Tags

What India’s Rice Export Ban Means for Pakistan?

Rice is a staple food for nearly 3 billion people and India accounts for 40 percent of its global production but it banned its exports of non-basmati rice last week amid significant monsoon damage to crops and domestic prices jumping 3 percent in a month and 11.5 percent in a year.

The move, coupled with the fallout from the heightened tensions in the Black Sea grain corridor, is set to send shockwaves in food prices globally.

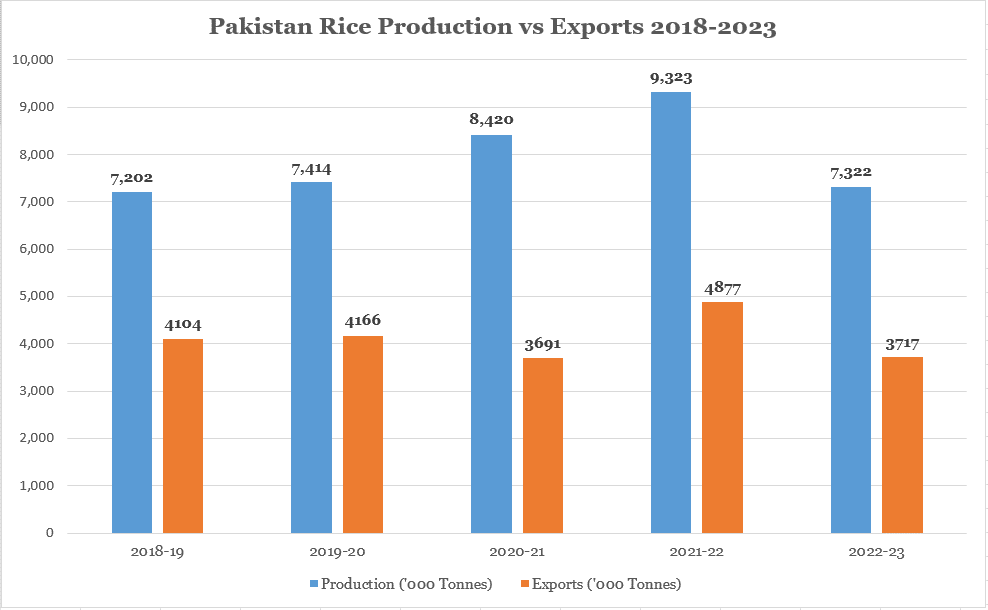

Rice is Pakistan’s third-biggest export group bringing more than $2.1 billion in FY23 despite the national production declining by 21 percent due to floods.

Pakistan is the fourth biggest rice exporter globally and also contributes significantly to national food consumption so it’s unlikely that it will be immune to the aftershock of the ban.

International rice prices are already hovering around their 11-year high so on a positive note, Pakistan can be expected to benefit from this as buyers of Indian rice always turn to Pakistan during such times. Although the new rice crop has yet to harvest, traders are hopeful that it can go favorably for the country’s exports.

“It will surely have some positive impact since non-basmati rice has a very high demand internationally, especially in the African countries”, stated Altaf Hussain Shiekh, Secretary of the Rice Exporters Association of Pakistan (REAP) talking to ProPakistani.

He also hoped that it will have the least impact on domestic prices since our population is more inclined towards basmati varieties.

Pakistan usually has a rice surplus since our annual consumption stands at less than 4 million tonnes while the production stood at 9.3 million tonnes in FY22 before falling to 7.3 million tonnes due to floods last year. However, there is still a strong possibility of a rise in domestic prices due to the ban.

Firstly, our domestic pricing operates more on the market sentiment than actual supply chain inflows and outflows where retailers can sometimes found to cite very ridiculous reasons to jack up the prices.

Secondly, the Indian ban on exports is till 31st August and its rice can enter the market after that which makes it a dual-edged sword.

“It seems risky as well because if growers will sell rice at high prices, the exporters and growers will earn profit but when India opens exports then millers will see losses because the market will go down” stated Amit Kumar, a rice trader from Karachi while talking to ProPakistani.

Secondly, as inflation has skyrocketed, the demand for IRRI-6 and broken non-basmati varieties has also increased as it’s traditionally cheaper than its basmati counterparts.

“Basmati rice prices are Rs. 350-500 per kg in the retail market now you tell how can a poor afford these prices. So they are diverting to IRRI-6 and 100 percent broken rice which is between Rs. 148-155 in wholesale”, added Amit.

Traders are already getting increased calls from India, Vietnam, and other places, and whatever leftover inventories are there, are depleting very quickly.

We have no shortage of market elements who can create a shortage out of nothing so in present circumstances, it’s logical to expect a short-term hike in rice prices, further endangering the food security of the country when wheat and flour are already getting inaccessible.

https://propakistani.pk/2023/07/24/what-indias-rice-export-ban-means-for-pakistan/Published Date: July 25, 2023