Tags

India’s Rice Exports:World’s Food Security Challenges

Jayan Jose Thomas, B Satheesha

Summary

This working paper explores the linkages between trade and food security in the context of India’s ban on the export of non-basmati white rice in July 2023. While rice is the staple food for about half of the world’s population, there are significant challenges to improving access to food globally through trade in rice. A few Asian countries, notably China, India, Pakistan, Indonesia and Bangladesh, are some of the major producers and also consumers of rice. Therefore, rice is a thinly traded commodity, with India alone accounting for about 40 per cent of the rice sold internationally. Following India’s rice export ban, there have been fears about rising food prices, particularly in food-insecure African countries, which collectively purchase about half of India’s rice exports. At the same time, India is trying to ensure adequate domestic supplies of food grains to restrain consumer inflation and to provide for the public distribution of subsidised food. Meanwhile, there are concerns about the future growth of rice production, especially in the wake of unpredictable weather patterns and climate change in South and Southeast Asia.

Introduction

Cereals contribute 44 per cent of the global human calorie intake per day but their production is unevenly distributed across the globe. Rice and wheat are the most widely consumed cereals worldwide. It is often argued that trade between food surplus and food-scarce regions can ensure food security for all and remunerative prices for the farmers. However, there are many challenges to achieving food security through trade, some of which are illustrated in the recent experiences in international trade in rice. Rice cultivation is mainly concentrated in a few populous Asian countries, including China, India, Indonesia and Bangladesh. As these rice producers are also major rice consumers, the volume of rice available for trade in the international market is limited. The case of wheat is different as some of its major European and North American producers can mobilise sufficient surpluses of that grain for trade.

It is against the above-discussed context that India, the largest rice exporter, announced a ban on the export of non-basmati white rice in July 2023, triggering fears of an escalation in global food prices. The concerns have been particularly severe for several African countries, which collectively purchase almost half of the rice India sells in the export market. Africa is the most food-insecure continent on the planet.

More than a year after India’s rice export ban, this working paper explores the linkages between international trade in rice and food security. It discusses significant features of the global trade in rice and wheat. It analyses India’s production and export of rice and wheat, as well as India’s emergence as a leading player in the international rice market. The paper then examines the major destinations for India’s rice exports. It discusses the future growth in the domestic demand for food grain in India, given the country’s current low per capita food intake levels. Finally, the paper discusses policy options that are required to reach the goal of a hunger-free world.

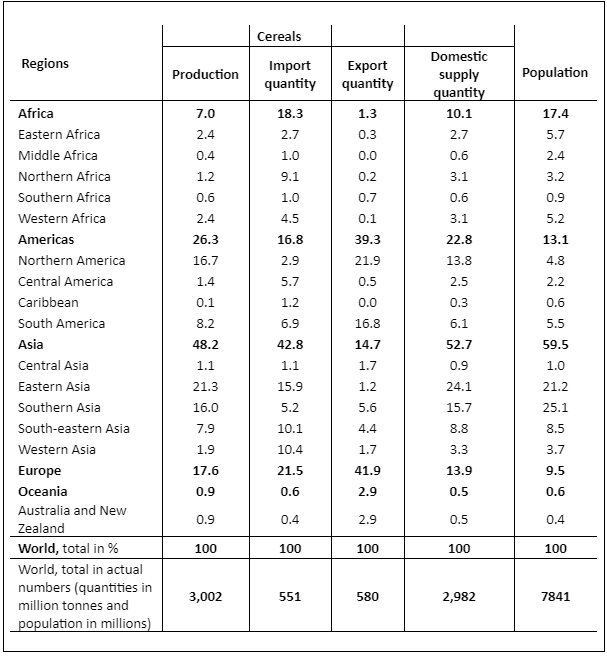

Global Trade in Rice and Wheat

Trade continues to be essential for securing food security for the planet. This is because the production of cereals, which contributed to 44 per cent of the human calorie intake per day in 2020, is unevenly distributed worldwide. On the one hand, in 2020, Africa accounted for only seven per cent of the worldwide cereal production, while it was home to 17.4 per cent of the world population. The shares in world cereal production were considerably lower than their shares in world population in South Asia and West Asia as well. On the other hand, North America and Europe accounted for 34.3 per cent of the total cereal production in the world, which was much higher than their combined share of the world population (14.3 per cent). Of course, these regions export a large part of their production; their combined share in worldwide cereal exports was 63.8 per cent (Table 2).

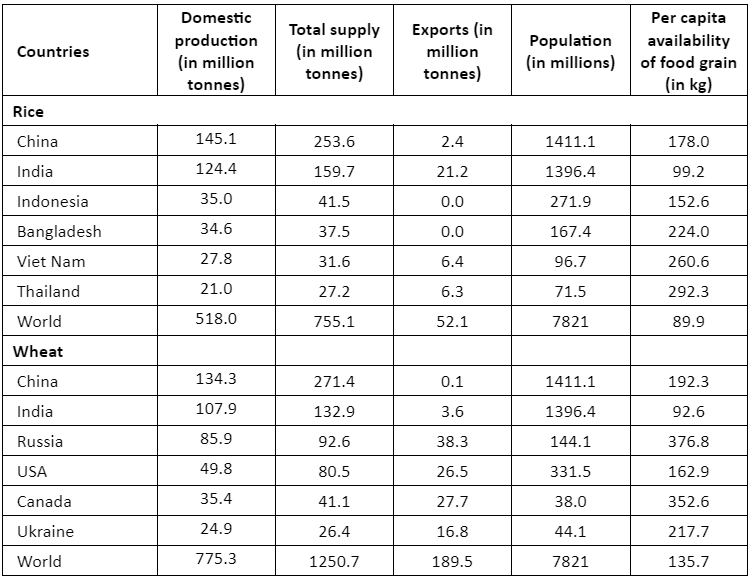

Rice is the staple food for approximately half the world’s population. At the same time, rice cultivation is geographically concentrated in a few Asian countries. China, India, Indonesia and Bangladesh are the largest rice producers. These are also populous countries; almost all their rice production is consumed domestically, leaving only a little for trade with the rest of the world. Therefore, rice is a thinly traded commodity in the world market. In 2020-21, the global export of rice was 52.1 million tonnes, which amounted to only 10 per cent of global rice production (Table 1).

The import of rice has been crucial for meeting the food security needs of several countries, including many in Sub-Saharan Africa, North Africa and West Asia, which are consumers but not significant rice producers. There are also countries like the Philippines, which are major rice producers but still depend on rice imports to meet a part of the domestic demand. India is now the largest rice exporter, with a share of approximately 40 per cent of worldwide exports. In 2020-21, India exported 21.2 million tonnes of rice, approximately one-sixth of the country’s domestic rice production (Table 1).

Compared to the case of rice, more countries produce and export wheat. In 2020-21, worldwide wheat exports amounted to 189.5 million tonnes or 3.6 times the corresponding figure for rice. Asia and the temperate regions of North America and Europe are significant wheat producers. After China and India, the major wheat-producing countries are Russia, the United States (US), Canada, France, Ukraine and Germany. In many of these less populous western countries, wheat production is much more than domestic requirements. Wheat exports constitute more than 50 per cent of domestic production in the US and more than 65 per cent in the case of Canada and Ukraine (Table 1).

Food grain supply in a particular year is the sum of food grain stocks at the beginning of the year, production during the year and imports. Notably, India’s total wheat and rice supply was 1.2 to 1.3 times the domestic production of these crops. The supply-production ratios were even higher (1.8 to 2 times) in the case of China (Table 1). In India and China, the relatively secure situation regarding food grain supply arises from the strategic build-up of grain stocks.

Table 1: Domestic Production, Supply, Export and Per Capita Availability of Rice and Wheat in Major Producing Countries in 2020-21

Note: Total supply = Opening stock + Production + Imports; per capita availability of food grain for domestic use = (Total supply – Exports)/Population; the food grain available for domestic use includes food grain that is directly consumed and food grain used as animal feed and for other purposes.

Source: The Food and Agricultural Organisation (FAO) – Agricultural Market Information System (AMIS).

Table 2: Cereal Production, Trade and Domestic Supply and Population: In Major Regions of the World in 2020, as Shares (In Per Cent) of the Worldwide Totals

Note: Please refer to FAOSTAT for countries categorised into different regions.

Source: The FAOSTAT

Production and Export of Rice and Wheat in India

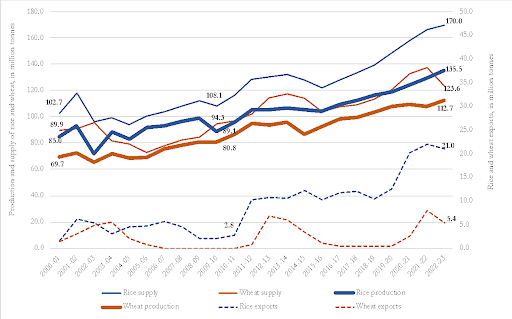

Over the last two decades, India has recorded remarkable growth in rice production, supply and exports, all of which have been noticeably higher than the corresponding figures for wheat (Figure 1). India’s rice production recorded robust growth from the mid to the late 2000s, then plateaued in the range of 105 million tonnes during the first half of the 2010s and rose sharply again during the second half of the decade to reach 135.5 million tonnes in 2022-23. India began exporting rice in significantly large quantities in the early 2010s. The country’s rice exports ranged between 10 and 12 million tonnes through most of that decade. India’s rice exports climbed further, registering 20 million tonnes or above after 2020-21. Exports accounted for at least a third of the country’s incremental rice production since 2018-19.

The growth of production and supply of wheat in India followed a pattern similar to that for rice – fast growth during the second half of the 2000s, followed by a half-decade of stagnation and fast growth again during the second half of the 2010s. At the same time, compared to rice, increases in the production, supply and trade of wheat were lesser. Over the decade until 2022-23, India’s wheat production rose by 18.5 million tonnes and rice production by 30 million tonnes (Figure 1). India exports only tiny quantities of wheat and despite some improvement in the early 2020s, India’s share in global wheat trade is negligible (Table 1).

Figure 1: Production, Supply and Export of Rice (Milled) and Wheat by India, 2000-01 to 2022-23 (in million tonnes)

Note: Milled rice has its husk, bran and germs removed through processing.

Source: Data about rice and wheat supply and export are obtained from the United States Department of Agriculture – Procurement Systems Division (PSD) and data on production is obtained from the Ministry of Agriculture and Farmers Welfare, Government of India.

Compared to wheat cultivation – primarily restricted to India’s northern States, rice cultivation is more regionally dispersed in India. The states of West Bengal and Odisha in the east, Telangana and Andhra Pradesh in the south and Punjab and Uttar Pradesh in the north are large rice producers. One of the factors that has helped to accelerate rice and wheat production in India is the public procurement of food grains from farmers at minimum support prices (MSP) fixed by the official agencies. This is a policy measure that the Indian government initiated in the mid-1960s and it has continued to date despite the general reduction of public expenditures in the country. Between 2015-16 and 2021-22, the Food Corporation of India’s procurement of rice and wheat increased by 25 million tonnes and 15 million tonnes respectively. In fact, for both these crops, the increase in procurement was adequate to absorb the incremental production between the two time periods.

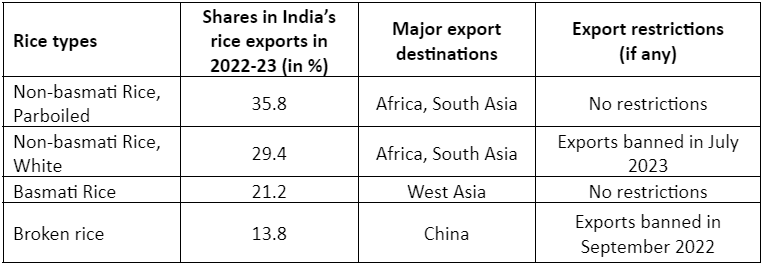

Types of Rice and their Export Destinations

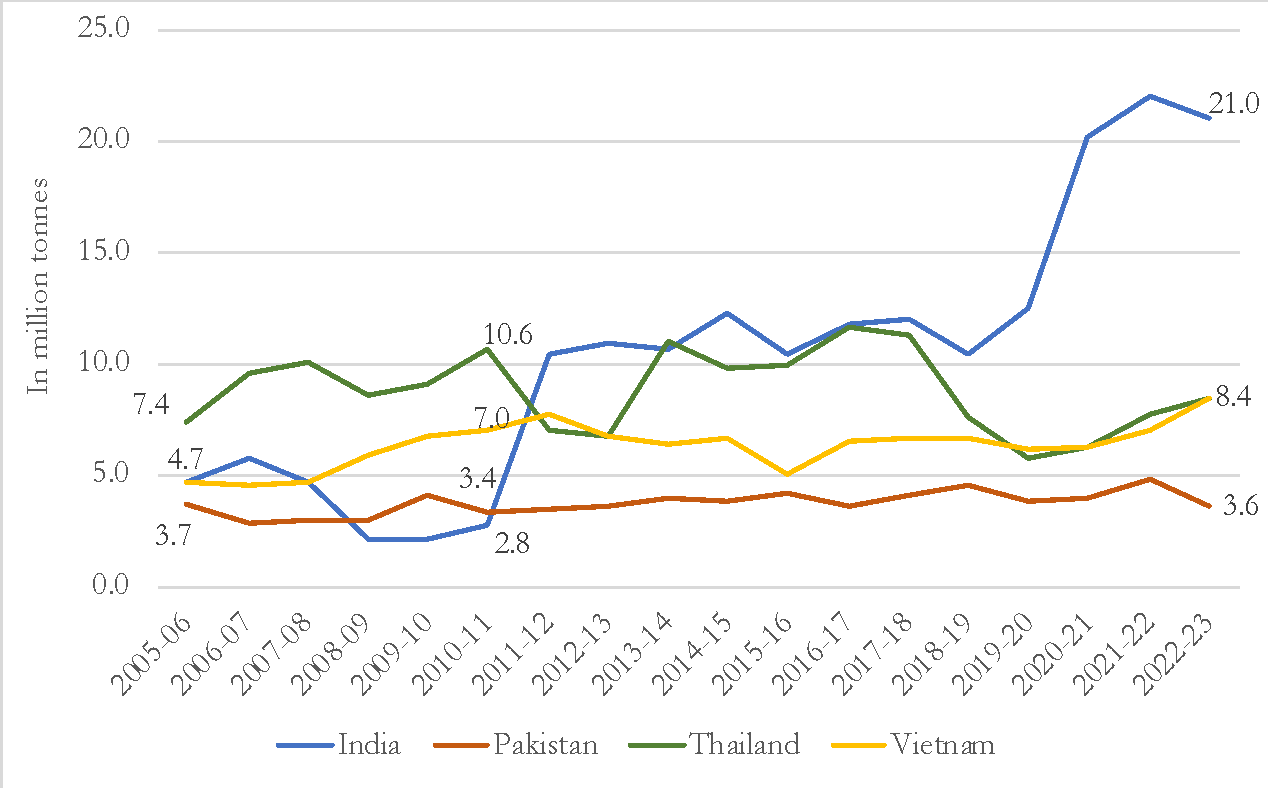

Rice produced in India can be classified into four categories: basmati rice, non-basmati parboiled rice, non-basmati white rice and broken rice. The major markets for the parboiled and white non-basmati rice varieties are in Africa. The West African countries of Benin, Côte d’Ivoire, Guinea and Cameroon and the East African countries of Madagascar and Kenya are some of the biggest purchasers of Indian rice. India’s neighbours, Nepal, Bangladesh and Sri Lanka, also depend on rice imports. At the same time, basmati rice from India is mainly exported to West Asian countries, including the Gulf countries, Iran and Iraq. Small quantities of rice are exported from India to Europe and North America, particularly to the US. China is the primary market for broken rice, mainly used for animal feed and ethanol production (Table 3).

Table 3: Types of Rice Exported by India, their Destinations and Export Restrictions (if any)

Note: See Table 4 below for details.

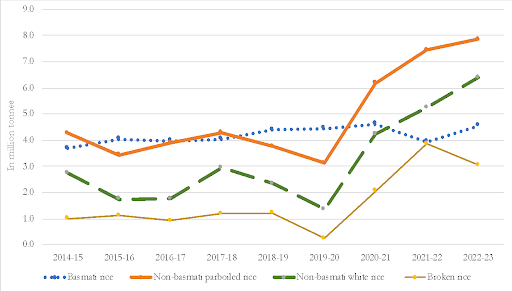

The significant rise in rice trade from India since the early 2020s was mainly due to strong export growth in the non-basmati rice varieties and broken rice (Figure 2). Of the total quantity of rice exported from India in 2022-23, the two non-basmati varieties had a combined share of more than 60 per cent (non-basmati parboiled rice, 35.8 per cent; non-basmati white rice, 29.4 per cent), while the shares of broken rice and basmati rice were 13.8 per cent and 21.1 per cent respectively. India banned the export of broken rice in September 2022. Subsequently, the Indian government banned the exports of non-basmati white rice from the country on 20 July 2023. The government maintains that the curb on rice exports is a move to increase the domestic supply of food grain and control inflation.

Of the total rice exported by India (all varieties together) in 2022-23, African countries purchased 44.8 per cent, West Asian countries purchased 19.8 per cent and 9.8 per cent of the rice was sold to India’s South Asian neighbours (Tables 3 and 4).

Figure 2: Different Types of Rice Exported from India, 2014-15 to 2022-23 (in million tonnes)

Source: Ministry of Commerce and Industry, Government of India.

Table 4: Types of Rice Exported by India and their Destinations, as Proportions of Total Rice Exported, 2022-23 (in per cent)

Note: Major export destination regions (in bold font) and countries (listed under each region). The Table does not list all the destinations to which India exports rice. Therefore, the sum of rows does not add up to the total (in per cent) exports of each rice variety.

Source: Ministry of Commerce and Industry, Government of India.

India’s Growing Importance in Global Rice Trade

Several factors have aided India’s emergence as a significant player in the global trade in rice since the 2010s. First is the increase in domestic production of rice, as discussed above. Second, in recent years, there has been a solid and rising demand for food grain imports from several countries, including India’s neighbours (Bangladesh, Sri Lanka and Nepal). Further, better access to deep-water ports (designed to accommodate large and heavily loaded ships) has facilitated the regular shipment of grain from India to Western African countries. Third, the domestic demand for food – which limits the quantity of grain available for exports – has been, by and large, depressed and certainly not grown in line with the increase in production. A fourth factor is the behaviour of Indian rice prices relative to international levels.

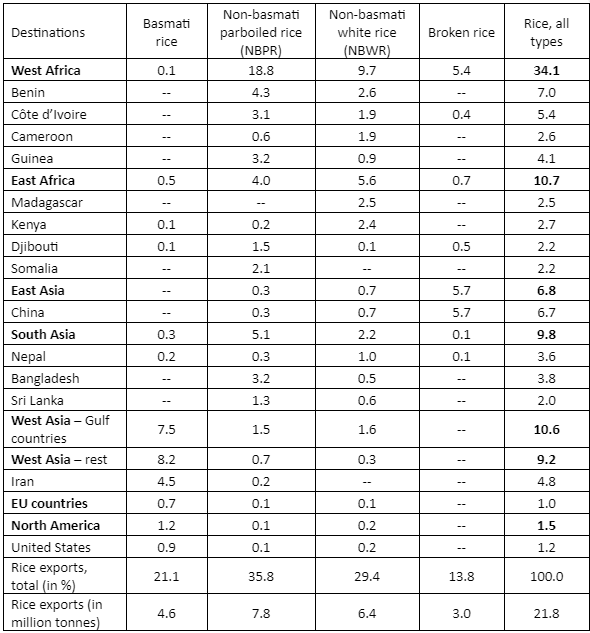

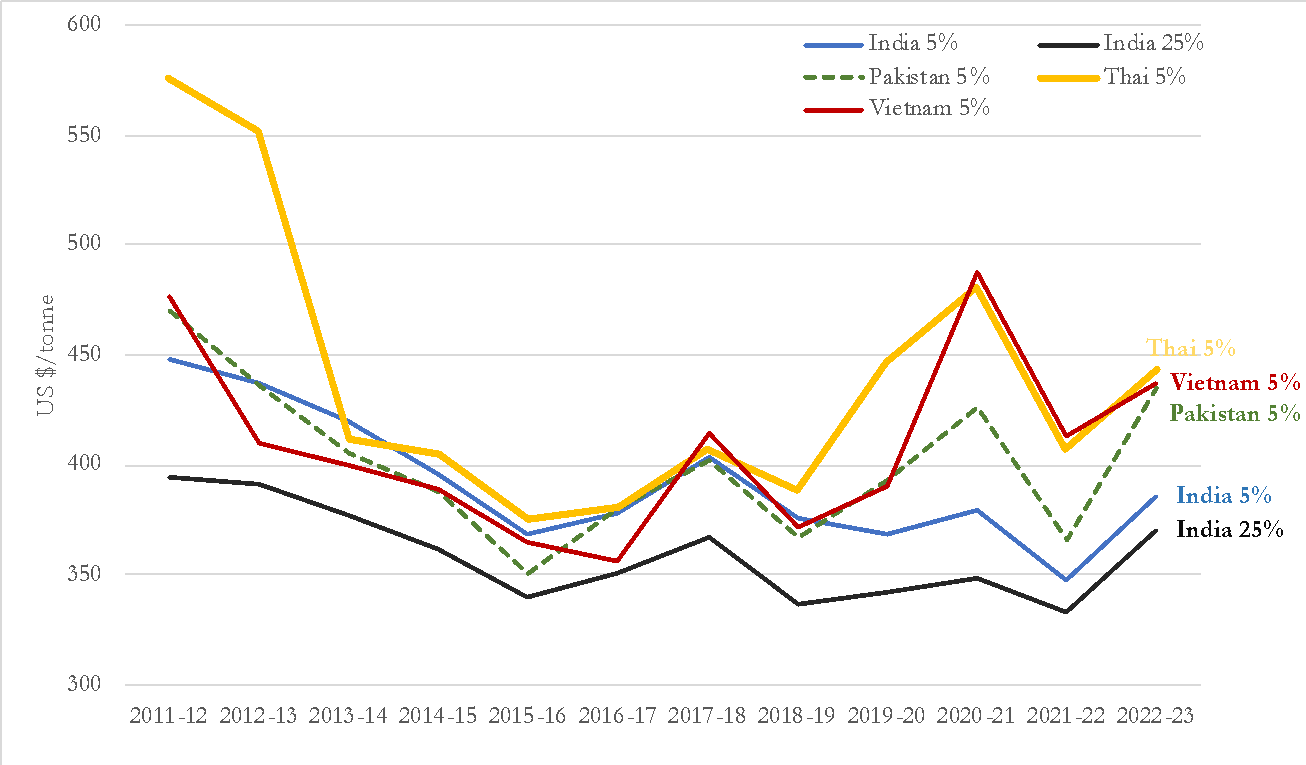

With respect to the prices at which rice is sold in the export market, India began to gain a competitive advantage over other major rice-exporting Asian countries from 2017-18 onwards. The situation was different at the beginning of the 2010s when Vietnam and Pakistan could sell rice cheaper than India. However, since the late 2010s, the prices of rice exported from Vietnam, Pakistan and Thailand have risen rapidly, while domestic demand has remained strong in these countries. By 2019-20, the price of higher quality Indica rice (non-basmati) exported by India was much lower than that of similar rice sold by its competitors, resulting in a surge in India’s rice exports (Figures 3 and 4).

Figure 3: Milled Rice Export Price Quotes, US$/tonne

Note: India five per cent, Vietnam five per cent, Pakistan five per cent and Thailand five per cent are higher quality Indica rice (non-basmati) and India 25 per cent is a lower quality Indica rice.

Source: United States Department of Agriculture

Figure 4: Rice Exports by Asian countries (in million tonnes)

Source: The Food and Agricultural Organisation (FAO) – Agricultural Market Information System (AMIS).

The rice export market is characterised by a high degree of instability. An increase in export volumes leads to a fall in export prices and vice versa. Globally, food prices rose sharply during 2007-08 and again during 2010-12, triggering food shortages and generating uncertainty among agricultural producers. During the 2007–08 food crisis, a ban on rice exports was imposed initially by Vietnam, followed later by India, Pakistan and Thailand. This led to a fall in rice exports globally, putting upward pressure on rice prices in the international market.

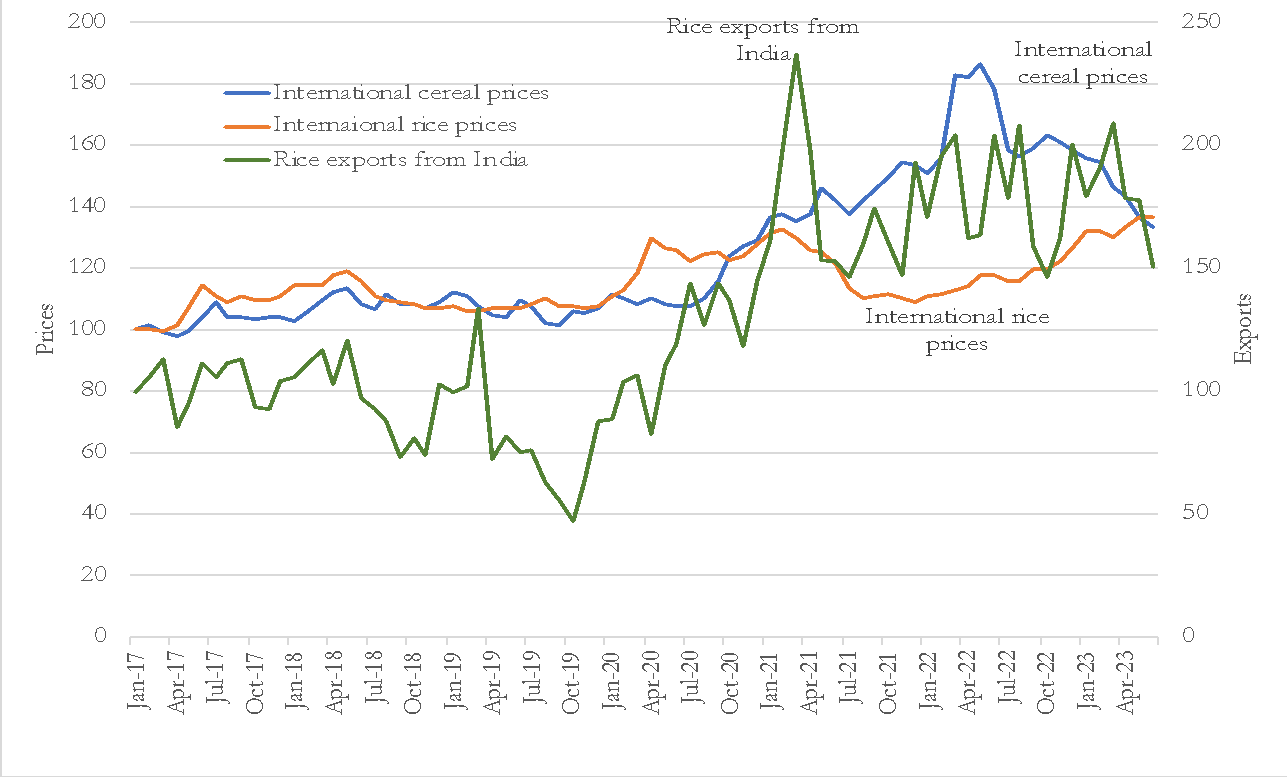

After the COVID-19 induced disruptions, international cereal prices began to rise quickly from September 2020 onward (Figure 5). The price of rice had reached a high level in April 2020, even before prices rose for other cereals (possibly because supply disruptions were more severe in developing countries that are rice producers). The Indian traders quickly took advantage of the price rise in export markets. Rice exports from India amounted to 9.8 million tonnes in 2018-19, which rose to 14.6 million tonnes in 2020-21 and 22.1 million tonnes in 2021-22. As a dominant player, India’s moves in the rice export market significantly impact global rice prices. In 2021, with the increase in rice exports from India, which more than compensated for the stagnant rice exports from other Asian countries, international rice prices started falling (Figures 4 and 5).

Global food prices are, of course, not determined by supply and demand factors alone. Food price increases have also been driven by the machinations of a few large multinational companies, which control the global grain market as an oligopoly. In the Indian context, Kunal Munjal (2023) argues that the gainers from the price rise of rice in the export market are a few private traders who dominate the market, not farmers.

India’s ban on the export of non-basmati varieties of rice is likely to – at least in the short run – aggravate concerns about food insecurity in Africa. Close to 45 per cent of all rice exports from India went to Africa in 2022-23. Benin, Côte d’Ivoire, Guinea, Madagascar and Kenya are significant importers of Indian rice (Table 4). Being a food deficit region, Africa is also affected by the disruptions in international trade in food grains caused by the hostilities between Russia and Ukraine.

Figure 5: International Cereal and Rice Prices and Rice Exports from India, Monthly Values, January 2017 to July 2023, as indices (with the values for January 2017 = 100)

Note: The figure shows the monthly values of the three variables, with the starting value (for January 2017) for each variable equivalent to 100. For instance, compared to the level in January 2017, India’s rice export was approximately half in October 2019 and 2.4 times in March 2021 (the indices were close to 50 and 240, respectively).

Source: The FAO, International Grain Council and Ministry of Commerce and Industry, Government of India.

Domestic Demand for Food in India

Even while India exports food, the domestic per capita availability of food grain is relatively low, leading to the prevalence of deprivation and undernourishment among large segments of India’s population. Wheat and rice are the two most widely consumed cereals in India. In 2020-21, the per capita availability of wheat and rice in India was 93 kg and 99 kg, respectively, much lower than the corresponding figures for China: 192 kg and 178 kg, respectively. The average daily per capita food intake was 2599 kilocalories only in India compared to 3337 kilocalories in China (FAO data for 2020).

India can export food grain mainly because of the depressed domestic demand for food, owing to the low purchasing power of the country’s poor. The contrast with China is striking. Despite being the world’s largest producer, China exports little rice or wheat. That is because of the high levels of domestic demand for these cereals for direct human consumption or as animal feed.

With India’s National Food Security Act, 2013, as much as 75 per cent of the country’s rural and 50 per cent of the urban population are legally entitled to receive food grain at subsidised rates through the Targeted Public Distribution System. Following the outbreak of the COVID-19 pandemic, in April 2020, the government began providing a monthly allocation of 5 kilograms of food grain per person for free, over and above the earlier allocation at subsidised rates. The provision of free food grain (5 kilograms per person per month), which benefits more than 800 million, has continued ever since (April 2020) under a new scheme titled Pradhan Mantri Garib Kalyan Yojana. The government has announced that the free food grain scheme will continue until 2029. Several of India’s state governments have instituted their welfare schemes to provide subsidised or free grain to targeted population segments. While providing much-needed relief for the poor, these governmental interventions also reduce the surplus for export. This was possibly a key consideration for the government when it banned the export of non-basmati white rice from the country in July 2023.

Climate Change and Future Rice Production

There are concerns about the future growth of rice production, especially in the wake of unpredictable weather patterns and climate change in South and Southeast Asia, which are home to some major rice producers. Scientists have warned that El Niño, a climate pattern related to the unusual warming of surface waters in the Eastern Pacific Ocean, will be strengthened in the coming years. The US Department of Agriculture predicts that, mainly because of El Niño’s drying effects, global rice production will increase only by 0.1 per cent in 2023-2024 over the previous year. This is likely to result in higher rice prices in the future.

Conclusion and the Way Forward

The export of rice from India has gained considerable momentum since the 2010s. As India accounts for about 40 per cent of the rice exported worldwide, any change in the quantity of the grain sold by India has immediate consequences for international trade in rice. After India banned the export of non-basmati white rice in July 2023, mainly to ensure adequate domestic supplies, there have been concerns about a significant escalation of rice prices globally. Recent reports indicate that during the 10 months following the export ban, India’s rice exports to Africa and Asia dropped by 43 per cent and 25 per cent, respectively. Further, these restrictions have led to a notable increase in rice prices in neighbouring countries, especially in Nepal and Sri Lanka.

The growth of India’s rice exports has been on the back of an impressive expansion in the production of rice and to a lesser extent of wheat, in the country since the mid-2000s. However, in the long run, the growth of food grain production may fall behind the expansion of domestic demand, given the rise in household incomes and the extension of the public provision of subsidised food. There are worries about the future growth of rice production globally due to unpredictable weather patterns and climate change in South and Southeast Asia. Notwithstanding such long-term concerns, India’s rice production for 2023-24 has reached 136.7 million tonnes, surpassing the 2022-23 figures, according to the third advance estimate of the Government of India. With high production and stock levels, India could consider easing the export restrictions.

The developing world, including India, other Asian countries and Africa, must institute public investments and policies to enhance agricultural yields, boost food production and improve food security. There is much scope for yield-enhancing technologies and investments in agriculture, including in rice cultivation in many regions in India (In 2020-21, the average rice yield was only 2717 kg/hectare for India compared to 4824 kg/hectare for China). At the same time, there may be limits to the dependence on rice and wheat, which are relatively water-intensive crops, for the future food needs of the planet. Countries in Asia and Africa must explore ways to diversify their sources of nutrient intake to other crops as well, including millets, sorghum and pulses.

Acknowledgements: We thank Madhura Swaminathan, Puspa Sharma and Roshan Kishore for their helpful suggestions.

https://www.isas.nus.edu.sg/papers/indias-rice-exports-worlds-food-security-challenges/Published Date: August 30, 2024