Tags

US and Brazilian rice industries align on trade concerns linked to India’s export policies

- India’s export resurgence reshapes market dynamics

- Western producers seek response to trade distortions

Global rice markets are facing renewed price pressure as shifts in export flows altered competitive dynamics across key producing regions. With India strengthening its presence in international trade, higher-cost exporters in the western hemisphere are increasingly exposed to sustained margin pressure, prompting closer coordination among industry bodies in the Americas.

India: Supply resurgence reshapes global pricing

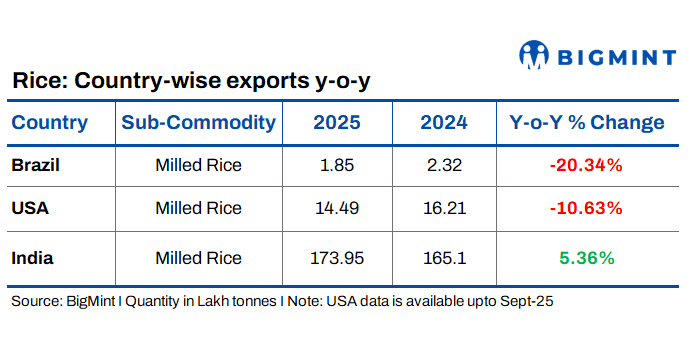

India has reinforced its position as the dominant supplier in the global rice market, with milled rice exports reaching around 173.95 lakh tonnes during January-December 2025, reflecting a y-o-y increase of about 5.4% compared with 165.10 lakh tonnes in the same period last year, as per BigMint data.

The expansion in Indian shipments has added substantial volume to global trade flows, weighing on international prices across both premium and commodity-grade segments. Market participants note that India’s export momentum, supported by policy-driven supply availability, has intensified competition in traditionally price-sensitive destinations across Africa, Latin America, and parts of Asia.

Brazil: Export contraction amid rising pressure

Brazil, the largest rice producer in South America, has historically remained focused on domestic consumption, with exports playing a secondary role in balancing the market. However, the changing global landscape has begun to test that model.

During JanuaryDecember 2025, Brazil’s milled rice exports declined sharply to nearly 1.85 lakh tonnes, down 20.3% from 2.32 lakh tonnes a year earlier. The contraction reflects weaker international competitiveness as lower-priced Asian supplies gained ground, reducing Brazils ability to place volumes abroad and increasing sensitivity to global price movements.

US: Trade concerns intensify as shipments ease

The United States, a key supplier to higher-value and regulated markets, has also seen export volumes come under pressure. Milled rice shipments stood at approximately 14.49 lakh tonnes during CY25 (January-September 2025), down 10.6% from 16.21 lakh tonnes in the previous year.

Faced with narrowing price differentials and rising competition from India, US exporters have become increasingly vocal about the impact of policy-driven supply surges on global price formation. These concerns formed a central theme of recent discussions between USA Rice and Brazil’s rice industry association, ABIARROZ, in So Paulo.

Outlook

Industry representatives acknowledge that the current imbalance in global rice trade is unlikely to correct quickly. As India consolidates its export dominance, western producers are expected to deepen coordination on trade policy and market access issues, while continuing to adapt to prolonged price pressure.

In the near term, market participants anticipate continued volatility, with pricing trends largely dictated by India’s export pace and policy stance. For producers in the Americas, competitiveness is likely to hinge on differentiation, market diversification, and stronger engagement in multilateral trade forums aimed at promoting transparency and discipline in global rice trade.

https://www.bigmint.co/insights/detail/us-and-brazilian-rice-industries-align-on-trade-concerns-linked-to-india-s-export-policies-716401Published Date: January 21, 2026