Tags

Rice prices at record high, but private importers stay on sidelines.

Sukanta Halder

Rice prices have been rising for roughly around one and a half years, with both premium and coarse varieties now at historic highs. Prompted by soaring prices and severe flooding in the northeast last August that devastated paddy fields, the interim government approved large-scale rice imports by private entities.

But five months after the approval and several extensions, data shows that businesses have not imported the amount they were permitted to bring in.

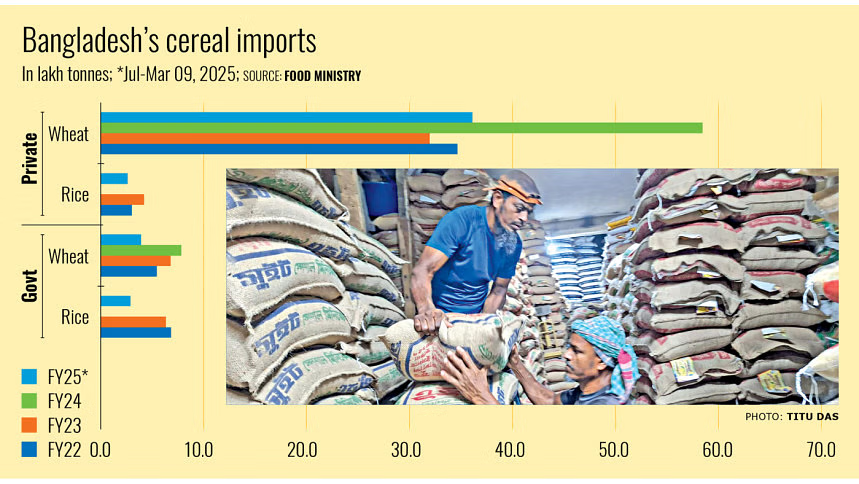

As of the first week of March, the private sector had imported only 2.63 lakh tonnes of rice against the approved 16.75 lakh tonnes — just around 17 percent of the permitted volume, according to the food ministry.

Importers say rice imports are currently unprofitable due to the high dollar exchange rate, a good Aman harvest and lower demand for imported grains.

However, an agri supply chain expert believes the August political changeover has created some sort of uncertainty, which reduces the profit assessment and market predictability for the private players.

Meanwhile, officials say a strong Aman harvest, steady public procurement, and smooth government imports have bolstered food stocks. This has helped stabilise the local market and run public food distribution programmes for low-income groups uninterrupted.

Of the 16.75 lakh tonnes approved for import, 12.19 lakh tonnes were for parboiled rice, while the remaining was sunned rice, according to food ministry documents.

Sunned rice, known as “Atap chal” in Bangla, is made from paddy dried under the sun rather than being boiled.

In fiscal year (FY) 2024-25, retail rice prices have been climbing since August last year, when floods disrupted Aman paddy cultivation in the northeastern swathe of the country.

To curb further price hikes caused by reduced yields, the government encouraged imports to boost stocks and ease price pressures. Because rice prices historically remain at the core of Bangladesh’s inflation metrics.

The overall inflation has remained above 9 percent since March 2023, straining low and middle-income households.

Md Masudul Hasan, secretary of the Ministry of Food, told The Daily Star that “moderate” Aman procurement, smooth government rice imports, and government-to-government (G2G) import deals have strengthened food reserves.

This has ensured a stable supply through public food distribution initiatives like Open Market Sales (OMS) and Trading Corporation of Bangladesh (TCB) truck sales, he said.

“These market interventions benefit millions of poor families and help keep rice prices stable,” he added.

WHAT THE IMPORTERS SAY?

Alamgir Hossain, a rice importer, said that although he has permission to import 35,000 tonnes, he has only managed to bring in 9,000 tonnes.

“Imported rice is not profitable in the local market, which is why I haven’t imported the full amount,” he said, adding that high dollar prices and limited availability of the US dollar for LC opening are major obstacles.

For example, he said, when a letter of credit is opened, the exchange rate is Tk 122. By the time the settlement is made, it rises to Tk 122.50.

“With a profit margin of only Tk 0.25 to Tk 0.50 per kg, doing business under these conditions is very difficult,” he said.

Md Ziaur Rahman, procurement manager of ACI Foods Limited, said his company received approval to import 6,000 tonnes but has only imported 1,800 tonnes so far.

“We import rice at Tk 70 per kg, but unless we sell it for Tk 75 to Tk 76 per kg, there is no profit. Neither the price nor the quality aligns with the local market,” he said.

Chitta Majumder, managing director of Majumder Group of Industries, which imports rice from India and also buys from local mills, said his company was allowed to import 100,000 tonnes but has so far imported only 22,000 tonnes.

“Out of the 22,000 tonnes, 15,000 tonnes remain unsold due to weak demand. Selling them now would mean losses,” he said.

The company imported medium-grain rice at Tk 52 per kg and had to sell it for Tk 54 to Tk 55 per kg. “There’s no profit in importing when demand is low,” he added.

Mohammad Jahangir Alam, a professor of the Department of Agribusiness and Marketing at the Bangladesh Agricultural University, said that political turbulence has created an uncertain environment amid which private sector traders cannot assess the market and their profitability.

“Besides, several G2G initiatives are currently in place, bringing in large-scale rice consignments. This further discourages the private importers,” Alam added.

NO RICE BELOW TK 50 A KG

State-run Trading Corporation of Bangladesh (TCB) data shows that rice prices in Dhaka markets remained unchanged over the past week.

Yesterday, fine rice was priced between Tk 72 and Tk 85 per kg, medium-grain rice between Tk 58 and Tk 65 per kg, and coarse rice between Tk 50 and Tk 55 per kg.

Over the past month, the price of fine rice has increased by 1.29 percent, medium-grain rice by 0.82 percent, while coarse rice prices have fallen by 1.87 percent.

Year-on-year, fine rice prices have risen by 14.60 percent, medium-grain rice by 13.89 percent, and coarse rice by 5 percent.

Bangladesh requires 3.7 to 3.9 crore tonnes of rice annually, with most of the demand met through domestic production. The country did not import any rice in the 2023-24 fiscal year.

https://www.thedailystar.net/business/news/rice-prices-record-high-pvt-importers-stay-sidelines-3844566Published Date: March 11, 2025