Tags

Global rice prices rise a tad, but trend may change soon on surplus supplies

Huge Indian inventories expected to put pressure in the market, says trade.

By Subramani Ra Mancombu

Rice prices in the global market have increased marginally in the past couple of weeks, but the trend is unlikely to continue in view of surplus supplies, trade sources said.

Moreover, there is a temporary setback to Indian shipments to Senegal as importers’ licences in the African nation have expired.

“Rice prices have increased slightly, but huge inventories in India are likely to put pressure on the prices,” said New Delhi-based exporter Rajesh Paharia Jain.

Currently, the Food Corporation of India has 33.6 million tonnes (mt) of rice and 30.91 mt of paddy (equivalent to 21 mt of rice) — a 10-year high.

Record output

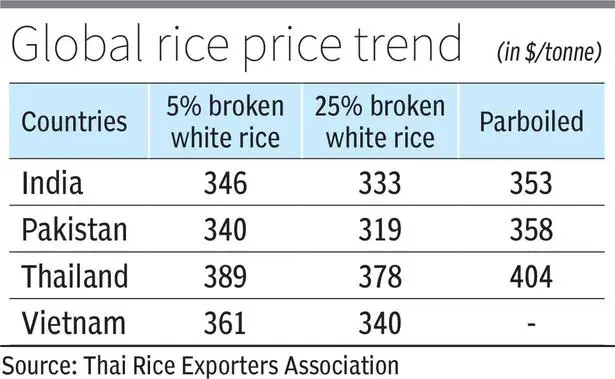

In the global market, India’s 5% broken white rice is offered at $346 a tonne, which is priced more competitively than Thailand and Vietnam. However, Pakistan is the most competitive at $340.

“The market will face more pressure as rice production has been projected at a new high for the kharif season,” said Jain.

According to India’s Ministry of Agriculture and Farmers’ Welfare, kharif rice production is expected to be a record high of 125.40 mt compared with 122.77 mt a year ago.

Global production, too, is estimated to be higher at a new high of 543 mt (541 mt last year), per the International Grains Council. After accounting for 61 mt (59 mt) trade and 549 mt (543 mt) of consumption, ending stocks are pegged at 189 mt (186 mt).

Speciality varieties output down

“Rice prices may fall further on bumper production in India. Additional output is coming from Telangana, thanks to the Kaleshwaram project,” said S Chandrasekaran, Managing Director of Svastha Ecoharvest, which exports climate- and chemical-compliant rice.

Production of speciality varieties such as Sona Masuri and BPT are lower this year in view of unremunerative prices for growers last year, he said.

In the domestic market, rice prices, despite surplus availability, are ruling higher in Telangana. “

“Nothing big is happening on the rice export front. We have not done much this year,” said M Madan Prakash, Director of Chennai-based Rajathi Group, which trades in agri commodities.

Exports down vs 2022-23

Data from the Agricultural and Processed Food Products Export Authority of India (APEDA), which supervises agricultural exports, show that in the first half of the current fiscal year, non-basmati rice exports were 7.02 mt. During the same time a year ago, exports were banned. However, in the comparable period of 2022-23, the cereal’s exports were 8.96 mt.

“Exports are happening at a slow pace. African buyers are short of US dollars, though they are ready to pay any amount in local currencies,” said Jain.

Chandrasekaran said one reason for slack export demand is that India did not lift its curbs on rice shipments from October 2024 in a calibrated way.

India banned exports of non-basmati white rice from July 2023 to September 2024 to tame food inflation and meet domestic needs, particularly to make up for the wheat supply shortage.

“Some of the Indian exporters are resorting to stock and sale in countries such as Vietnam after they faced problems leading to huge losses in previous years,” said Prakash.

These exporters have tie-ups with buyers in Vietnam, and prices of cargoes are determined when the shipments near delivery ports. “If there is agreement on the price, the cargo is offloaded and sold,” he said.

Senegal impact

Chandrasekaran said Indian rice has not been positioned properly in the global market. This, in a way, has not helped exporters to get better prices, which could help farmers too.

On the other hand, the suspension of rice imports by Senegal will only have a short-term effect. “The quantity involved is less than 50,000 tonnes and small traders may be affected,” said Jain.

Chandrasekaran said with Cyclone Senyar on cards and La Nina set to emerge sometime in December, rice production could face problems. “Any problem to the paddy crop in Far-East or South-East Asia, besides India, could lift prices,” he said.

https://www.thehindubusinessline.com/economy/agri-business/global-rice-prices-rise-a-tad-but-trend-may-change-soon-on-surplus-supplies/article70327249.ecePublished Date: November 27, 2025