Tags

Philippine Bonds Seen Getting Tailwind From Falling Rice Prices

By Malavika Kaur Makol and Karl Lester M. Yap

(Bloomberg) — Philippine sovereign bonds are seen extending gains as falling rice prices cool inflation and back the case for more interest-rate cuts.

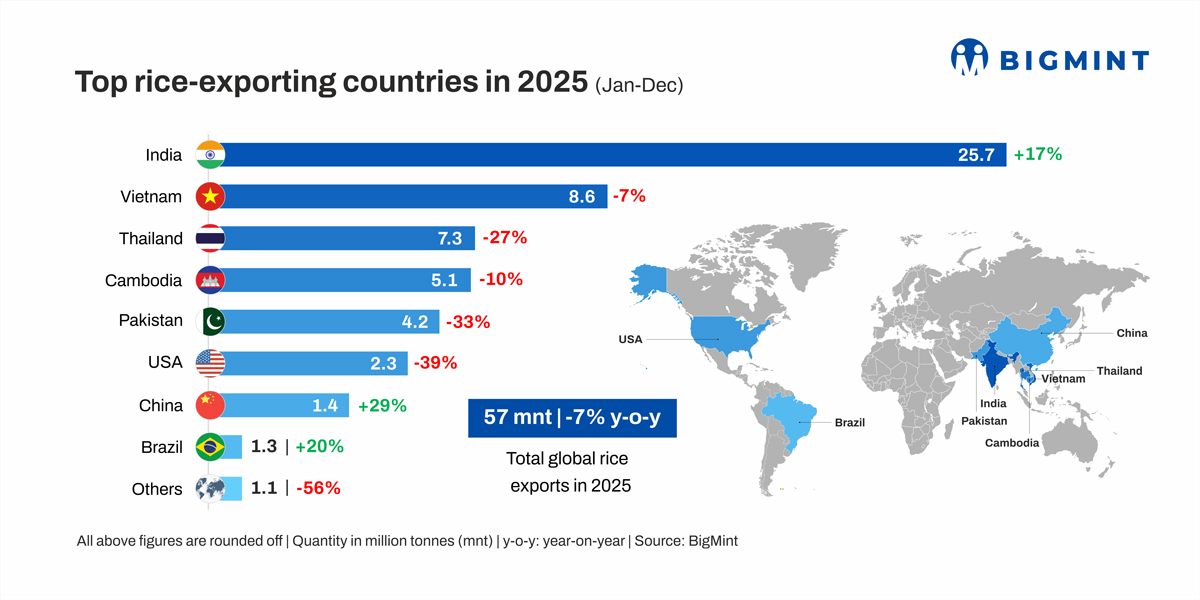

Inflation in the country slowed to a four-year low in September before India eased restrictions on rice exports. HSBC Holdings Plc expects the Philippines to benefit the most from India’s move as rice accounts for 9% of its consumer price inflation basket.

“India’s decision to ease curbs on its rice exports is an unexpected boon to Philippine policymakers,” said Eugenia Victorino, head of Asia strategy at Skandinaviska Enskilda Banken in Singapore. “It opens the space for Bangko Sentral ng Pilipinas to start an aggressive easing path, which would further put downward pressure on bond yields.”

Philippine peso bonds have handed investors a return of more than 6% so far this year, the highest in Asia after India. Gains have been supported by the BSP kicking off its easing cycle in August with a quarter percentage point rate cut, which was followed up with a 250-basis-point reduction in banks’ reserve requirement that takes effect on Oct. 25.

“Some of this excess liquidity will be funneled into buying Philippines government bonds, driving yields lower,” said Peerampa Janjumratsang, portfolio manager for Asia fixed income at M&G Investments in Singapore. “While the medium-term outlook points to lower yields, there may be short-term volatility, influenced by both local and US economic data.”

BSP Watch

BSP Governor Eli Remolona said last week a 25 basis-point cut is on the cards for the Oct. 16 policy meeting, followed by a reduction of the same size in December. However, some central bank watchers aren’t ruling out a larger cut next week after Finance Secretary Ralph Recto, who represents the government in the central bank’s rate-setting board, backed a half-point cut in October to match the Federal Reserve.

Inflation coming in lower than the central bank’s 2% to 4% target could justify even more aggressive rate cuts, said Michael L. Ricafort, chief economist at Rizal Commercial Banking Corp. in Manila. He sees at least 25 basis points of easing next week, with the possibility of a 50-basis-point reduction.

That could push yields on 10-year notes down to 5.5% in the next six months, , Ricafort said, from about 5.74% on Wednesday.

–With assistance from Ditas Lopez and Marcus Wong.

https://www.bnnbloomberg.ca/investing/commodities/2024/10/10/philippine-bonds-seen-getting-tailwind-from-falling-rice-prices/Published Date: October 9, 2024