Tags

Asia: White rice export prices rise on firming demand, tighter supply

- Vietnam leads with 24% rise; Thailand sees 14% uptick

- Indian prices rise marginally; ample supply caps gains

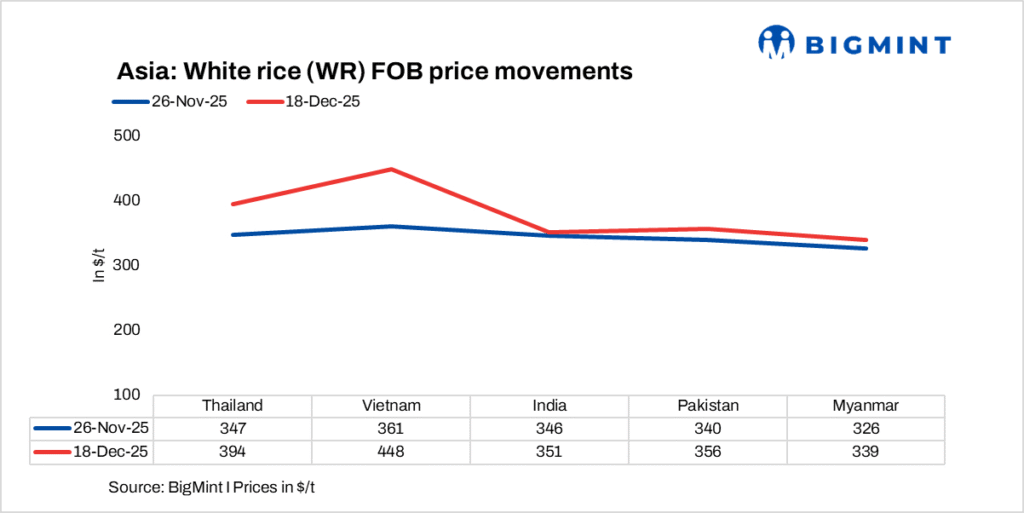

Asian white rice (5% broken) export prices increased across major producing countries on 18 December compared to 26 November, as per data from the Vietnam Food Association. Prices strengthened, as demand improved, while supply remained limited in comparison.

Across the five major Asian exporters, average white rice FOB prices rose to $378/t from $344/t, marking an approximate 9.8% increase or a $34/t gain. Vietnam and Thailand drove the overall momentum, while India’s relative stability provided a counterbalance, reflecting a mixed but generally bullish regional export market heading into year-end.

Thai prices surge by over 10%

Thailand’s white rice FOB prices rose 13.5% to $394/tonne (t) on 18 December from $347/t on 26 November. The surge reflects a combination of higher global demand and tighter domestic availability, as traders in the key export hubs recalibrated offers ahead of end-of-year shipments. Thailand’s premium parboiled varieties continued to attract steady interest from regional buyers, supporting upward price momentum.

Vietnam records sharpest price jump

Vietnamese FOB prices surged 24.1% to $448/t from $361/t over the same period. The rapid escalation is attributed to accelerated procurement by importers and firming global rice markets, particularly in South and Southeast Asia. The limited exportable volumes from key Mekong Delta ports, coupled with logistical constraints, further intensified price pressure.

India’s prices rise marginally

India’s white rice (WR) FOB prices edged up by 1.4% to $351/t from $346/t, while non-basmati parboiled (PB, 5% broken) saw a modest gain of 1.7%, reaching $358/t, as per BigMint’s assessment. A Delhi-based trader noted that while supply is currently sufficient to prevent spikes, a tightening of stock could lead to slight upward movement in early 2026.

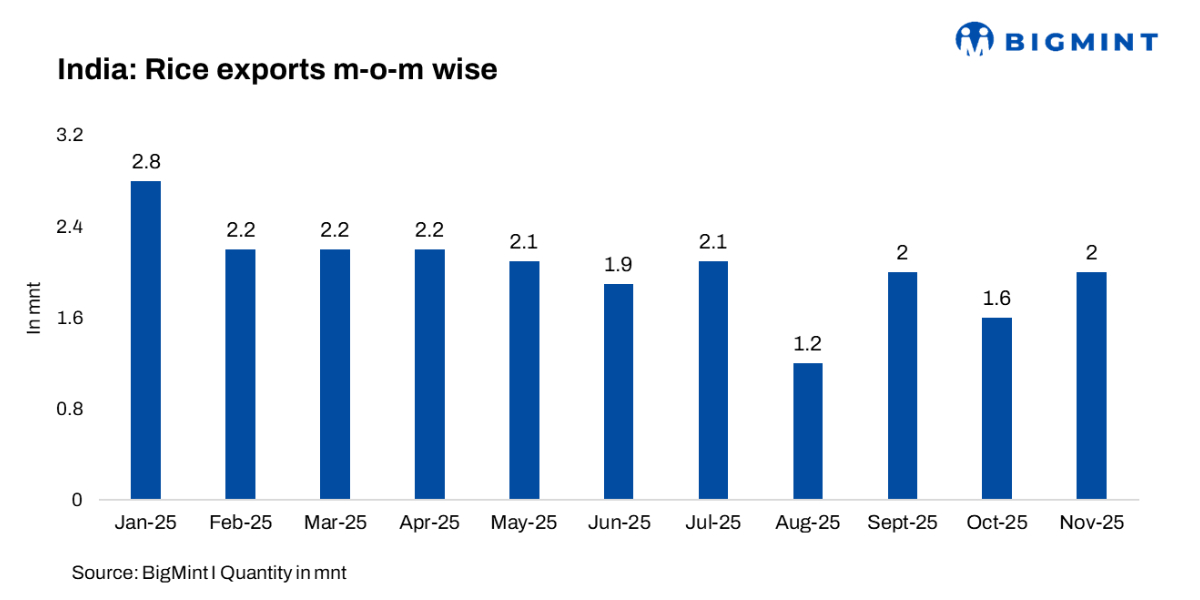

In 2025, exports peaked at 2.8 million tonnes (mnt) in January before easing to around 2.2 mnt through March and April, gradually dipping to 1.9 mnt in June. A slight recovery was seen in July at 2.1 mnt, followed by a seasonal low of 1.2 mnt in August. Exports rebounded to 2.0 mnt in September, slipped to 1.6 mnt in October, and rose again to 2.0 mnt in November. This steady performance, alongside modest gains in FOB prices, reflects India’s ability to maintain supply consistency even as regional markets such as Vietnam and Thailand experienced sharper price movements.

Pakistan posts steady gains

Pakistan’s white rice FOB prices increased 4.7% to $356/t from $340/t. Stable international demand and moderately strong buying from Middle Eastern markets were key drivers. Although export shipments remained consistent, tighter milling outputs and seasonal logistic bottlenecks contributed to steady price appreciation.

Myanmar experiences moderate price growth

Myanmar’s FOB prices climbed up by 4% to $339/t from $326/t. Traders noted that slow but consistent export enquiries, primarily from regional buyers, supported the incremental price growth. Limited port operations and ongoing logistical challenges in key rice-producing regions continued to influence supply flows, maintaining upward pressure on offers.

https://www.bigmint.co/insights/detail/asia-white-rice-export-prices-rise-on-firming-demand-tighter-supply-708095Published Date: December 23, 2025