Weekly Rice Market

(Indicative Quotes)

Basmati Rice

Basmati Rice | Indicative Quotes | Updated Weekly

Global Market | White Rice

White Rice | Indicative Quotes | Updated Weekly

News

Iran War Impacts I...

Rice faces the largest potential impact. India exported $4.43 billion worth of rice to West Asia in 2025, accounting for 36.7% of its global rice exports. Gyanendra Keshri | DHNS

Impact of Middle E...

OV News Desk The ongoing conflict in the Middle East is beginning to exert significant pressure on the global economy, affecting trade flows, energy supplies, and food

Rice exports up 5%...

In the first two months of the year, rice exports reached 1.3 million tonnes valued at 599.3 million USD, up 5% in volume but down 11.2% in value compared with the same period

Demand surges for ...

Women in 21 villages keep earthen ovens burning from dawn to dusk. Sushanta Ghosh and Sohrab Hossain Traditional puffed rice from the southern districts of Barishal, Jhalakathi

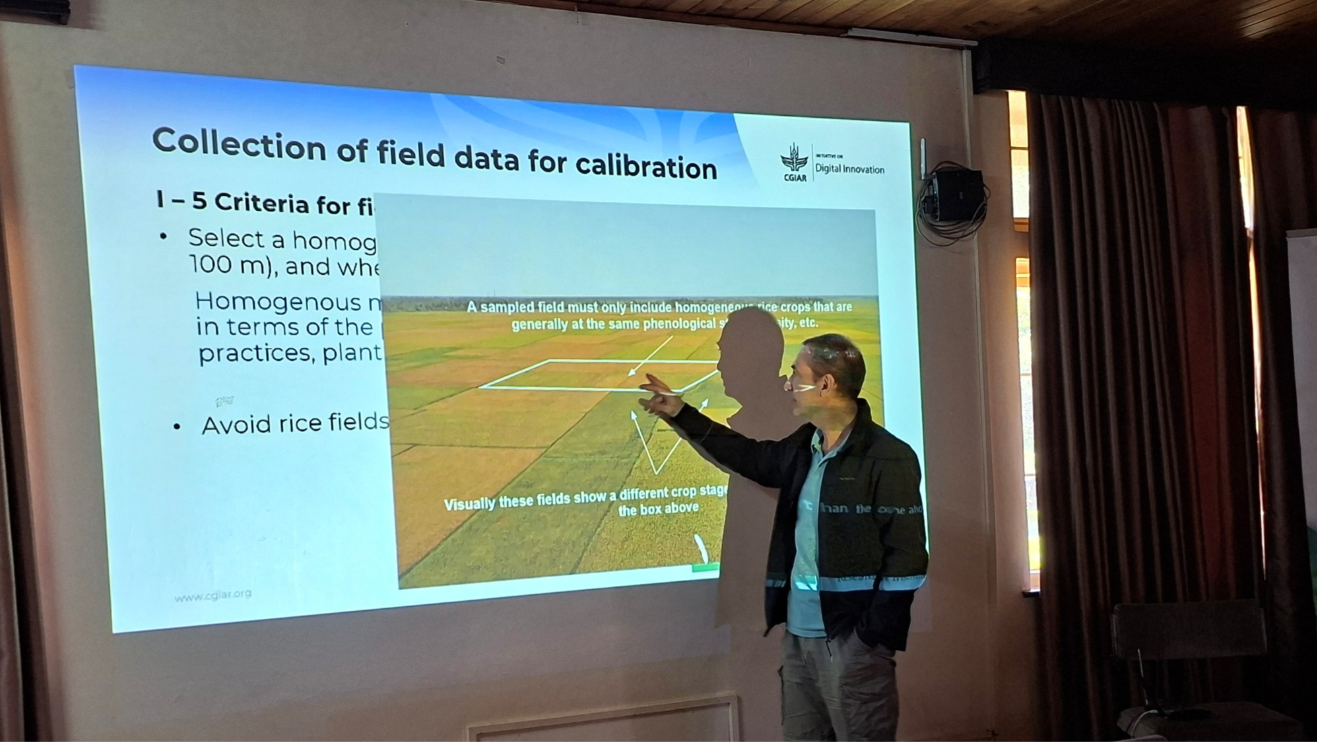

Mozambique seeks T...

ARTICLE BY: Staff Reporter Mozambique is looking to Thailand for knowledge, technology, and practical expertise as it aims to dramatically increase domestic rice production and

Gov’t Approv...

JERLUN, March 8 (Bernama) — The government has approved an allocation of RM45.6 million for the development of a rice mill by the Muda Agricultural Development Authority

Promoting high-qua...

Amid abundant global supply, high inventories in importing markets and pressure from the upcoming Winter-Spring harvest, Vietnam’s rice sector is accelerating its shift toward

Cambodia’s A...

PHNOM PENH: About 400 tonnes of premium fragrant jasmine rice will be exported in batches to Australia. Noted producer Amru Rice Company signed an agreement with Green Group, one

Viet Nam targets n...

In 2026, Viet Nam’s rice industry is determined to maintain export market shares in traditional destinations while proactively expanding into new markets with high demand and

Featured Registered Companies

RNT Tube

India-EU FTA Sparks Alarm In Pakistan As Export Edge Fades And 10 Million Jobs Face Uncertain Future

February 10, 2026

Statistics

Sustainable Rice

Farmers Place

Upcoming Events

Forex Rates

Open Market Forex Rates

Updated at:

From | ||

|---|---|---|

To | ||

| Countries | Currency | Spot Rate |

Enjoyed the read?

Join our monthly newsletter for helpful tips on how to run your business smoothly