Weekly Rice Market

(Indicative Quotes)

Basmati Rice

Basmati Rice | Indicative Quotes | Updated Weekly

Global Market | White Rice

White Rice | Indicative Quotes | Updated Weekly

| Origin | Type of Rice | Variety Name | Broken | Price | Change | High | Low |

|---|---|---|---|---|---|---|---|

| India | Milled White Rice | Long Grain | 5% | $353 | +4 | $380 | $348 |

| India | Milled White Rice | Long Grain | 5% | $381 | +4 | $496 | $379 |

| Pakistan | Milled White Rice | Long Grain | 5% | $358 | +3 | $360 | $334 |

| Pakistan | Milled White Rice | Long Grain | 5% | $380 | +3 | $640 | $380 |

| Pakistan | Milled White Rice | Long Grain | 5% | $590 | +3 | $613 | $488 |

| Thailand | Milled White Rice | Long Grain | 5% | $430 | +3 | $430 | $351 |

| Thailand | Milled White Rice | Long Grain | 5% | $387 | +3 | $669 | $387 |

| Thailand | Milled White Rice | Long Grain | 5% | $596 | +3 | $659 | $469 |

| U.S | Milled White Rice | Long Grain | 4% | $566 | 0 | $622 | $566 |

| U.S | Milled White Rice | Long Grain | 4% | $654 | 0 | $818 | $654 |

| U.S | Milled White Rice | Long Grain | 4% | $798 | 0 | $798 | $708 |

| Vietnam | Milled White Rice | Long Grain | 5% | $367 | +4 | $403 | $363 |

| Vietnam | Milled White Rice | Long Grain | 5% | $386 | +4 | $657 | $382 |

| Vietnam | Milled White Rice | Long Grain | 5% | $579 | +4 | $667 | $445 |

News

Govt approves impo...

Officials said the rice imports would help maintain adequate public food stocks and curb market volatility during Ramadan when demand for essentials rises sharply. UNB The

India’s rice stock...

MUMBAI, (Reuters) – India’s rice inventories in government warehouses climbed nearly 12% from a year earlier to a record high for early December after state-run

Indonesia to stop ...

By Vietnam News Agency Indonesia will not import rice for either consumption or industrial use next year, citing sufficient domestic production, according to a government

Kingdom, Sri Lanka...

Sreekanth Ravindran / Khmer Times Synopsis: Both sides explore opportunities to expand collaboration in high-value agricultural products and agri-food industries. Cambodia and Sri

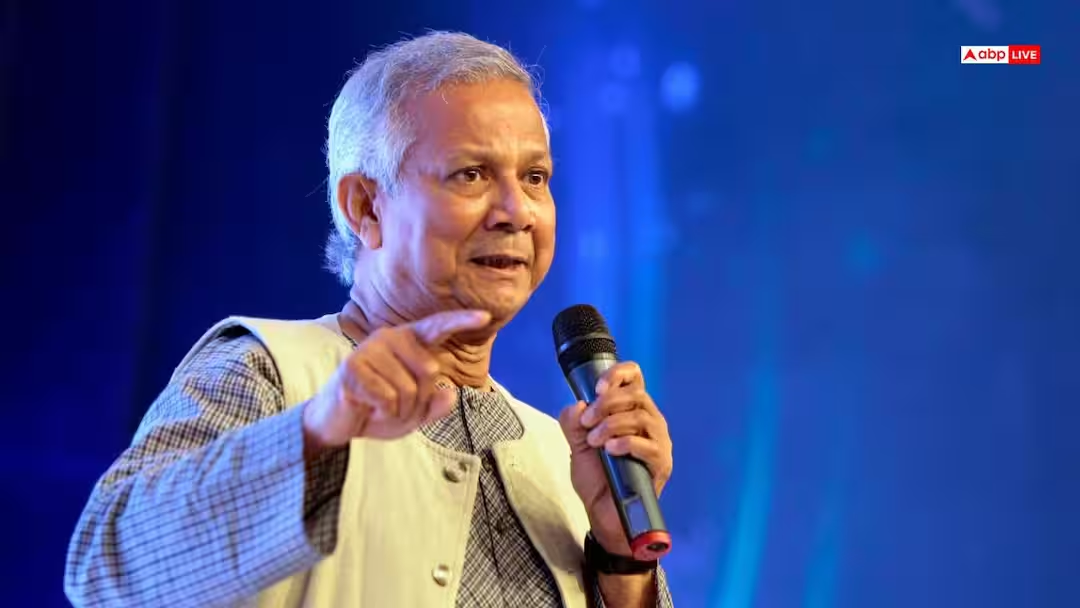

Bangladesh interim...

Bangladesh Sangbad Sangstha . Dhaka Bangladesh interim government has taken fresh initiatives to strengthen food security by approving proposals to procure 100,000 metric tons

India-Bangladesh T...

Bangladesh moves to ease tensions with India by approving the import of 50,000 tonnes of rice, signalling that economic needs are taking priority over political differences.

Russia will replac...

The Russian government did not extend the ban on the export of rough rice outside the Eurasian Economic Union for 2026 but established a quota on grain exports. This decision is

PHL palay output e...

PHILIPPINE PRODUCTION of palay (unmilled rice) is expected to decline 0.16% to 19.6 million metric tons (MMT) in marketing year (MY) 2025-2026, the US Department of Agriculture

Indonesia’s ...

Statistics Indonesia earlier reported that potential domestic rice production this year is estimated at 34.79 million tonnes, up 4.17 million tonnes or 13.6% from 30.62 million

Featured Registered Companies

RNT Tube

What Trump’s Tariffs On Basmati Rice Means For India? Experts Answer

December 12, 2025

Statistics

Sustainable Rice

Farmers Place

Upcoming Events

Forex Rates

Open Market Forex Rates

Updated at:

From | ||

|---|---|---|

To | ||

| Countries | Currency | Spot Rate |

Enjoyed the read?

Join our monthly newsletter for helpful tips on how to run your business smoothly