Tags

Rice Prices Decline Amid Weather Challenges, But Increased Production Expected to Boost Supplies

Rice prices fell last week, possibly due to farm selling after a mid-week rally. U.S. weather issues, including early excess rain and current drought in Texas, have affected yields. However, increased planted area from last year suggests a rebound in production, with expected supply tightness easing as greatly increased supplies arrive this fall.

By Jack Scoville

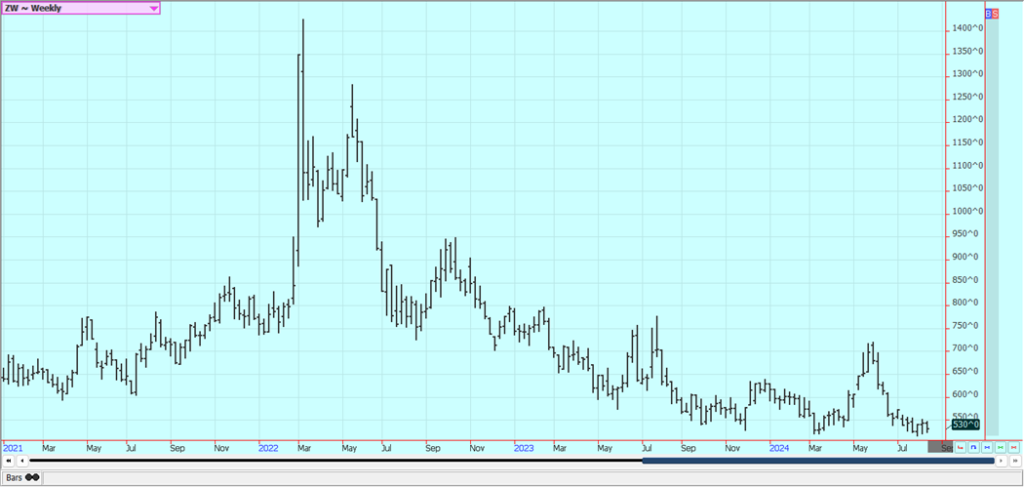

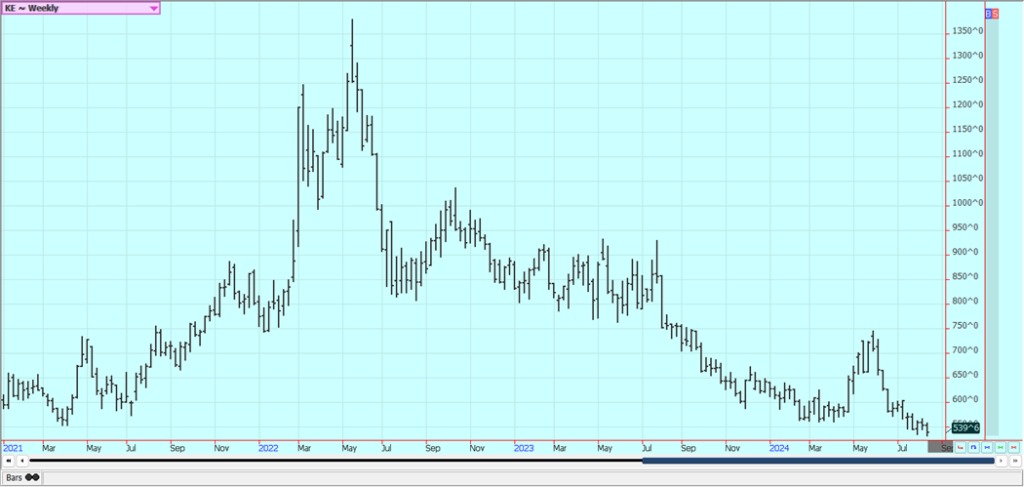

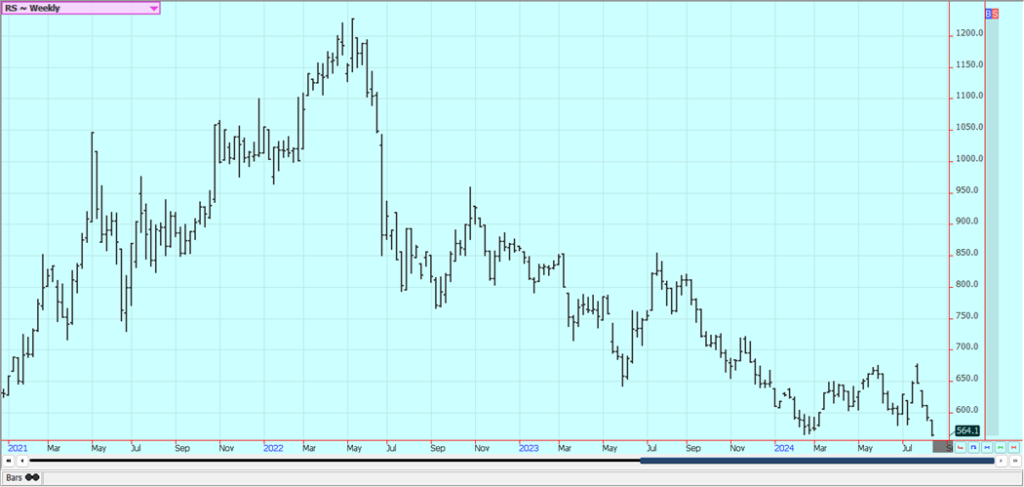

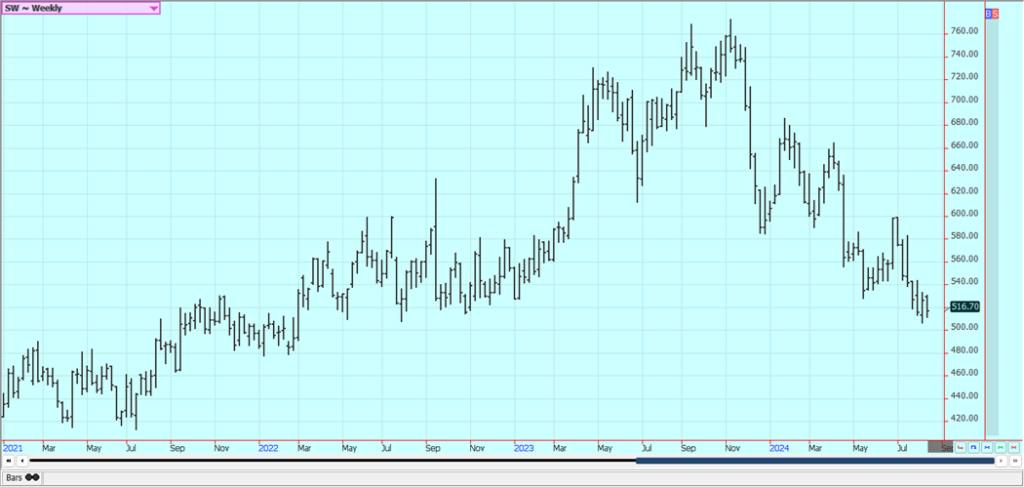

Wheat: Wheat was lower in Winter Wheat markets on selling seen in part on weaker overseas prices reported in Russia and Europe and less than inspiring weekly export sales reported by USDA. The USDA crop report also hurt Winter Sheat, but supported prices in Minneapolis which closed a little higher for the week.

US harvest progress and ideas of good crops went against reports of hot and dry weather in eastern Europe and Russia and too wet weather in France and Germany are still heard and the weather there affecting world production estimates. There were more reports of hot temperatures coming this week to Russian growing areas. It has also been very dry there. Eastern Europe is also hot and dry. Western Europe has seen too much rain.

Weekly Chicago Soft Red Winter Wheat Futures

Weekly Chicago Hard Red Winter Wheat Futures

Weekly Minneapolis Hard Red Spring Wheat Futures

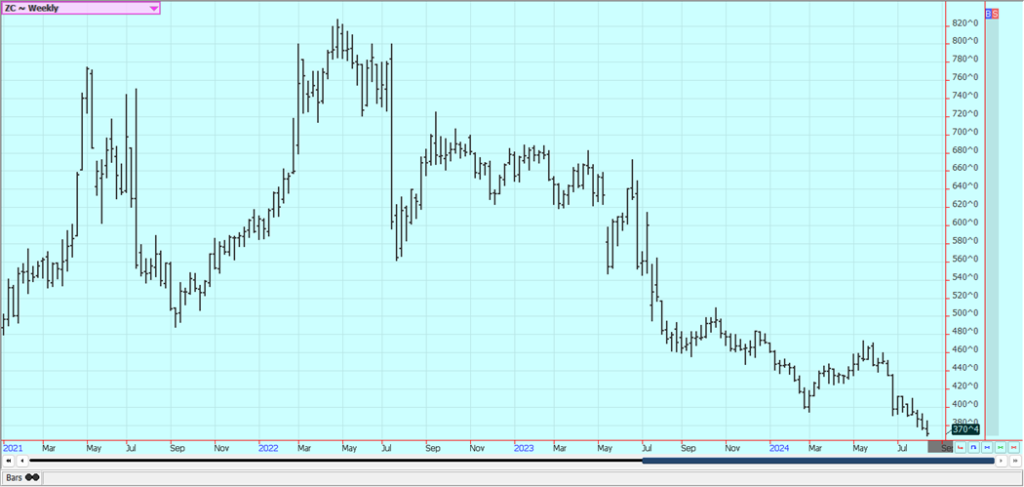

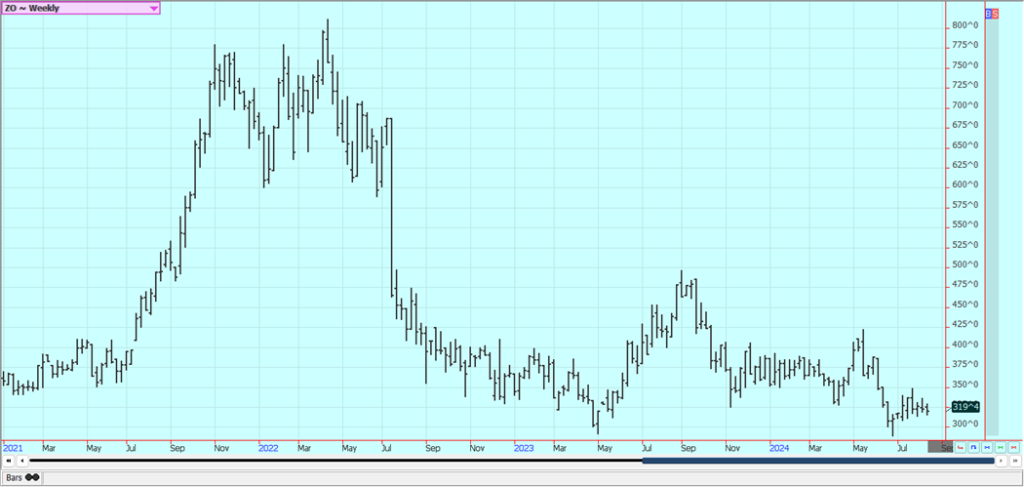

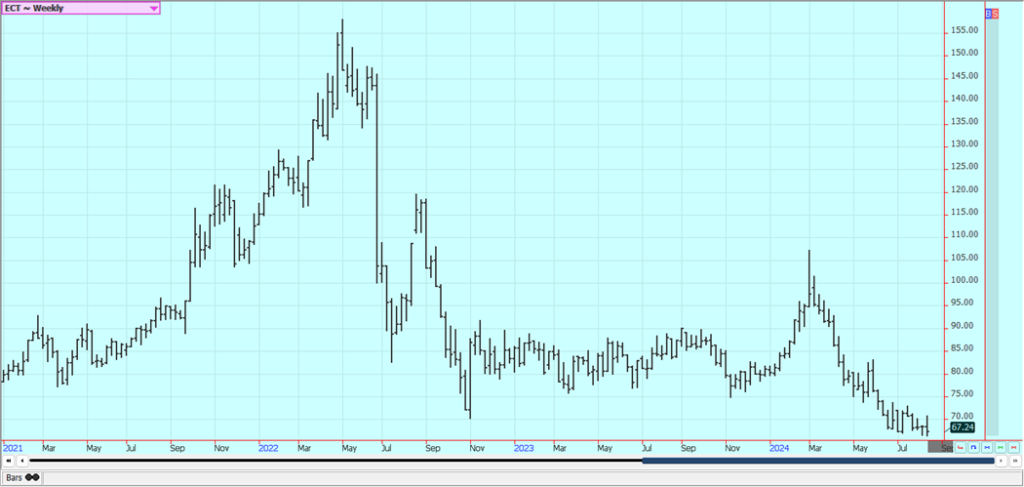

Corn: Corn and Oats closed lower last week, with both crops showing very strong yield potential but Corn supported by USDA reducing harvested area and planted area and also increasing demand potential. The weekly USDA export sales report showed average sales.

The increased demand came from the fact that Corn prices are already the cheapest in the world. Current forecasts call for cooler and drier weather for the Midwest this week. Pro Farmer is holding its annual Midwest crop tour this week and most traders expect the tourists to report top yields and record production potential given the USDA reports from last Monday and the weather outlooks.

Weekly Corn Futures

Weekly Oats Futures

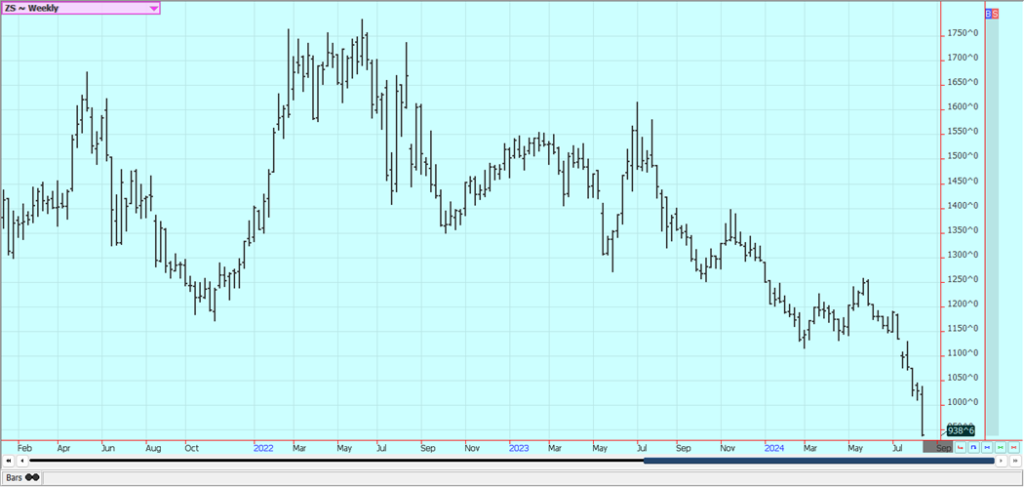

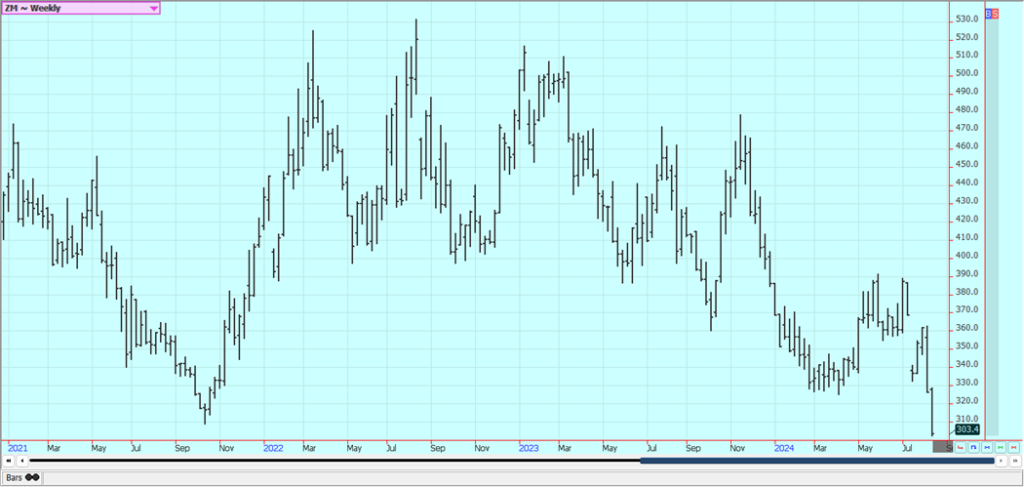

Soybeans and Soybean Meal: Soybeans and the products were lower last week despite a stronger than expected weekly export sales report from USDA. Soybean Oil was lower as the export sales report was not strong. Trader anticipate top production potential and traders expect the Pro Farmer crop tour to confirm these ideas this week.

There was more beneficial precipitation in much of the Midwest over the last week. This week should be dry and temperatures should turn cooler amid dry weather this week. Some selling came from reduced demand ideas. Reports indicate that China remains an active buyer of Soybeans in Brazil. Domestic demand has been strong in the US but has suffered as crushers were crushing for oil.

Weekly Chicago Soybeans Futures

Weekly Chicago Soybean Meal Futures

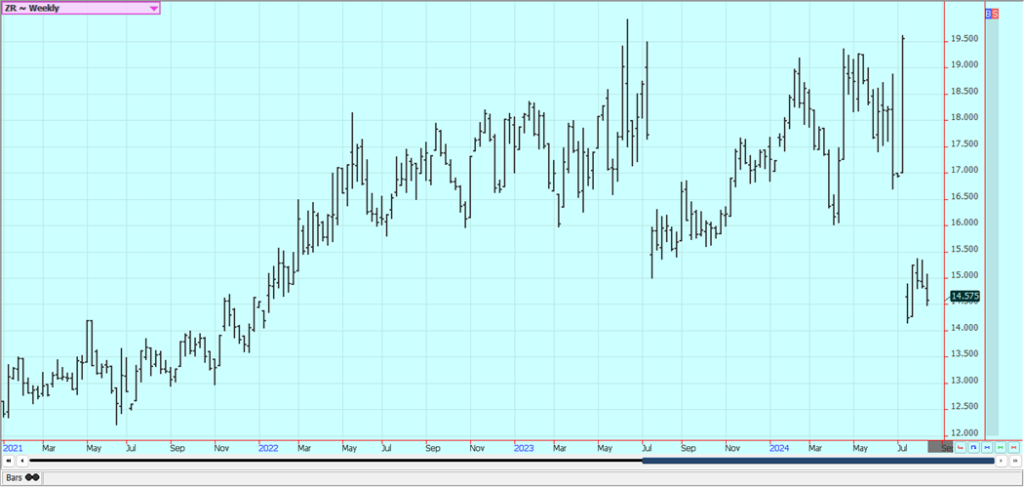

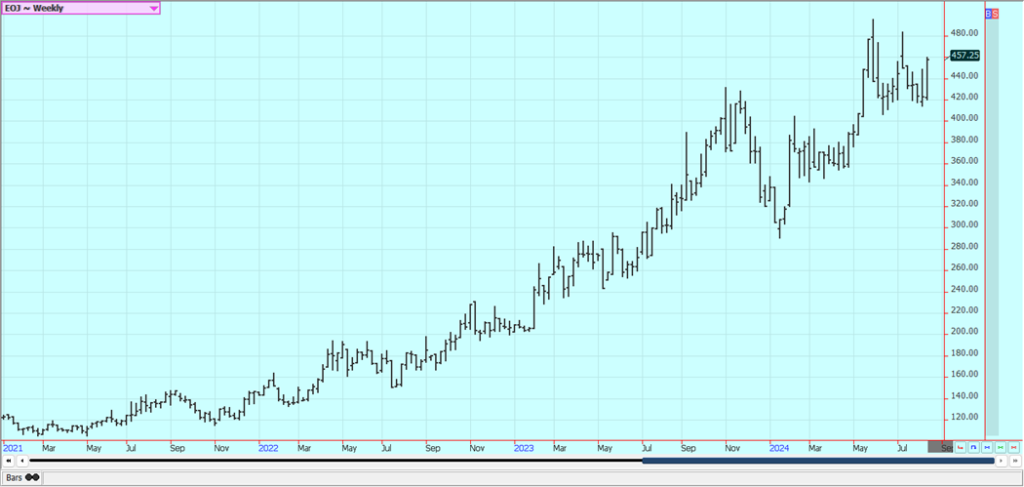

Rice: Rice closed lower last week and might have found some farm selling after a mid week rally. The US weather has been an issue much of the rice growing season with too much rain early in the year. Some areas are now too dry, especially in Texas, and Texas rice yields are down as a result as the rice harvest moves forward.

However, planted rice area has increased from last year and so most are looking for a rebound in rice production this year. Rice supply tightness is expected to give way to increased production this year and greatly increased rice supplies this Fall.

Weekly Chicago Rice Futures

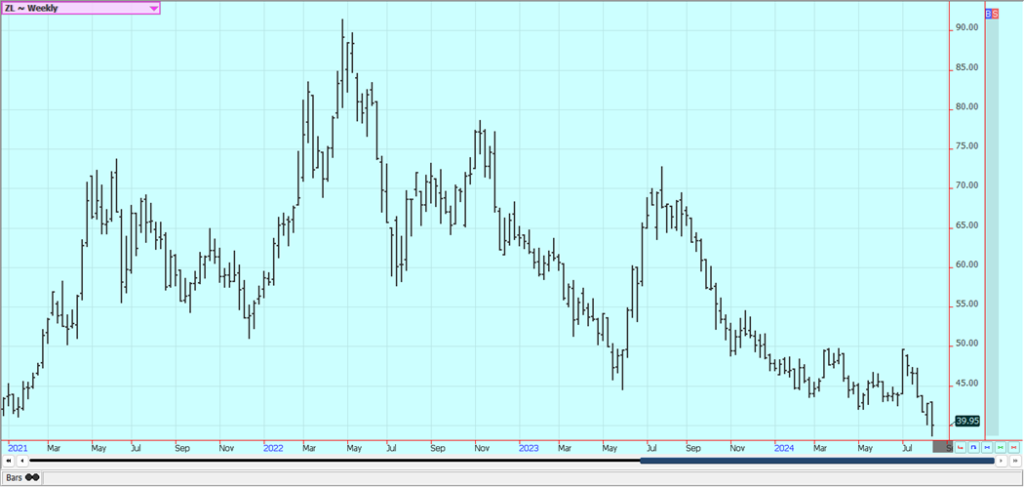

Palm Oil and Vegetable Oils: Palm Oil was lower last week despite reports of stronger export demand as Soybean Oil is lower. Indian imports of Palm Oil were the highest for the year in July. Reports indicate that production is rising as well. Export demand has been very strong in recent private reports but has been weaker in recent days.

There is talk of increased supplies available to the market, and the trends are down on the daily charts. Canola was lower as oilseed supplies look to be ample in the coming year and as demand ideas are down. The weather has called for dry conditions in the Prairies, but growing conditions overall are good.

Weekly Malaysian Palm Oil Futures:

Weekly Chicago Soybean Oil Futures

Weekly Canola Futures

Cotton: Cotton was a little lower last week in response to weakness in Chicago grains and oilseeds and also Crude Oil futures in New York, and on ideas of weaker demand potential against an outlook for improved US production in the coming year. It looks like futures are cheap enough for now but speculators see no reason to buy except to cover short positions as there have been demand concerns about Bangladesh and China and ideas are that production is strong enough.

The Delta should have the best looking crops right now, but crops in other areas are more suspect. Texas and the Southeast have seen some extreme heat so far this year, and Texas has also seen dry conditions at times during the growing season. Demand has been weaker so far this year but there are hopes for improved demand with the lower prices.

Weekly US Cotton Futures

Frozen Concentrated Orange Juice and Citrus: FCOJ closed higher last week despite forecasts for no tropical activity in the near future in the Atlantic. Nothing appeared threatening in the forecasts for this week as the current tropical system should stay in the ocean and there is nothing in the ocean to suggest that a storm is on its way to Florida.

A very active year is forecast and there have been some reports of flooding in the state even with no huge storms. The market remains well supported in the longer term based on forecasts for tight supplies and very hot weather in Florida. The reduced production also appears to be at the expense of the greening disease. There are no weather concerns to speak of for Florida or for Brazil right now.

Weekly FCOJ Futures

Coffee: New York and London closed higher last week with offers from Vietnam still hard to find but offers from Brazil and Indonesia in the market. Reports indicate that Brazil suffered some light frosts in southern areas away from Coffee regions and the weather is one of the main reasons to play the long side of the market.

The weather forecasters now say that conditions are good in Vietnam, but damage was done to crops earlier in the growing season. There were also reports of poor Robusta yields in Brazil during the harvest due to small bean sizes but offers have been strong so far this season. Arabica yields in Brazil and Colombia are reported to be less this year due to extreme weather in both countries.

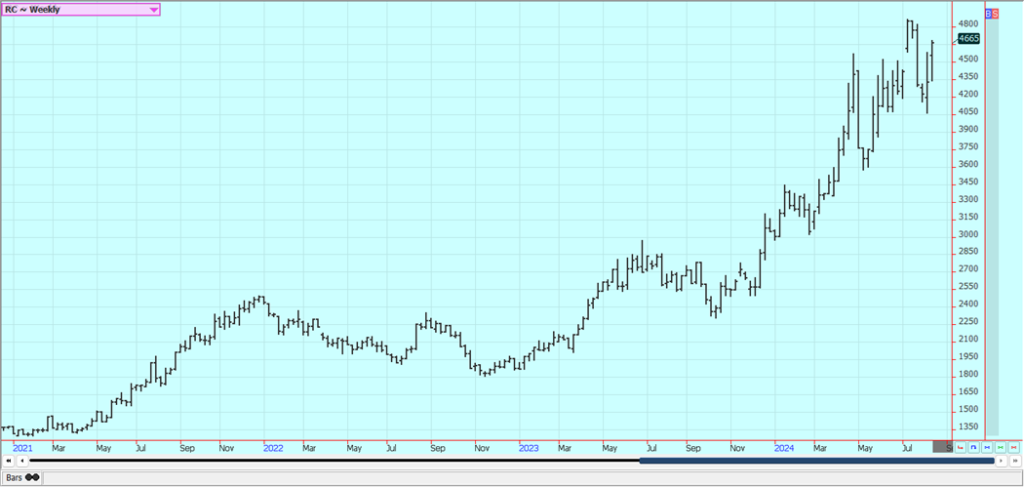

Weekly New York Arabica Coffee Futures

Weekly London Robusta Coffee Futures

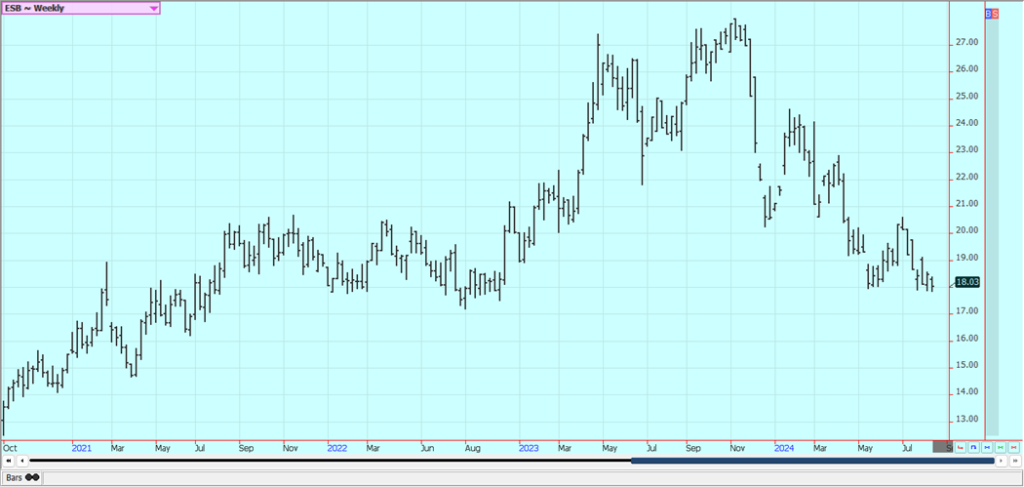

Sugar: New York and London closed lower last week, but held to the weekly trading range on a lack of new bullish news. Harvest progress in Brazil and improved growing conditions in India and Thailand are the important fundamentals and growing conditions are turning drier in Brazil.

Indian and Thai monsoon rains have been very beneficial and mills are expecting strong crops of cane. They are pushing the gov-ernments to allow exports but so far the governments have not agreed. Production estimates were raised in the northern hemisphere. Harvest yields of Sugarcane in Brazil are falling but not enough to impact prices much.

Weekly New York World Raw Sugar Futures

Weekly London White Sugar Futures

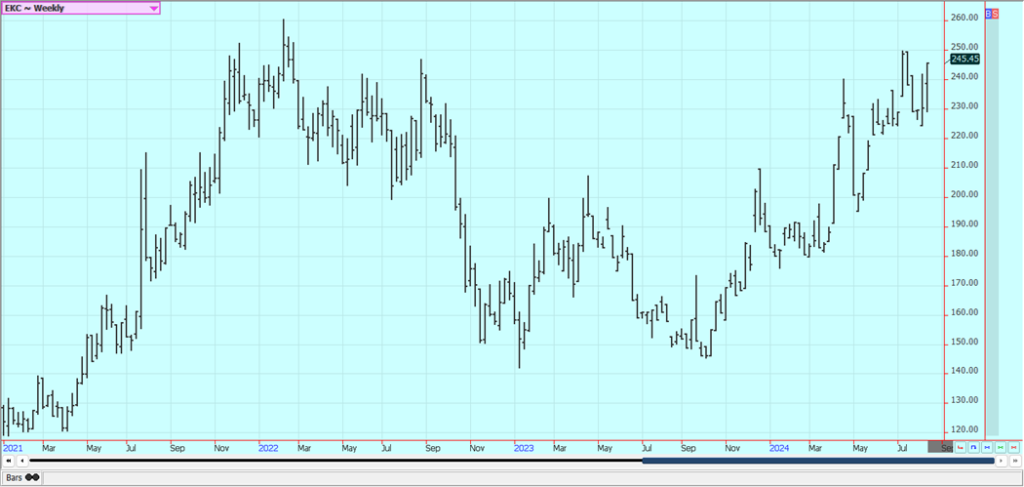

Cocoa: New York closed higher and London closed a little lower in consolidation trading last week as tight supply conditions and reports of dry and hot weather in Ghana, but as prospects for the next crops are called good in Ivory Coast. Production concerns in West Africa as well as demand from nontradi-tional sources along with traditional buyers keep supporting futures, but this support is running its course and the market is searching for a new bullish fundamental.

Production in West Africa could be reduced this year due to the extreme weather which included Harmattan conditions. The availability of Cocoa from West Africa remains very restricted, but surplus production against demand is expected in the next crop year.

Weekly New York Cocoa Futures

Weekly London Cocoa Futures

(Featured image by TranDuyet via Pixabay)

https://born2invest.com/articles/rice-prices-decline-production-boost/Published Date: August 20, 2024