Tags

Trump tariff threat casts shadow over Indian rice exports

- Tariff remark triggers a sell-off in rice exporter stocks as investors anticipate weaker U.S. demand

- Premium basmati segment seen most exposed to pricing and margin risks if duties are imposed

U.S. tariffs on Indian rice sent shares of leading rice exporters sharply lower on Tuesday after President Donald Trump suggested that India may soon face additional import duties. The comment, interpreted as a potential shift towards stricter trade policy, prompted investors to exit stocks linked to India’s rice export value chain.

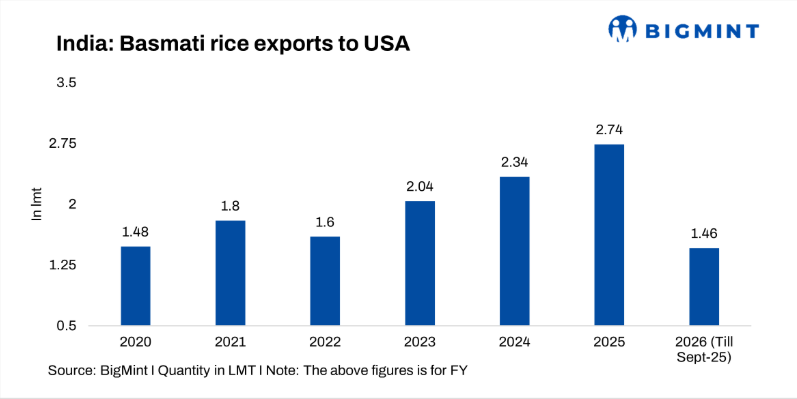

U.S. imports of Basmati rice from India rose 14.7% from FY2023 to 2.34 LMT in FY 2024, followed by another 17.1% growth in FY2025 to 2.74 LMT. In FY2026 (till September), imports stood at 1.46 LMT, which is 46.7% lower than the full-year FY2025 figure, signalling a sharp deceleration so far.

Why the U.S. matters despite limited share

India supplies rice to more than 150 countries, with the bulk of basmati exports destined for the Middle East, Africa, and Europe. The U.S. accounts for a relatively small share of India’s overall rice exports, but it remains one of the few high-value markets for branded basmati where companies command a premium.

KRBL, known for the India Gate brand, and LT Foods, the producer of Daawat, have built strong distribution channels in North America. Higher U.S. tariffs would raise retail prices for Indian basmati and non-basmati rice, which could dampen consumer demand and place pressure on export volumes and realisations.

Trade uncertainty clouds earnings outlook

Industry participants say the tariff proposal has not been formalised, and Indian authorities have not received an official notification. However, uncertainty alone is weighing on business sentiment. Market analysts note that if the U.S. follows through with higher duties, rice exporters may need to adjust pricing strategies, redirect supply toward alternative geographies or absorb part of the duty burden to retain market share.

The episode highlights the vulnerability of agricultural exporters to sudden geopolitical and trade-policy shifts. For companies heavily reliant on branded basmati sales in premium Western markets, any additional tariff barrier risks eroding margins at a time when global freight and procurement costs remain elevated.

Waiting for clarity from Washington

Exporters are monitoring developments closely, while investors are adopting a cautious stance until the U.S. government provides clarity on whether new duties will be implemented and whether exemptions may apply to specific rice categories. Until then, both equities linked to rice exports and medium-term demand projections are expected to remain sensitive to policy signals.

Outlook

Indian rice exporters face a cautious near-term outlook as potential U.S. tariffs create uncertainty around premium basmati shipments, pressuring volumes and margins for companies with meaningful exposure to the American market, but the overall industry impact is expected to remain limited because the U.S. represents a small share of Indias global rice exports; strong demand from the Middle East, Africa, and Europe, along with Indias price and quality edge, should help offset U.S. weakness, though premium-segment players may experience temporary volatility until trade policy clarity emerges.

https://www.bigmint.co/insights/detail/trump-tariff-threat-casts-shadow-over-indian-rice-exports-703996Published Date: December 10, 2025