Tags

Rice exports stagnate in 8MFY’26 as Iran crisis, US tariffs weigh on demand

- Higher global stocks cap exports despite India’s dominance

- Iran’s currency stress and US tariffs pressure basmati flows

India’s rice exports remained largely stagnant during April-November 2025 (8MFY’26) with shipments valued at $7.3 billion – marginally above $7.29 billion recorded in the same period last year, data from the Directorate General of Commercial Intelligence and Statistics show. The muted performance reflects a combination of elevated global inventories, robust crop yields across major producing origins, and demand-side disruptions in key markets, even as India continues to command a dominant 3540% share of global rice trade.

India has been the world’s largest exporter of both basmati and non-basmati rice for more than a decade, supplying over 140 destinations across Asia, the Middle East, Europe and the United States. However, the current fiscal has seen limited volume growth as importing countries draw down stocks accumulated earlier at a time of geopolitical uncertainty.

Nov slump signals near-term weakness

Export momentum weakened sharply toward the end of the period. Rice exports in November fell 30% y-o-y to $0.79 billion from $1.12 billion, underscoring softer spot demand and cautious buying behaviour. For the full FY’26 so far, rice shipments stood at 19.86 million tonnes (mnt), valued at a record $12.47 billion, indicating that volumes remain substantial even as incremental growth slows.

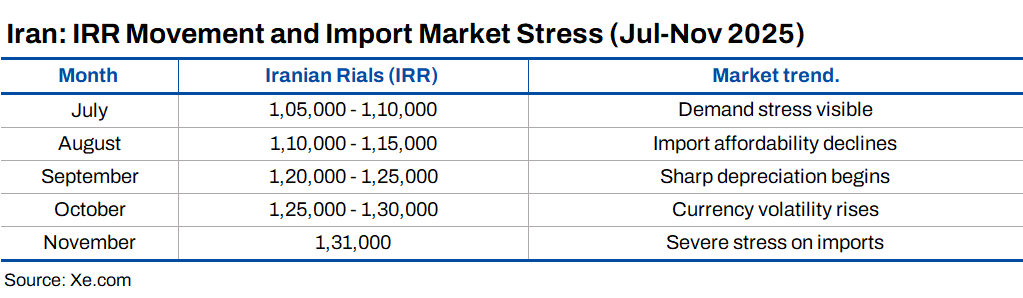

Tariffs, Iran’s currency crisis hit basmati demand

Market participants point to policy and macroeconomic headwinds as key drags on basmati exports. The imposition of higher import tariffs by the United States has reduced price competitiveness in that market, while Iran – one of India’s largest buyers of aromatic rice – has emerged as a major risk. A sharp depreciation of the Iranian rial to around 131,000 per US dollar from about 90,000 earlier has eroded purchasing power and constrained import capacity amid a deepening economic crisis.

The Iranian government had earlier indicated plans to permit imports of about 0.18 mnt of rice, but progress has been limited. The delay reflects Tehran’s difficulty in issuing import permissions at the official exchange rate of 28,700 rials per dollar, far removed from prevailing market levels.

Geopolitical risks and competition intensify pressure

Rising geopolitical tensions, particularly involving Iran, have also heightened concerns over shipment delays and payment risks. While Iran remains a key destination alongside Saudi Arabia, Iraq and the United Arab Emirates, exporters face intensifying competition from origins such as Pakistan and Thailand, which have benefited from aggressive pricing amid softer global benchmarks.

Outlook

While India’s long-term export fundamentals remain intact, near-term prospects are likely to stay constrained by ample global supply, cautious importer behaviour and external policy risks. Any meaningful recovery in export growth will depend on a drawdown in global stocks, currency stability in key markets and improved trade conditions in major destinations.

https://www.bigmint.co/insights/detail/higher-global-rice-stocks-cap-india-exports-706445Published Date: December 18, 2025