Tags

EU moves to curb Asian rice imports through safeguard tariffs

- Brussels plans automatic duty trigger on basmati and non-basmati shipments

- India and Pakistan expected to face highest market disruption from 2027

The European Union is moving to curb rice imports from India, Pakistan, and other Asian suppliers under a new safeguard mechanism aimed at protecting its growers and millers from rising volumes of competitively priced shipments. The regulation, which covers both basmati and non-basmati rice varieties, is expected to take effect on January 1, 2027, following final legislative approval.

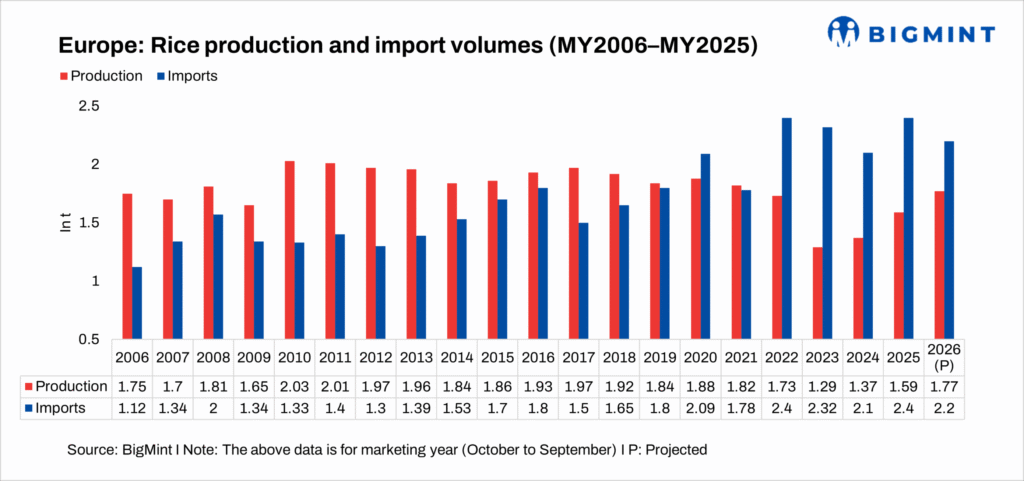

EU rice imports have steadily increased over the past two decades. Imports stood at 1.12 million tonnes in the marketing year (MY) 2006 and reached 2.4 million tonnes in MY2024, with a forecast of 2.2 million tonnes for MY2026, representing a rise of more than a 114% since MY2006, even as the bloc begins tightening trade controls to protect domestic interests.

Production, meanwhile, has remained largely stagnant. EU output was 1.75 million tonnes in MY2006 and 1.59 million tonnes in MY2025, marking a decline of about 9.1% and with a projection of 1.77 million tonnes in MY2026. The marginal recovery does not offset the rapid rise in imports, particularly from India, Pakistan, Myanmar and Cambodia. Thailand and Vietnam have maintained stable export volumes to Europe and are expected to see limited impact under the safeguard trigger.

Safeguard mechanism to activate on import surge

The legislation sets a tariff-rate quota allowing preferential duties only if imports stay within historical levels; exceeding them triggers higher MFN tariffs, protecting the EU rice sector despite ongoing trade talks with India. The EU aims to protect its rice milling industry by encouraging imports of raw paddy over processed rice, ensuring value-addition happens within Europe. The trade battle will focus on tariffs and diplomacy rather than prices over the next three years.

Push to shift value-addition to Europe

The Federation of European Rice Millers (FERM) has urged for higher duties on husked, milled, and packaged rice, claiming current tariffs don’t match market conditions. They propose raising tariffs to 416 per tonne for semi- and wholly-milled rice and 264 per tonne for husked rice to discourage imports of processed rice and encourage shipping raw paddy for milling and packaging within the EU.

Industry weighs strategic response

Some Indian companies are already adapting by establishing processing capacity in Europe, with Daawat setting up a plant in the Netherlands. Trade experts argue that India must now use the FTA negotiations to secure tariff safeguards for packaged basmati and GI-tagged varieties to avoid a long-term market access hurdle. Without such protections, the value chain for high-margin rice could shift from South Asia to Europe, even if raw grain continues to be sourced from India and Pakistan.

Outlook

The new tariff framework is expected to consolidate the European rice market, allowing only a handful of large millers to dominate retail supply. As duties make packaged and processed imports less competitive, Asian exporters are likely to lose shelf visibility and brand presence in EU supermarkets. Over time, the centre of value addition in the rice trade could shift from India and Pakistan to Europe, with milling, packaging and branding increasingly captured by EU processors rather than Asian suppliers.

https://www.bigmint.co/insights/detail/eu-moves-to-curb-asian-rice-imports-through-safeguard-tariffs-703695Published Date: December 9, 2025