Tags

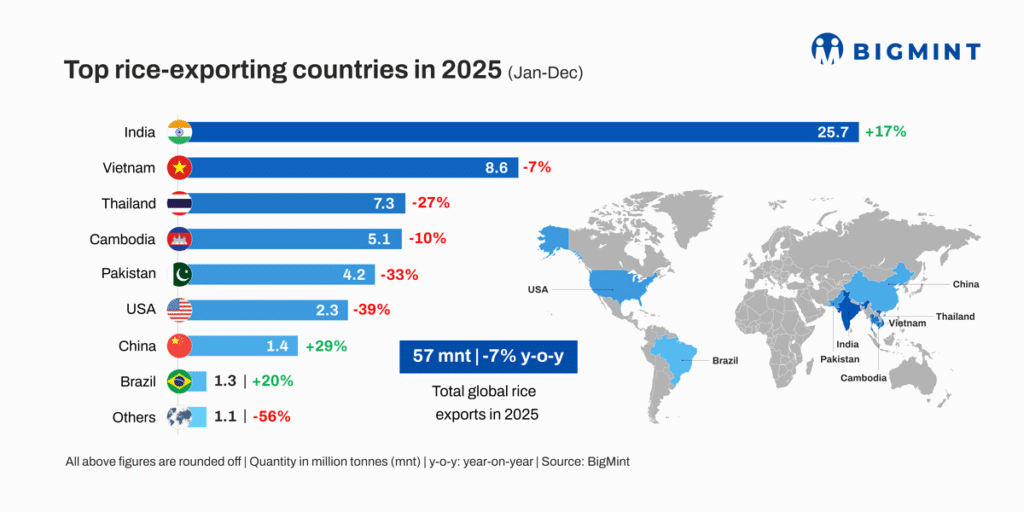

Global rice exports fall 7% y-o-y in CY’25; India’s shipments surge 17%

- India remains largest exporter, accounts for 45% of trade volumes

- Rising production, competitive pricing aid India’s export growth

- Vietnam’s exports fall 7%, Thailand’s shipments plunge 27% y-o-y

Morning Brief: Global rice exports declined by 7% y-o-y to 56.9 million tonnes (mnt) in CY’25, as per data maintained by BigMint. Trends diverged across regions, but India continued to dominate global rice trade in CY’25, accounting for 45% of global trade volumes. India remained the world’s largest exporter, with shipments increasing sharply by 17% y-o-y to 25.7 mnt.

In CY’25, global trade was driven by India’s surplus-led pricing power, while other origins faced cost, currency, and supply constraints. Global production rose slightly by 0.21% y-o-y to 477 mnt in CY’25, heavily concentrated in Asia. Output from India and China, the two largest producers, increased marginally by 1% y-o-y each to 151 mnt and 146 mnt, respectively.

In some markets such as India, higher production translated directly into larger exportable availability and stronger shipments. In others, including Brazil, exports increased despite lower output due to stock drawdowns and favourable trade economics, while Southeast Asian exporters faced tighter domestic supply and cost pressures that constrained shipments.

Region-wise exports in CY’25

India: India’s export growth (+17%) was supported by a large exportable surplus backed by strong kharif procurement and comfortable buffer stocks. Competitive FOB pricing in parboiled and white rice kept Indian material attractive versus Thailand and Vietnam, particularly in Africa. Stable milling throughput, container availability at west coast ports, and steady demand from price-sensitive markets sustained shipment momentum. Policy calibration — export restrictions and their phased easing — on non-basmati flows, currency depreciation, and freight economics also played a decisive role in maintaining India’s trade dominance.

Vietnam: Shipments moderated by 7% as tighter domestic supply and the government’s prioritisation of food security influenced export availability. Price competition from India in the white rice segment reduced Vietnam’s share in cost-sensitive destinations, while demand from China and ASEAN showed periodic volatility. Logistics disruptions in the Mekong Delta channels and the appreciation of the dong also affected trade competitiveness.

Thailand: The 27% decline in exports was driven by higher offers, a strengthening baht against the US dollar, and water availability concerns affecting paddy output. Competition from lower-priced Indian supplies in standard white rice markets and shifting demand towards parboiled varieties weighed on shipment volumes. Inventory management and demand for premium varieties remained key balancing factors for exporters.

Cambodia: Exports, primarily comprising fragrant rice, fell 10%, driven by milling capacity constraints, higher production costs, weather disruptions, and strong domestic consumption. Heavy reliance on cross-border logistics through Vietnam and Thailand added cost pressures, while limited scale restricted its ability to compete in bulk white rice markets. EU and niche Asian demand continued to guide shipment trends.

Pakistan: Exports fell 33%, impacted by irrigation constraints, crop quality variability, and elevated production costs. Softer basmati demand in key Middle East markets and stronger competition from India in non-basmati segments pressured volumes. Currency fluctuations and high freight costs further influenced trade realisations.

US: Lower exports (-39%) reflected acreage adjustments, weather-related disruptions, and higher production costs. Demand from Latin America softened, while strong domestic consumption absorbed a larger share of output. Higher freight costs and intermittent price gaps with Asian suppliers weighed on competitiveness in global tenders.

China: Export gains (+29%) were largely opportunistic, supported by stock rotation and selective regional demand rather than structural trade expansion. High domestic consumption and food security priorities kept export volumes limited, with participation mainly in neighboring Asian markets.

Brazil: Export growth (+20%) was aided by improved crop availability, currency support and stronger regional demand within the Americas. Trade flows remained largely intra-regional, with Brazil capitalising on logistical proximity and competitive pricing in nearby markets rather than global bulk trade.

Outlook

Looking ahead, India is likely to continue anchoring global rice trade in CY’26, while recovery in Southeast Asian output and currency movements will determine competitiveness among Vietnam, Thailand, and Pakistan and if their exports will pick up. Import demand from Africa and parts of Asia, coupled with freight trends and policy decisions in key exporting countries, will remain the primary drivers shaping export momentum.

https://www.bigmint.co/insights/detail/india-dominates-global-rice-exports-cy25-45-percent-share-722625Published Date: February 12, 2026