Tags

What’s driving our rice price crisis amid 8-year global low?

Shahadat Hossain

Since August last year, prices have surged in waves, even during peak Aman and Boro harvests.

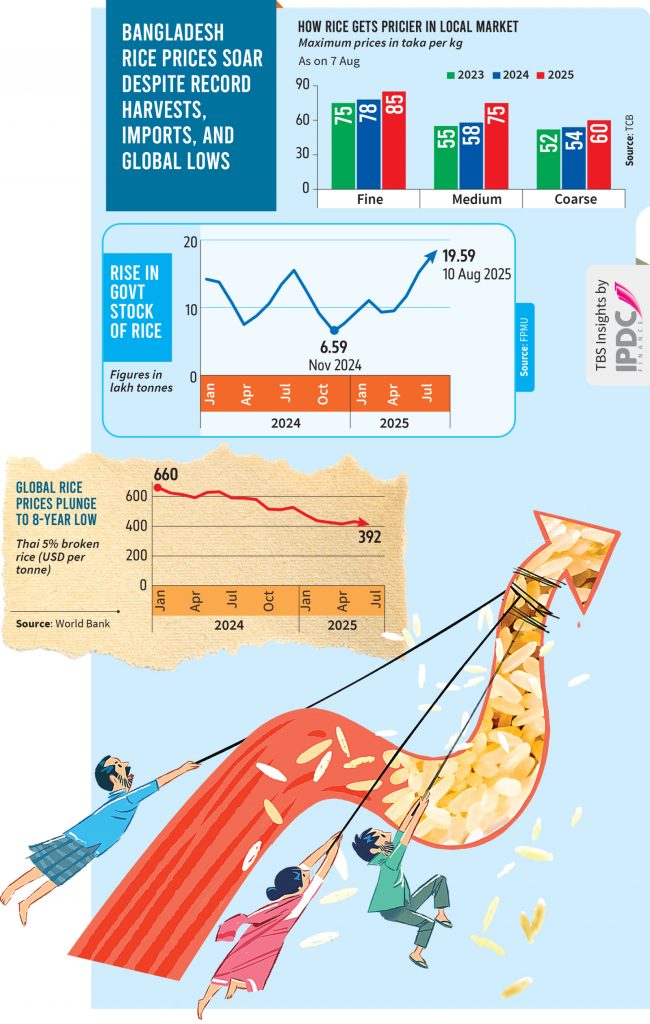

Global rice prices have slumped to their lowest in eight years, yet in Bangladesh, they continue to climb—defying record harvests, high imports, and large government reserves. The result: record-high retail prices for the country’s staple grain, persisting for what may be the longest period in its history. And no one seems to know why.

Since August last year, prices have surged in waves, even during peak Aman and Boro harvests. Despite bumper production, steady imports, and healthy government stocks, consumers are now paying Tk5–17 more per kilogram than a year ago. The squeeze has fuelled inflation, hitting lower-income households the hardest.

Economists and market analysts say the trend points to a failure of market management. Farmers sell paddy cheaply right after harvest, but prices quickly rise as millers and stockpilers withhold supply. Large corporate mills—accused of dominating the market—buy in bulk and later raise prices. The companies deny this, saying storage periods are short and profits limited.

‘Bad data, bad decisions’

Fahmida Khatun, executive director of the Centre for Policy Dialogue, said rice accounts for nearly a tenth of Bangladesh’s overall inflation basket, but for poorer households the share is far higher.

“The real problem is unreliable data,” she told The Business Standard. “We are told we are self-sufficient, yet we still import. The Bangladesh Bureau of Statistics uses outdated methods, so the truth is uncertain. Extortion within the supply chain also drives up prices from farm to market.”

Professor Mohammad Jahangir Alam of Bangladesh Agricultural University suspects production data is inflated. “If harvests and imports are at record levels, there should be no shortage. If supply is fine, hoarding is the obvious cause. The government has the legal tools to act, but they are not used,” he said.

Bangladesh typically imports rice each year to stabilise supply, but in FY24 imports were halted entirely. As a result, government reserves dropped to 6.5 lakh tonnes in November – far below the safe level of 12.5 lakh tonnes, which is about 15 days’ national consumption.

Even after imports resumed and reserves climbed to 19.17 lakh tonnes this July—a record high—prices did not ease.

“If stocks fall below that level, millers know the government’s bargaining power is weak,” he explained.

But prices have not eased despite renewed imports and record harvests since November last year, which led to rice reserves reaching nearly 20 lakh tonnes in July this year.

Prices outpace production

Trading Corporation of Bangladesh data show prices are 15–20% higher than a year ago and well above August 2023 levels.

According to the Department of Agricultural Extension, this year’s Boro harvest yielded 2.26 crore tonnes, while Aman produced 1.65 crore tonnes—together about 13 lakh tonnes more than last year. Imports in FY25 have also been robust, at 14.36 lakh tonnes—the highest in seven years.

Yet the market remains tight. Some analysts trace the problem to the FY24 import halt, which depleted stocks and emboldened millers to raise prices.

According to the Tariff Commission, annual demand for rice in the country ranges from 3.5 crore to 3.8 crore tonnes. Around 55% of the country’s total paddy production comes from the Boroseason.

Strain on households

For Zahidul Islam, a caretaker in Dhaka, the relentless rise is unprecedented. “Before, prices went up and came down again. Now, even with good harvests, they only go up. Who is taking the extra money?” he asked.

The latest Household Income and Expenditure Survey shows rice accounts for around 20% of national food spending—and over 40% for the poor—magnifying the impact of any price rise.

Corporate dominance and denial

The Consumers Association of Bangladesh says the market is dominated by large corporate mills with massive storage capacity. “A Tk1 per kg price hike means Tk10 crore extra a day for traders,” said CAB vice-president SM Nazer Hossain.

He added that the market is now controlled by large corporate mills. “They buy from farmers and raise prices within a week. This is why prices have risen even during peak harvest. The government has failed to check this power.”

Farhad Hossain Chokdar, general secretary of the Naogaon District Rice Mill Owners’ Group, said small mills cannot significantly influence prices.

“The government knows everything – the price of paddy, who is stockpiling, and how much. Paddy prices were high this year, which has kept rice prices high,” he said.

Small mills have kept at least 30% less rice in stock than usual, he added, because large companies have far greater storage capacity. “A single major company’s mill can match the capacity of 50 auto-rice mills. Many small mills are closing after defaulting on loans.”

Large conglomerates such as ACI and PRAN have long been involved in the rice trade, while newcomers like City Group, Rupchanda and Meghna have recently entered the market.

Corporate players deny controlling the market. PRAN-RFL’s marketing director KamruzzamanKamal said prices rose mainly because paddy was costlier this year, especially during the harvest when everyone was buying. “Rice cannot be stored for more than two to three months without loss. We regularly share stock data with the government,” he said.

Government steps in

Food Secretary Md Masudul Hasan attributed the current spike partly to seasonal heavy rains. He said the government has started open-market sales of rice through the Trading Corporation from 10 August, alongside the Food-Friendly Programme starting 17 August. This year, 55 lakh families will receive 30 kg of rice per month at Tk15 per kg for six months.

Food Adviser Ali Imam Majumdar said production costs have risen sharply, but the government still subsidises rice production at about Tk25 per kg. “The Food-Friendly Programme will help, but bringing down open-market prices will be difficult,” he admitted.

TBS Chattorgam correspondent Md Masud contributed to this story

https://www.tbsnews.net/bangladesh/whats-driving-our-rice-price-crisis-amid-8-year-global-low-1211001Published Date: August 13, 2025