Tags

Headwinds for Thai rice industry

Thai exports to decrease as Indian restrictions ease, while long-term challenges remain, says BMI

NEWSPAPER SECTION: Business

Thai rice exports for the 2024-25 harvest season are expected to decrease after a positive 2023-24, due to the easing of Indian export restrictions on the grain, according to BMI, a Fitch Solutions company.

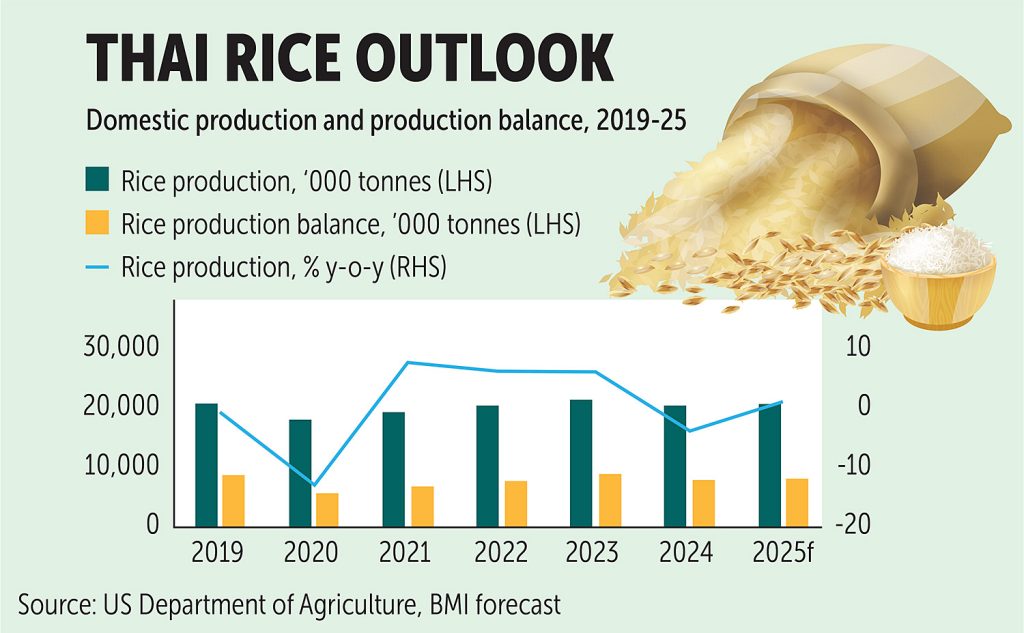

While we forecast rice production in Thailand to increase by 0.5% year-on-year from 20 million tonnes in 2023-24 to 20.1 million in 2024-25, we also expect that exports will post a decrease in the coming season.

The imposition of successive trade restrictions on Indian rice in 2022 and the second half of 2023 contributed to tighten the global rice market significantly as the country is the world’s largest rice exporter.

Thailand was among the markets that benefited the most from this development, with government data released in January 2025 pointing to an increase in rice export volumes of 13.7% year-on-year in 2023 and again by 13.4% in 2024.

Decreased production of rice in 2023-24 in Indonesia and the Philippines also resulted in growing demand for Thai rice. While Indonesia accounted for 1.1% of Thai rice exports in 2022, this rose to 14.3% in 2023 and 12.3% in 2024.

Similarly, the Philippines accounted for 1.9% of Thai rice exports in 2022, rising to 4.2% in 2023 and 5.1% in 2024. Looking ahead at 2024-25, we expect improved production in both countries and the Indonesian government’s focus on boosting domestic self-sufficiency to also weigh on their demand for Thai rice.

LOW YIELDS

We highlight downside risks faced by the sector including stagnant growth, relatively low yields and low competitiveness. While Thailand remains the world’s second largest rice exporter, India’s rice sector has been significantly outperforming it over the past decade. This is evident in their roles as exporters.

India has increased its share of global rice exports from 25.4% in 2012 to 35.5% in 2022, while Thailand’s share decreased from 19.2% to 14.7%. In addition, Indian rice exports between 2013 and 2017 were 45.4% higher than Thai exports and this difference increased sharply between 2018 and 2022, up to 104.7%.

Long-term challenges affecting the Thai rice industry have contributed to India’s growing dominance over Thailand in the rice sector. According to US Department of Agriculture (USDA) data, in 2023-24 Thai rice yields were 2.9 tonnes per hectare, significantly lower than other large regional producers like India (4.4 tonnes), Pakistan (4.0) and Vietnam (6.1).

Thailand’s rice yields also experienced the smallest growth over the past decade, increasing by just 8% between 2014-15 and 2023-24 compared to India (73%), Pakistan (44%) and Vietnam (34%).

Stagnating growth for the sector is also seen in developments in area harvested, with the compound annual growth rate (CAGR) for area harvested between 2012-13 and 2024-25 of -0.1% and for yields of 0.08%. Consumption is growing with a forecast CAGR of 3.1% between 2015-16 and 2024-25, outpacing production with a CAGR of 2.4% in the same period, further evidence of limited growth.

Thai rice exports also face challenges in terms of their prices. According to the UN Food and Agriculture Organization’s latest Rice Price Update from December 2024, Thai parboiled 100% rice prices were $535.70 per tonne, significantly higher than Indian parboiled rice at $439.80.

Although rice exports remain an important source of revenue for Thailand, their importance has decreased over the past decade. Rice accounted for 17.3% of total agricultural exports in 2012, down to 12.5% in 2023, while still the largest category within that group.

REGIONAL PRESSURES

We expect the reopening of the Indian export market to also weigh on other regional exporters like Vietnam and Pakistan, while highlighting that this is a positive development for importers that have historically relied on India, such as Sub-Saharan African countries.

As seen in the chart, the USDA expects rice exports from Pakistan and Vietnam to also decrease in 2024-25 despite small increases in production, forecasting year-on-year reductions in exports of 12.9% and 16.7%, respectively.

Indian rice export restrictions were particularly concerning for African countries, which imported 53.5% of their total rice imports from India in 2022. African countries like Ivory Coast, Togo and Mozambique all increased their imports from Thailand and other alternative exporters in the face of Indian restrictions. We expect them to now return to importing from India given their price-sensitivity, and believe this is an upside risk for countries in the region that rely on India for rice imports.

https://www.bangkokpost.com/business/general/2965323/headwinds-for-thai-rice-industryPublished Date: February 22, 2025