Tags

Why Punjab’s rice procurement this year faces problems

Punjab is India’s largest source of rice for PDS. A severe storage crunch there leading to delayed procurement of the current harvest is distortionary. The immediate solution is to quickly move rice procured last year from Punjab’s godowns while hiring more storage space. The long-term solution is to find ways to push some farmers in Punjab and Haryana into crops other than paddy.

Siraj Hussain

Punjab is so central to Indian agriculture’s landscape that it continues to make headlines both in times of shortages and surpluses.

In 2022-23, India procured only 18 million tonnes of wheat down from 43.3 million tonnes in 2021-22. It was Punjab which contributed 9.45 million tonnes, about half of India’s total procurement. So, it is really a tough time for Punjab’s paddy farmers when they find that their paddy cannot be procured due to shortage of storage capacity.

Mechanics of rice procurements

In Punjab, paddy is mainly procured by state government agencies. It is then handed over to shellers for milling into rice. Once the rice is ready, state agencies take its delivery on paper and hand it over to FCI for storage. The FCI stores it in its own or hired warehouses. The rice is then moved by FCI to the consuming states where it is stored in FCI warehouses and then handed over to state governments for distribution under the public distribution system.

The storage space in Punjab is created by moving rice out of Punjab. FCI has to issue the rice within two years of taking delivery from state agencies. So, the outward movement of rice before the next Kharif Marketing Season (October – September) is critical to creating storage in Punjab.

In Punjab, FCI took delivery of about 124 lakh tonnes (lakh tonnes) of rice in KMS 2022-23 but it could move out only 7 lakh tonnes, as of September 2024. FCI had rice stock of 60 lakh tonnes on October 1, 2023. This has risen to 121 lakh tonnes on September 1, 2024. As a result, Punjab’s warehouses do not have storage space for taking delivery of rice in KMS 2024-25.

Another reason for storage crisis is that by the end of wheat procurement season this year, Punjab had stored about 45 lakh tonnes of wheat in covered godowns. Earlier this used to be kept in Covered and Plinth Storage (CAP) and the covered storage was available for rice. Due to lower wheat procurement in 2022-23 and 2023-24, storage space was available and FCI stored wheat in covered space.

No shortage of storage capacity in India and Punjab

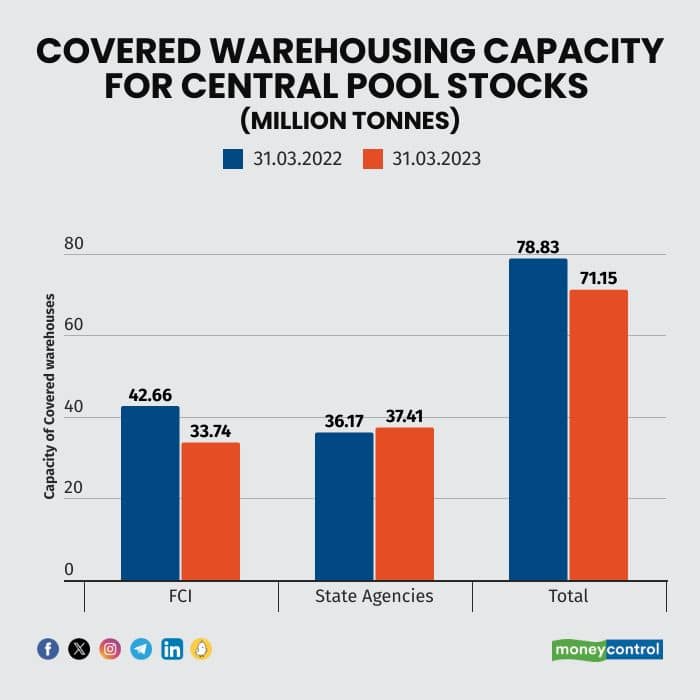

It is not that India does not have adequate storage capacity for central pool stocks. The following table shows the capacity:

At all-India level, on March 31, 2022, the total storage capacity was 78.83 million tonnes, quite sufficient for the level of procurement and distribution. In fact, the FCI has done quite well in creating additional storage capacity under Private Entrepreneurs Guarantee scheme under which private investors were given guaranteed payment of storage rent for 10 years.

At all-India level, there is no shortage of storage capacity for the level of stocks held by the FCI and state agencies in normal years of procurement.

However, due to lower wheat procurement in 2021-22 and 2022-23, the capacity came down to 71.15 million tonnes on March 31, 2023. This would be due to de-hiring of rented warehouses. This would perhaps be due to FCI’s fear of possible objections from CAG for not utilising the storage capacity.

The Government has given a push to create storage capacity thorough modern steel silos under Public Private Partnership (PPP) mode. Additional silo capacity of 29.25 lakh tonnes has been awarded and it is under implementation.

Three solutions

The current problems of storage in Punjab will be solved over the next few month by moving rice to other states; by hiring storage capacity in both procuring and consuming states (even it is of rather poor quality) and by selling rice for ethanol (a wrong policy choice).

One of the reasons for high rice procurement lies in Punjab’s policy of levying high Market Development Fee (MDF, 3 percent) and Rural Development Fee (RDF, 3 percent). The APMC regulations of allow arhatiya commission of 2.5 percent of MSP. Since MSP has been rising every year, the arhatiya commission has also been going up even though there is hardly any improvement in services provided by them. At the old formula of 2.5 percent of MSP for paddy (Rs 2,320 per quintal), the arhatiya commission comes to Rs 58 per quintal.

In a long overdue decision, the union government capped the arhatiya commission at Rs 46 per quintal (in 2018-19) and this is one reason why the arhatiyas are agitated. The Union Government is not reimbursing the RDF and (please delete as) it has capped MDF at 2 percent.

These charges, constituting about 8 percent of MSP, make it unviable for private trade to purchase non-basmati paddy from Punjab and the government agencies end up procuring almost 90 percent of market arrivals.

More incentive for rice than other crops

The root of the problem lies in government’s commitment to provide free food grains under the National Food Security Act for which the policy of open-ended procurement is followed. Incentives for cultivation of paddy continue in other states also and Chhatisgarh and Madhya Pradesh are giving paddy MSP of Rs 3100 per quintal.

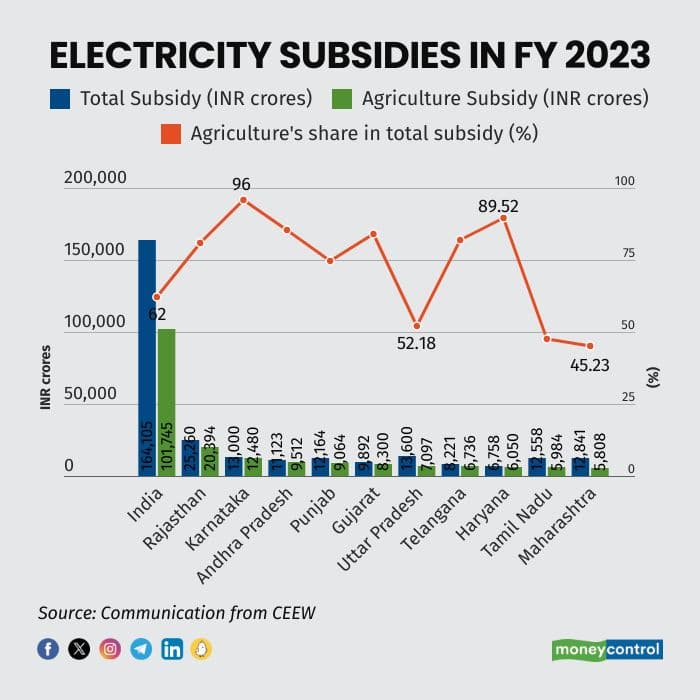

Rice procurement has been going up in AP, Telangana, TN, West Bengal, Bihar, MP, Chhatisgarh and Odisha. In addition, free electricity is now becoming more common (Telangana, Maharashtra, TN, MP, UP) and states are incurring heavy subsidy.

As a result, in KMS 2023-24, despite the erratic monsoon in several states, rice procurement reached 52.5 million tonnes which was 38.4 percent of rice production (136.7 million tonnes).

The problem of bulging rice stocks across India may become even more pronounced when wheat procurement reaches normal levels of 35 million tonnes. That will reduce offtake of rice under PDS. Higher export of non-basmati rice is therefore important for rice economy of India. From a ten-year perspective, some area under paddy, especially in Punjab and Haryana should be moving to other (less water guzzling) crops.

https://www.moneycontrol.com/news/opinion/why-punjabs-rice-procurement-this-year-faces-problems-12853752.html#goog_rewardedPublished Date: October 29, 2024