading stocks into the domestic market and even into ethanol production — at lower prices than for human consumption — to free space ahead of the next harvest.

“We are going into [a period of] low commodity prices,” said Mohanty. “I don’t see the trend reversing for at least the next two years, unless there’s a war or some other major shock.”

https://www.ft.com/content/68b38273-5a03-4943-bfea-0f8085671033Published Date: August 11, 2025