Tags

Global rice export prices soften y-o-y in Jan’26 led by declines in everyday grades

- Regular white and parboiled rice benchmarks fall across Asia

- Premium varieties, Thai and Indian basmati, diverge from market trend

Global rice export prices showed a clear year-on-year correction in January 2026 compared with January 2025, with declines concentrated in everyday white and parboiled rice benchmarks across major Asian origins, while select premium fragrant varieties moved in the opposite direction amid tighter supply dynamics.

Regular benchmarks trend lower

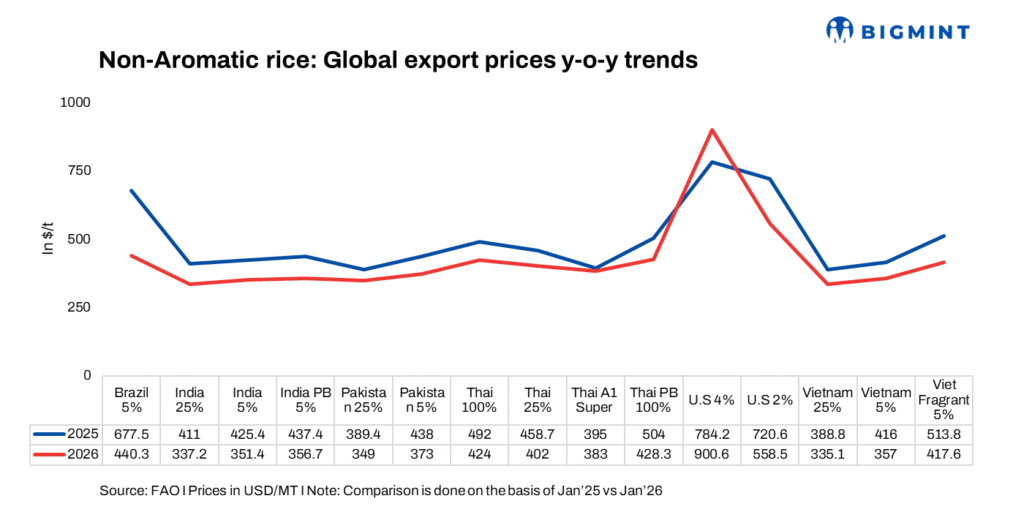

Export quotations for regular non-aromatic rice weakened across India, Pakistan, Thailand and Vietnam, reflecting improved supply availability, steady milling activity and softer import demand from price-sensitive African and Asian markets.

India’s 5% broken white rice declined from $425.4/t in January 2025 to $351.4/t in January 2026, while 25% broken fell from $411/t to $337.2. Parboiled 5% followed a similar trajectory, easing from $437.4/t to $356.7/t as competition intensified among Asian exporters.

Pakistan mirrored this trend, with 5% broken prices retreating from $438/t to $373/t and 25% broken from $389.4/t to $349/t, reflecting steady export flows and limited upward pressure from domestic procurement.

Thai benchmarks also softened. Thai 100% white rice fell from $492/t to $424/t, Thai 25% from $458.7/t to $402/t, and A1 Super from $395/t to $383/t. Thai parboiled 100% declined from $504/t to $428.3/t, tracking weaker demand in key African destinations and increased price competition from India.

Vietnam’s white rice segment registered similar movement, with 5% broken easing from $416/t to $357/t and 25% broken from $388.8/t to $335.1/t, reflecting normalisation after the tight supply environment seen in earlier periods.

Brazil’s 5% broken rice recorded one of the sharpest corrections, falling from $677.5/t to $440.3/t as South American export competitiveness weakened relative to Asian origins.

In contrast, the United States showed mixed performance. Medium-grain 4% strengthened from $784.2/t to $900.6/t, supported by tighter domestic availability and steady demand from premium markets, while US 2% white rice declined from $720.6/t to $558.5/t, reflecting shifting trade flows and pricing adjustments.

Premium segment diverges from broader market

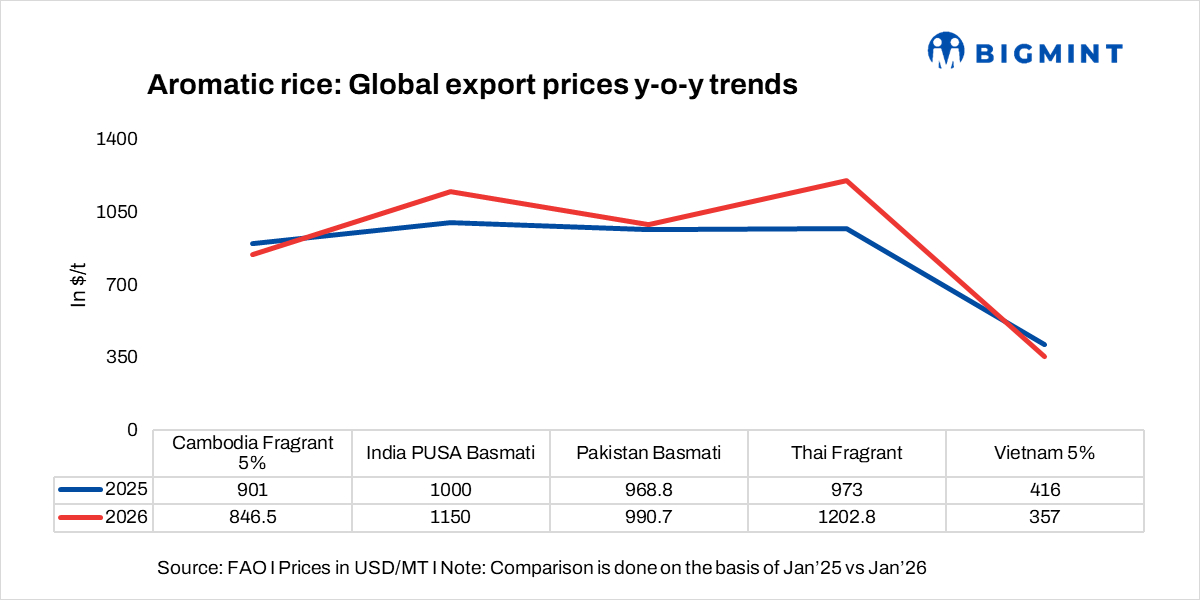

Unlike the broader white rice market, premium fragrant and basmati varieties displayed divergent movements, with several benchmarks firming on supply tightness and sustained demand in high-value markets.

India PUSA basmati strengthened from $1,000/t in January 2025 to $1,150/t in January 2026, supported by firm Middle East demand and limited availability of premium quality lots. Pakistan basmati also edged higher from $968.8/t to $990.7/t, reflecting steady export enquiries and stable domestic procurement.

Thai fragrant rice recorded the sharpest increase among premium varieties, rising from $973/t to $1,202.8/t amid constrained supply and continued demand in key Asian and premium global markets.

Cambodia fragrant 5% moved lower from $901 /t to $846.5/t, reflecting competitive pressure from Thai and Vietnamese fragrant offerings, while Vietnam’s 5% fragrant benchmark declined from $416/t to $357/t as exporters adjusted pricing to sustain volumes.

Widening gap between staple and premium segments

The January y-o-y comparison highlights a widening divergence between staple and premium rice segments. Everyday white and parboiled grades faced downward pressure due to ample exportable supplies, normalisation after earlier disruptions and aggressive price competition among major Asian exporters.

At the same time, premium fragrant and basmati markets remained supply-sensitive and demand-driven, allowing select origins particularly Thailand and India to sustain higher realisations despite the broader correction in global rice prices.

Such price behavior underscores the structural split in global rice trade, where staple varieties remain volume-driven and highly price-competitive, while fragrant and basmati segments continue to be influenced by quality availability, branding and destination-specific demand patterns.

https://www.bigmint.co/insights/detail/global-rice-export-prices-soften-y-o-y-in-jan-26-led-by-declines-in-everyday-grades-721979Published Date: February 11, 2026