Weekly Rice Market

(Indicative Quotes)

Basmati Rice

Basmati Rice | Indicative Quotes | Updated Weekly

Global Market | White Rice

White Rice | Indicative Quotes | Updated Weekly

| Origin | Type of Rice | Variety Name | Broken | Price | Change | High | Low |

|---|---|---|---|---|---|---|---|

| India | Milled White Rice | Long Grain | 5% | $354 | 0 | $380 | $348 |

| India | Milled White Rice | Long Grain | 5% | $381 | 0 | $496 | $379 |

| Pakistan | Milled White Rice | Long Grain | 5% | $369 | 0 | $374 | $334 |

| Pakistan | Milled White Rice | Long Grain | 5% | $380 | 0 | $640 | $380 |

| Pakistan | Milled White Rice | Long Grain | 5% | $590 | 0 | $613 | $488 |

| Thailand | Milled White Rice | Long Grain | 5% | $410 | 0 | $430 | $351 |

| Thailand | Milled White Rice | Long Grain | 5% | $387 | 0 | $669 | $387 |

| Thailand | Milled White Rice | Long Grain | 5% | $596 | 0 | $659 | $469 |

| U.S | Milled White Rice | Long Grain | 4% | $566 | 0 | $622 | $565 |

| U.S | Milled White Rice | Long Grain | 4% | $654 | 0 | $818 | $654 |

| U.S | Milled White Rice | Long Grain | 4% | $798 | 0 | $798 | $708 |

| Vietnam | Milled White Rice | Long Grain | 5% | $367 | 0 | $403 | $360 |

| Vietnam | Milled White Rice | Long Grain | 5% | $386 | 0 | $657 | $382 |

| Vietnam | Milled White Rice | Long Grain | 5% | $579 | 0 | $667 | $445 |

News

Thai rice exports ...

Thai rice exporters forecast 2026 exports at 7.03m tonnes, a five-year low, citing a stronger baht and potential US tariffs hitting competitiveness Thai rice exporters are

Gov’t to pro...

By Ko Dong-hwan K-Ricebelt aims productivity to reach 6 tons per farm Korea is expanding assistance to African nations to boost rice production. The Rural Development

THAI RICE EXPORTS ...

By Khaosod English Thailand’s rice exports fell sharply in January, raising concerns that 2026 shipments could hit a five-year low amid a strong baht and intensifying global

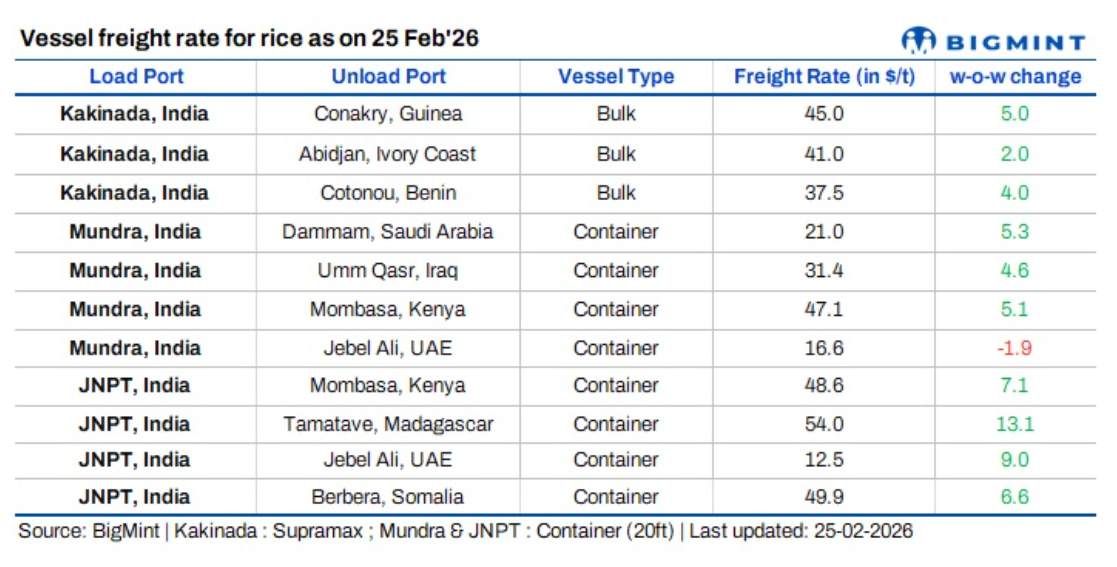

India: Rice freigh...

India’s rice export freight market firmed w-o-w as of 25 February 2026, marking a shift from the previous week’s softer tone. East coast bulk rates strengthened across

Anutin, Suphajee d...

Anutin and Suphajee meet with Chinese Ambassador to speed up exports of 40,000 tons of rice in February, aiming for 500,000 tons by the end of the year. On Tuesday evening

Malaysia’s rice st...

By Bernama KUALA LUMPUR (Feb 25): As of Feb 3, Malaysia’s physical rice stock stood at 1.09 million metric tonnes, including 200,000 tonnes of buffer stock and 889,285 tonnes

Pakistan rice expo...

ISLAMABAD (Web Desk) – Pakistan’s rice exports fell 40.5 percent to $1.31 billion in the first seven months of the fiscal year, official data showed on Tuesday, as

Basmati rice to bo...

TNM (With ANI Inputs) Union Agriculture Minister Shivraj Singh Chouhan assured on February 7 that the government has safeguarded all major crops and dairy products, prioritising

Pakistan’s food ex...

Rice exports drop to $1.305 billion; fish shipments up 9%; January exports reach $624.4 million. By News Desk Pakistan’s food exports declined by 35.21% to $2.988 billion

Featured Registered Companies

RNT Tube

India-EU FTA Sparks Alarm In Pakistan As Export Edge Fades And 10 Million Jobs Face Uncertain Future

February 10, 2026

Statistics

Sustainable Rice

Farmers Place

Upcoming Events

Forex Rates

Open Market Forex Rates

Updated at:

From | ||

|---|---|---|

To | ||

| Countries | Currency | Spot Rate |

Enjoyed the read?

Join our monthly newsletter for helpful tips on how to run your business smoothly