Tags

Global rice prices plunge to multi-year lows as supplies surge

- Premium grade prices correct sharply

- Asian mid-grades hold competitive advantage

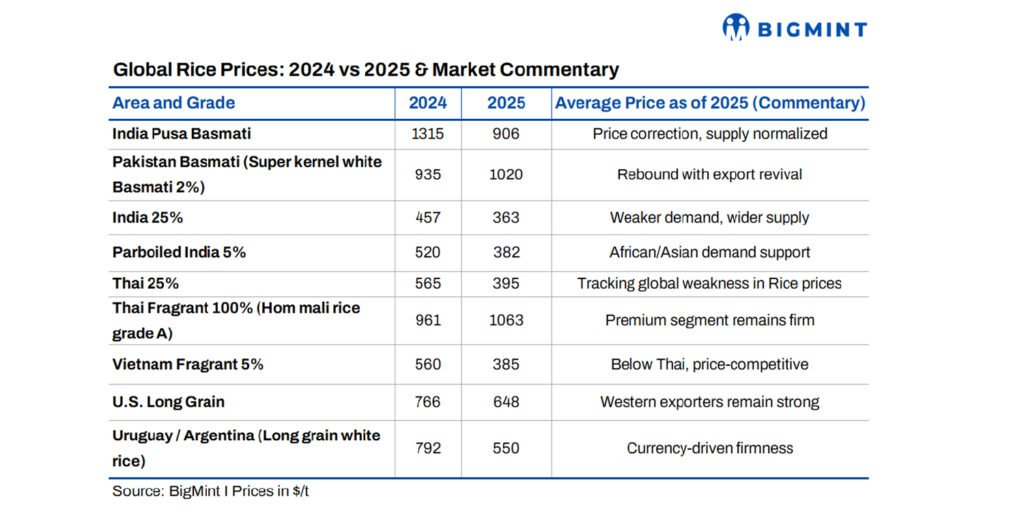

Global rice prices had slipped to multi-year lows at the start of 2025 as swelling supplies and uneven export demand pushed down benchmark quotes across several origins. The latest FAO Rice Price Update (December 2025) shows the FAO index registering a fifth consecutive monthly decline, underscoring persistent pressure in the international market. Activity remains uneven, with exporters in South and Southeast Asia reporting contrasting price patterns across premium fragrant and lower-grade milled rice. Currency fluctuations, export controls and shifting trade flows continue to influence liquidity.

India remains price setter, premium correction widens

India still the fulcrum of global trade is experiencing a distinct price trajectory. Basmati values eased from their 2024 peaks as export competition intensified. India Pusa Basmati slipped from $1,315/metric tonne (t) in 2024 to roughly $906/t in 2025, while Pakistan Basmati declined from $935/t to $1,020/t. Despite the correction, values remain elevated relative to other fragrant origins, signalling that demand for premium long-grain aromatics is intact but more price-sensitive.

The outlook for non-basmati rice is more fragmented. India 25% broken fell sharply from $422/t in 2024 to $362/t in 2025 as liquidity rose and government interventions softened. Parboiled 5% shipments held firmer at $382/t, supported by steady off-take from Africa and South Asia. The Indian 5% grade traded flat through 2025, marginally below the highs posted earlier, underscoring stable demand for parboiled cargoes even as milled grades weakened.

Thailand benefits from price stability, policy clarity

Thai export quotes remained broadly stable across Southeast Asia. Thai 5% traded in the $535550/t band through 2024-25, maintaining a competitive edge. Premium Thai Fragrant 100% consistently cleared above $1,000/t, consolidating Thailand’s position among high-value import markets. Thai A1 Super and Thai 25% hovered near $394395/t in 2025, offering a value proposition for buyers seeking predictability during periods of tight Indian policy.

This steep correction brings the price level for this benchmark down by over 29%year-over-year. The spot price was trading even lower, at $361.7/MT, in November 2025.

Vietnam holds ground on strong China, Philippines demand

Vietnamese prices stayed resilient on the back of consistent bookings from China and the Philippines. Viet 5% stood at $385/t in 2025, while Viet Fragrant 5% fetched $471/t below Thai fragrant equivalents but high enough to preserve competitiveness. Glutinous segments were active as well, with Viet Glutinous 10% averaging around $554/t. Vietnam’s pricing gains reflect improved milling capacity and strong throughput on fragrant and specialty varieties.

Western Hemisphere exporters maintain firm premiums

Prices in the US and South America remained insulated from the broader price slide due to lower carry-over stocks and steady demand within the Western Hemisphere. US long-grain averaged $647/t in 2025, while Uruguay and Argentina traded at $549/t and $536/t respectively. Shipping costs and currency effects offered additional support, keeping volatility lower than in Asia-based origins.

Diverging momentum points to recalibrated global trade map

The FAO update highlights pronounced month-to-month volatility through 2024-25. Thailand and Vietnam saw periodic demand spikes tied to short-term buying waves, whereas India and Pakistan alternated between soft and firm phases depending on domestic policy, supply arrivals and the export pipeline. Premium fragrant rice remains the most sensitive to supply shocks, while parboiled and 25% broken grades continue to trade within a narrower band due to wider end-user diversity.

Market outlook

As 2026 knocks on the door, the global rice market is structurally less aligned than in previous years. Premium aromatic grades are retreating from last year’s historic highs, mid-grade Asian rice retains a competitive foothold across major importing regions, and Western Hemisphere exporters are defending high price levels with reduced volatility. The coming quarters are likely to stay range-bound but volatile as weather patterns, government policies and import demand continue to dictate trade flows.

https://www.bigmint.co/insights/detail/global-rice-prices-2025-premium-correction-asian-mid-grades-advantage-703913Published Date: December 11, 2025