Tags

Leveraging the Rice Export Ban for Crop Substitution in India

Introduction

Rice, scientifically called Oryza sativa, is usually associated with humid and wet climates, although not restricted to tropical zones. While some posit that rice is a descendant of wild grass from the eastern Himalayan regions, another school of thought is that rice originated in southern India, finding its way to northern India and subsequently to China, Korea, the Philippines, Japan, and Indonesia around 1000 BCE.[1] Paddy, the Malay word for “rice plant,”[2] is interchangeably used with rice, specifically to describe the fields used for growing rice. Despite taking centuries to spread around the world, rice is now a primary agricultural and economic product. Besides being a staple food crop, rice is used to make ready-to-eat products like puffed rice. Rice husk, straw, and bran serve as animal and poultry feed, while rice bran oil is used in the soap industry. Given the crop’s influence over diets, cultures, and economic lifestyles worldwide, the United Nations (UN) designated 2004 as the `International Year of Rice’.[3] Rice comprises the bulk of the diet for almost 3.5 billion people,[4] with Asia having the longest continued reliance on rice for its average daily calorie intake.[5] Although the grain is grown in over 100 countries, 90 percent of the production occurs in Asia.[6] As the global population grows, the demand for rice will rise, pressuring the global agricultural chain for increased production. The disruption of factor markets and suppressed global supply in the aftermath of COVID-19 and the Ukraine-Russia crisis, amid other geopolitical strife, has put excess pressure on the rice market.[7] However, global rice production is expected to improve by 1.3 percent in FY 2023-24 due to higher producer prices, softening fertiliser costs, and continued government subsidies.[8]

Rice is vital in meeting the Sustainable Development Goals (SDGs). While about 900 million economically weak people depend on rice as either consumers or producers in the global value chain, around 400 million are directly involved in rice production.[9] Increased productivity and lower prices benefit economically weaker consumers and play a significant role in economic growth via growth linkages. As the source of 70 percent of the calorie consumption for the most marginalised populations in Asia, [10] rice is a crucial component in mitigating global hunger by providing greater food security and increased nutritional benefits. Besides directly contributing to SDG-1 (ending poverty) and SDG-2 (zero hunger), rice and its production process have implicit effects on SDG-5 (gender equality), SDG-6 (clean water and sanitation), SDG-8 (decent work and economic growth), SDG-12 (responsible consumption and production), SDG-13 (climate action), and SDG-15 (life on land).[11] For instance, despite playing a significant role in the farming, processing, and marketing processes of rice, women still face significant barriers in access to resources such as information, technology, and primary inputs. Irrigated rice fields receive almost 35 percent of the global irrigated water,[12] highlighting the need for water-saving management technologies and sustainable cropping mechanisms in its production process. As water becomes scarce and temperatures rise, this also raises questions about the sustainability of the rice sector. As such, sustainable consumption and production practices must be incorporated into the industry. International cooperation is needed to realign the rice value chain into a more sustainable practice, mainly focusing on innovations and practical research in the field (invoking SDG-17—strengthening the means of implementation and revitalising the global partnership for sustainable development).

India’s rice economy is estimated to be worth US$51.58 billion as of 2024.[13] India is also the second-largest producer and the largest exporter of rice globally,[14],[15] contributing to 40 percent of the global trade in rice. This paper focuses on the Indian rice market and delves into its structure—its processes, agents, and institutions. Further, it assesses the ban imposed on the exports of non-basmati rice (economic quality rice used for daily consumption) in July 2023, a measure by the Indian government to ensure domestic price stability. It delves into the harmful effects of the export ban on the basmati (premium quality of rice) and non-basmati income divide. It presents a demand-supply theoretical framework to analyse the ban’s effects on Indian consumers and producers. Here, the water-intensive nature of basmati is highlighted to foreground the need for crop-substitution policies that can attenuate India’s looming water crisis. A second theoretical model attempts to address the issue of the high environmental cost of rice production by promoting drier crops and leveraging the export ban. The paper also recommends promoting drier, climate-resilient millets to ensure nutritional security at a lower social price.

India’s Rice Value Chain

India is the world’s second-largest rice producer (after China) and has a rich biodiversity encompassing ancient rice varieties. As such, rice cultivation in the country is multifaceted, tied to climatic patterns, and follows a meticulous process that transforms paddy into consumable rice through various milling stages. Still, India’s rice industry (and indeed its agricultural sector) faces critical productivity constraints. For instance, significant economic disparities exist between basmati and non-basmati rice producers, highlighting the challenges and opportunities within the rice value chain. Analysing government policies, procurement systems, and market dynamics can offer an understanding of the complexities characterising India’s rice sector.

Processe

India has the largest area under paddy cultivation and is the second-largest producer of rice.[16] While the Indica variety of rice is believed to have been domesticated in Northeast India, the Japonica variety was possibly domesticated from wild rice in southern China and subsequently found its way to India. [17] The cultural significance of rice has been stated in the Vedas and is still observed abundantly in households where it signifies prosperity and fertility.[18] However, the production process of rice has undergone enormous restructuring over the centuries.

Rice is grown primarily in three seasons, classified based on harvesting season—autumn, winter, and summer. The autumn, or pre-kharif, rice is sown from May to August and contributes to almost 7 percent of the total crop production. However, the main rice growing season, comprising around 84 percent of the total rice production, is the winter, or kharif crop, harvested in November-December. Harvested during March-June, the summer, or rabi, crop contributes about 9 percent of the annual rice production. However, the paddy crop procured during the harvest is unsuitable for human consumption. To make polished rice, rice must be milled to remove the hulls and bran. This milling process involves pre-cleaning, de-stoning, parboiling, husking, husk aspiration, paddy separation, whitening, polishing, length grading, blending, weighing, and bagging.

Consider the distribution structure of basmati and non-basmati farmers.[19] Basmati farmers are relatively large-scale producers concentrated in Punjab, Haryana, and West Bengal, while non-basmati farmers are small-scale producers distributed across the remaining rice-producing states. An increase in scale means not only greater rents accruing to these producers but also better access to the networks of the rice value chain. This gives them greater bargaining power and access to more attractive prices than non-basmati farmers. This is a critical issue in the context of this paper and will be addressed in detail in the later sections.

Productivity and Problems

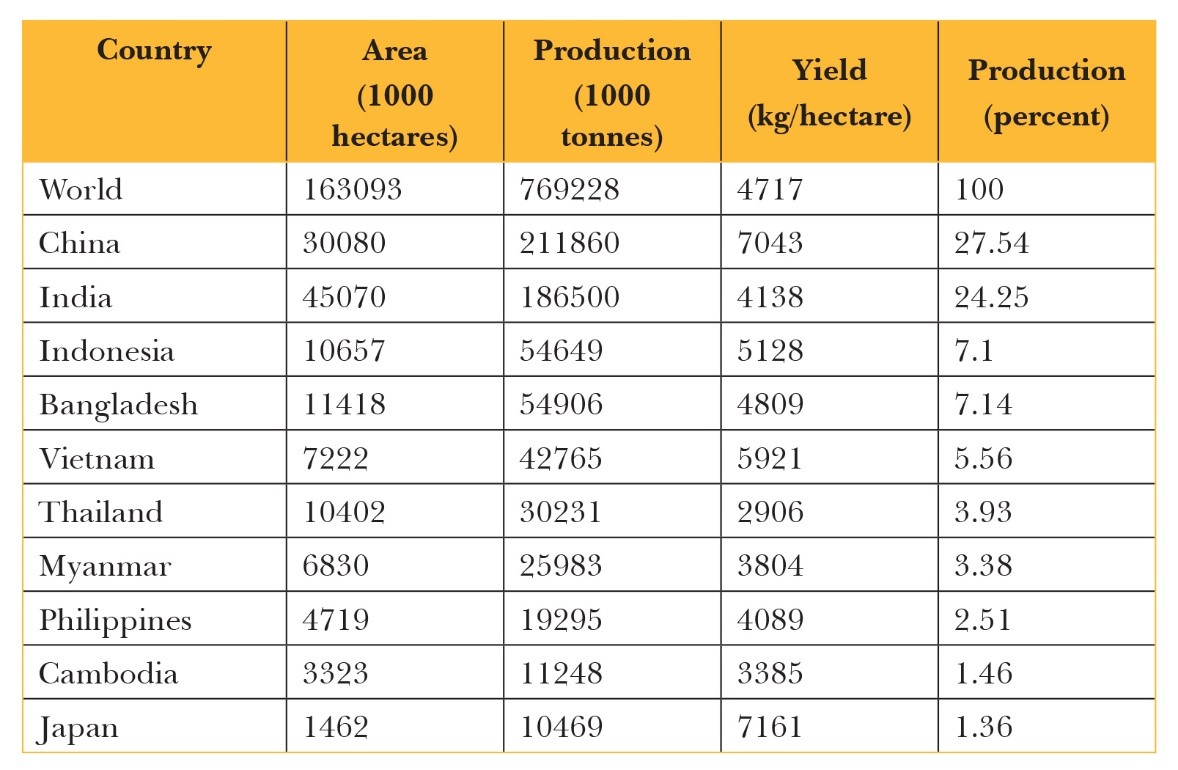

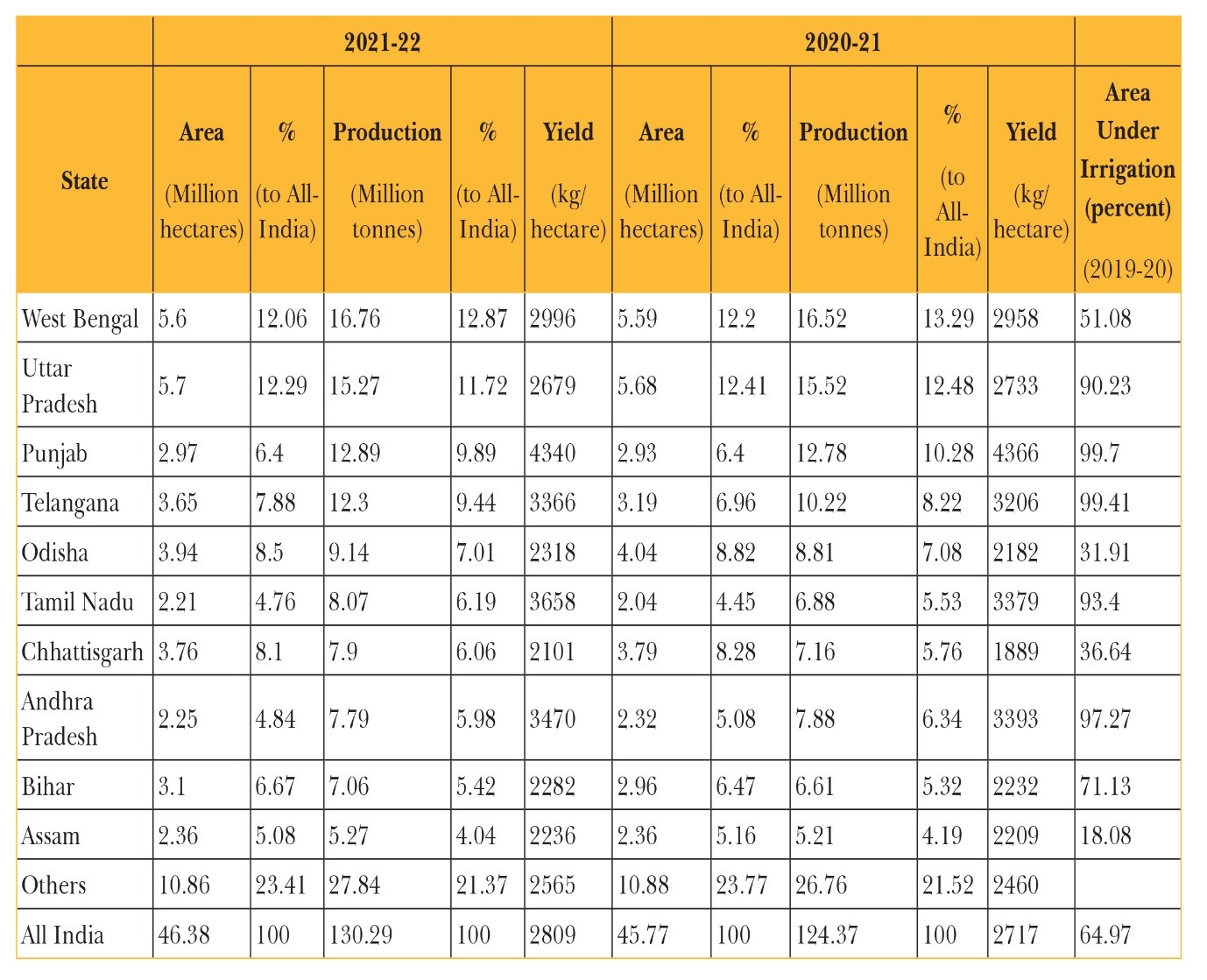

India has 11.2 percent of the world’s arable land and is the third largest cereal producer after the US and China. India is a world leader in terms of agricultural production and performs exceptionally well in the context of commercial crops and livestock. However, while India has the highest area under cultivation for rice—almost 50 percent higher than China—it is the second largest producer of rice. This stems from the shockingly low yield in India, at 2809 kilograms per hectare (see Table 2).

Table 1: The 10 largest rice producers worldwide (in 2020)

Source: Agricultural Statistics at a Glance (2022)[20]

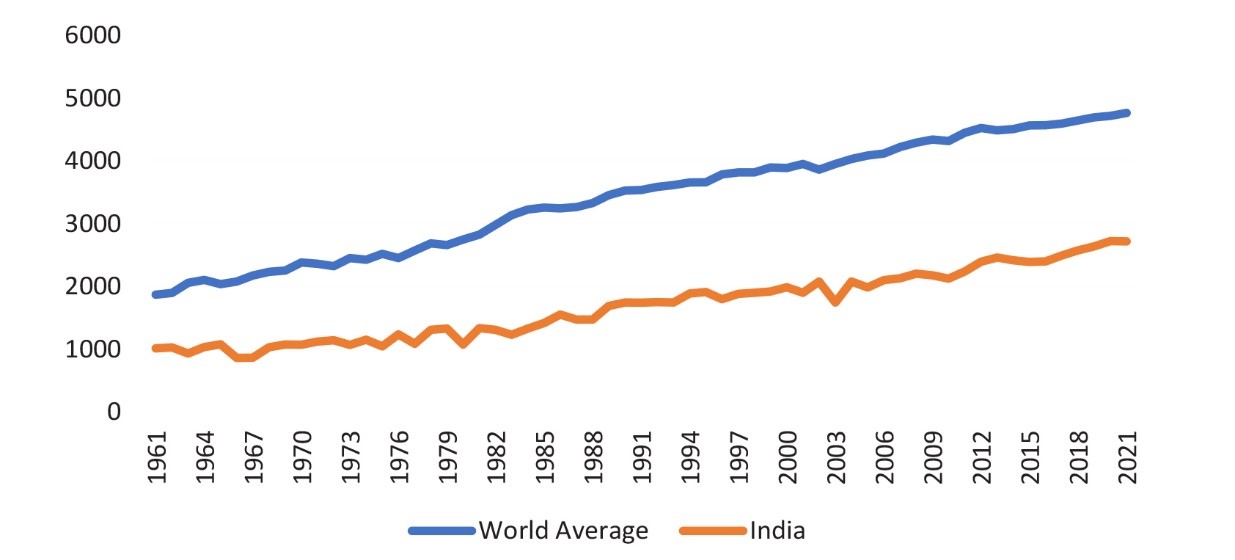

Crop markets are highly susceptible to global price shocks and natural calamities, which can lead to unanticipated supply shortages and skyrocketing domestic food prices. While this is true for the Indian rice market, it should also be highlighted that low productivity is a significant bottleneck to realising the actual potential of the vast area under production. This entails a scrutiny of the reasons behind the relatively low rice productivity in India. Figure 1 shows that although productivity has increased significantly since India’s independence, it is still low compared to global rates and should concern agricultural policymakers.

Figure 1: Rice Yield in India (in kg/hectare, 1961-2021)

Source: India Stat[21]and Our World in Data[22]

Table 1 shows how rice productivity varies across states, with Punjab exhibiting the highest yield per hectare. While rainfed ecosystems comprise almost half of the area under cultivation, 90 percent of high-yield varieties are suitable for irrigated ecosystems.[23] The high-yield varieties are responsive to fertiliser use. Still, the stark disparity in regional fertiliser consumption curtails the potential of these crops, resulting in much lower productivity in India compared to its South Asian counterparts. Moreover, the complex structure of rainfed ecosystems demands the adoption of technologies that Indians have yet to acquire. Around 15 percent of the area under cultivation is flood-prone, resulting in increased volatility in yield. Poor management practices and the lack of adequate irrigation facilities add to this and jeopardise the production process. These are the primary reasons for the low yield in India and cause some uncertainty over the final stock available, forcing the government to intervene with support mechanisms in the form of trade measures.

Table 2: India’s Major Rice-Producing States (2020-21 and 2021-22)

Source: Agricultural Statistics at a Glance (2022) [24]

The Role of the Government

Investigating the paddy procurement system is necessary to analyse India’s rice market. Paddy is purchased at the minimum support price (MSP) by the Food Corporation of India (FCI) and various state government agencies (SGAs) for the central pool (the stock of paddy procured by both state and central governments).[25] Procurement targets are generated using production estimates, marketable surplus, and possible crop patterns. The SGAs procure paddy in consultation with the FCI for distribution under the National Food Security Act (NFSA) and other welfare schemes. Under the Centralised Procurement Scheme, paddy is procured directly by FCI or SGAs, then handed over to the FCI for distribution by the government against welfare schemes. The central government reimburses the SGAs for the procurement cost. The decentralised procurement (DCP) system allows SGAs to procure and distribute rice in their respective states, and the central government reimburses the entire procurement cost at previously decided rates. The DCP was introduced to reduce transport costs and increase procurement efficiency.

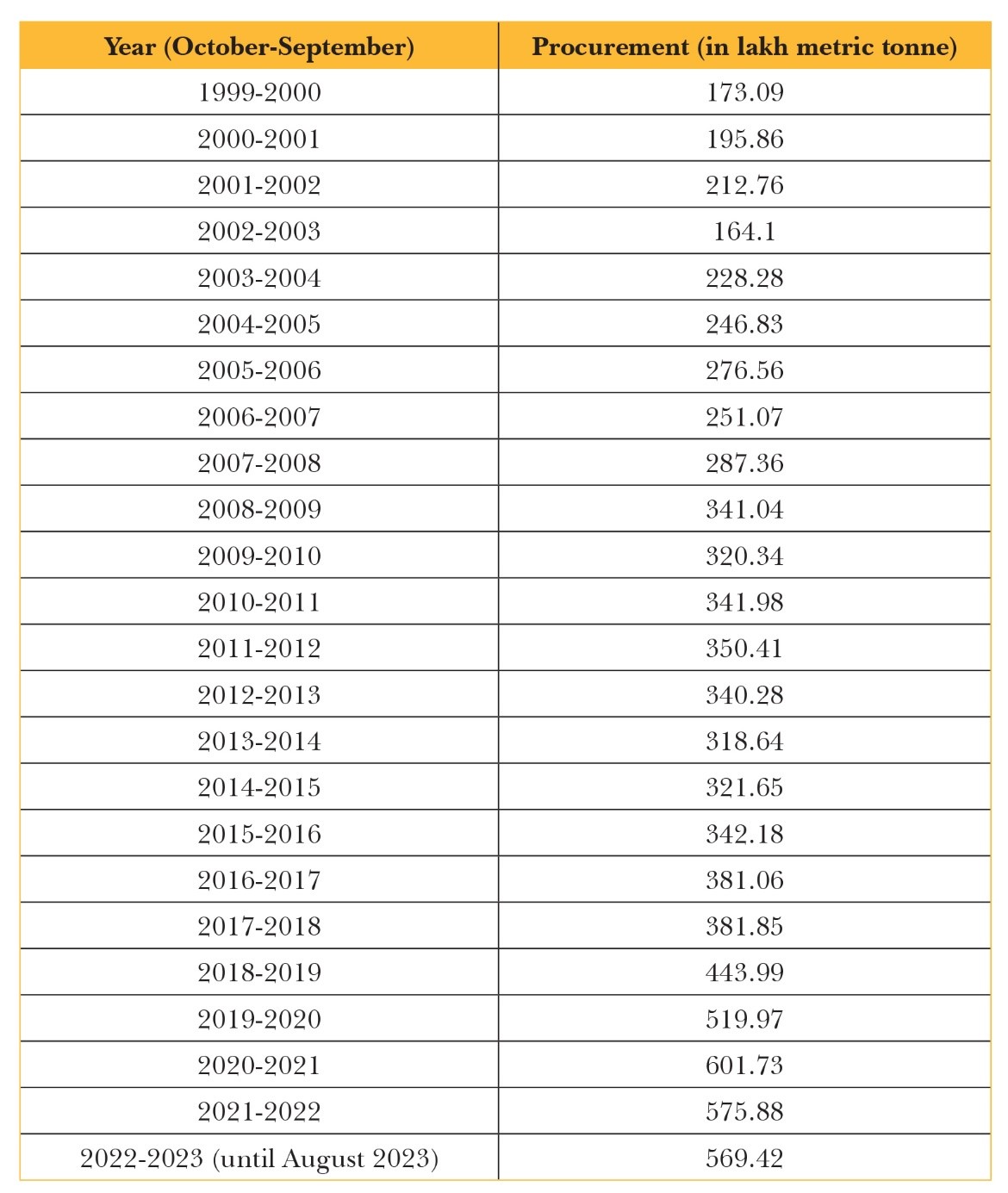

Table 3: Paddy Procurement for the Central Pool (1999-2023)

Source: India Stat[26]

Two methods of rice procurement were followed before 2014-15—custom milled rice (CMR) and levy rice policy.[27] Under the CMR, the FCIs and the SGAs directly procured paddy from farmers at MSP, and registered millers were contracted to extract rice from the crop. Under the levy policy, the states dictated a fixed percentage of rice in the central pool, which had to be delivered by the millers. However, the levy policy had two significant drawbacks: the uncertainty regarding quality and the absence of any measures to ensure MSP to farmers. Thus, the levy policy was abolished on 1 October 2015, giving the FCI and the SGAs the sole right to procure paddy directly from farmers at the MSP.

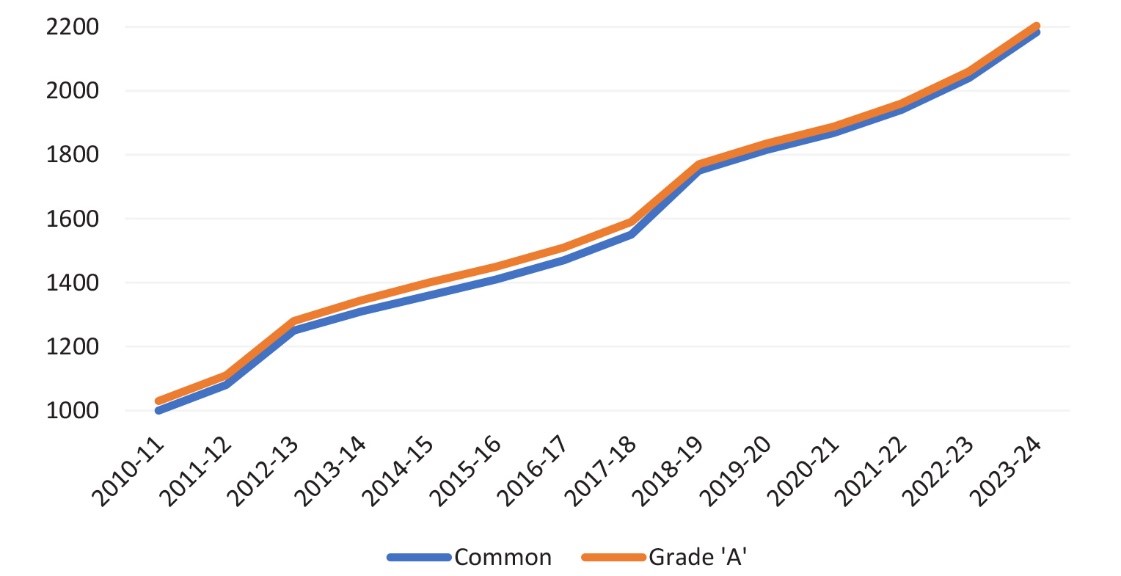

Figure 2: Minimum Support Price of Paddy (in INR/quintal, 2010-2024)

Source: Ministry of Agriculture and Farmers Welfare[28] and Farmers’ Portal[29]

The central government decided to distribute free foodgrains for a year, beginning 1 January 2023, to Antyodaya Anna Yojana households and priority household beneficiaries.[a],[30] The central issue price is still marked at INR 3 for each kilogram of rice, as stipulated in the NFSA. The stocks remaining after rice collection via procurement for the central pool are made available in the open market. This is where farmers and other entities in the value chain can enjoy remunerative prices. This is also where one-third of the population, who are not eligible for the support available to the 800 million NFSA beneficiaries,[31] enter the rice market and transact at market-determined prices. This necessitates an inquiry into the structure of the international rice market.

Current Structure of the Global Rice Trade

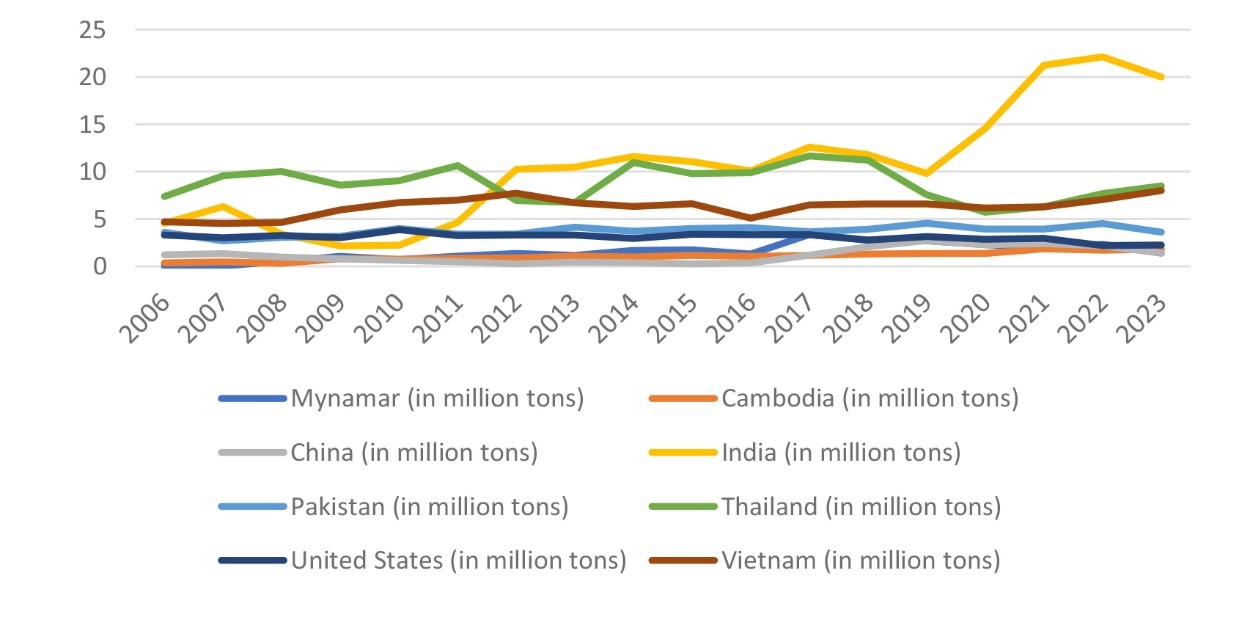

Rice trade comprises around 10 percent of global rice production,[32] with Asia accounting for 86.56 percent of production. Although China is the largest producer of rice worldwide, it has a relatively lower share of global exports (see Figure 3). At the same time, it is also one of the largest importers,[33] with nearly two-thirds of the country dependent on rice as a staple food.

Figure 3: Top Rice-Exporting Countries (2006-2023)

Source: USDA[34]

Sub-Saharan Africa is the largest rice importer, making up a 30 percent share of global imports, with a slightly higher import demand than Asia. West Asia is a major rice importer, with a 37.8 percent share in rice consumption.[35] While the EU and North America import record quantities of rice, their dependence on the crop is much lower than that of their economically weaker partners. The global import structure reveals a vital attribute of rice; it tends to feature heavily in the diets of the developing regions. It should be noted that this is not a stylised fact and merely depicts a possible trend. However, Asian nations, particularly their economically weak populations, are highly dependent on rice as a significant source of their calorie intake. This reinforces rice’s crucial role in food security.

India in the Global Rice Market

India is the world’s largest rice exporter (since 2012), with its exports increasing by 49 percent in 2020 and 46 percent in 2021, reaching 22.1 million tonnes in 2022.[36] Given its growing population, India needs to ensure domestic food security. To retain its position as a frontrunner among emerging economies and an ally to the Global South countries, India needs to extend support, directly or indirectly, even when global conditions are tumultuous. This would prevent India from undertaking drastic foreign policies, especially related to agricultural trade restrictions.

This paper considers four categories of rice (based on their share in trade and production): basmati rice (HS Code 10063020), parboiled rice (HS Code 10063010), rice except parboiled (and excluding basmati) (HS Code 10063090), and broken rice (HS Code 10064000). In 2022-23, these four categories comprised almost 98 percent of all rice exports from India.[37] Basmati had the highest share, at nearly 43 percent, followed by parboiled rice (27 percent), rice except for parboiled (20 percent), and broken rice (8 percent).

Figure 4: Major Rice Export Destinations from India (in US$, 2022)

Source: ITC[38]

India’s Rice Export Prohibitions

The COVID-19 pandemic and the Russia-Ukraine conflict have exposed global food chains to supply shocks, resulting in international food price inflation.[39] This put net exporters of agricultural commodities in a difficult position, as their domestic food security was at increased risk. A viable option is relinquishing the external balance to ensure domestic price stability and food security through export prohibitions. To tackle the same problem, India levied a 20 percent export duty on non-basmati rice on 8 September 2022. Despite the export duty, the export of non-basmati white rice increased due to international shortages following geopolitical tensions and unfavourable weather conditions. Exports of broken rice, which is used as cattle feed and in the manufacturing of ethanol, were also prohibited from 9 September 2022.[40] To ensure domestic price stability, the government banned exports of non-basmati white rice on 20 July 2023[41] without altering the export policy of other categories of rice to allow international price benefits to accrue to Indian farmers. The Indian government devised the export ban to safeguard domestic consumers from price shocks while allowing farmers to enjoy competitive prices.

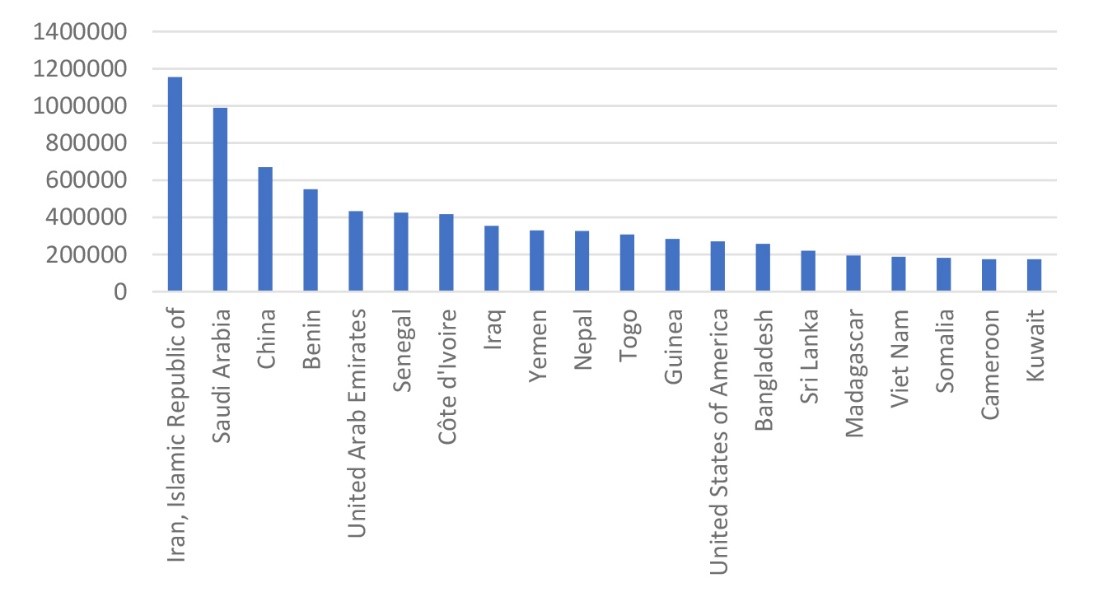

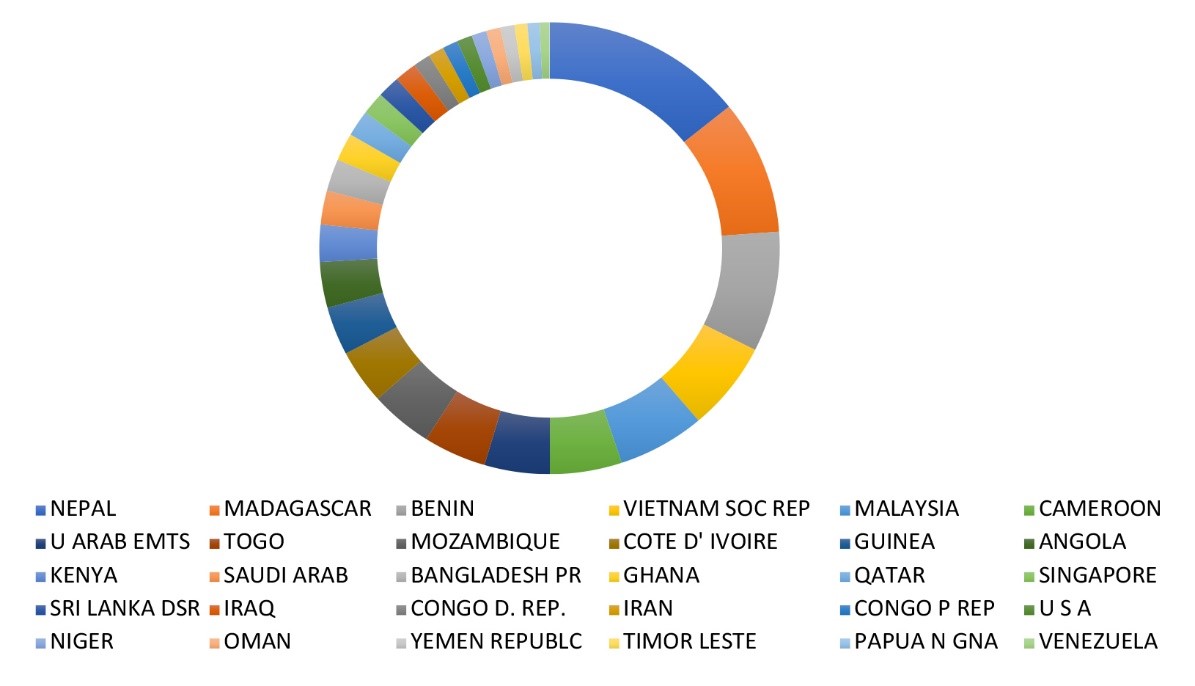

To identify the countries most affected by the export ban of this quality of rice, it is necessary to narrow down the largest importers. In decreasing order of their share in Indian exports, the top 10 importers (as of 2021-22) are Nepal, Madagascar, Benin, Vietnam, Malaysia, Cameroon, United Arab Emirates, Togo, Mozambique, and Cote D’ Ivoire.

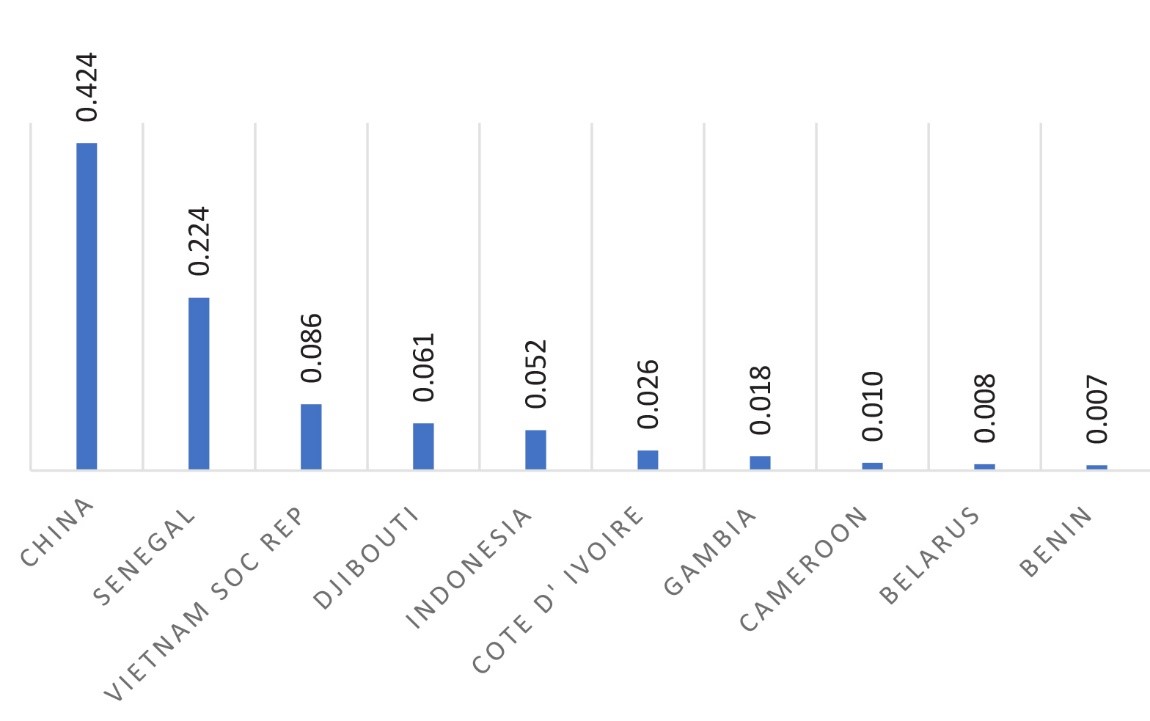

India’s exports of broken rice increased almost 43 times in the four years before the export ban was introduced.[42] Meeting this increased international demand caused a significant shortfall of broken rice in the Indian market. Given its role as an input in the animal husbandry and poultry sectors, an intervention was required to secure domestic stocks and stabilise prices. Moreover, the usage of broken rice in ethanol blending also stagnated the output of ethanol distilleries. A 15.14 percent average increase in the retail price over five years made an export ban the only viable option.[43] In 2021-22, the top importers of broken rice were China, Senegal, Vietnam, Djibouti, Indonesia, Cote D’ Ivoire, Gambia, Cameroon, Belarus, and Benin.

Figure 5: Top 10 Importers of Broken Rice from India in 2021-22 (as a percentage of share in imports)

Source: Department of Commerce[44]

African nations are large importers of Indian rice. Therefore, any disruptions in trade, in the form of duties or restrictions, will have severe repercussions for the African market. India’s decision will cause global prices to shoot up and disproportionately affect the African countries, worsening their food security problems. Moreover, as was seen in India, a shortage of broken rice will have contractionary effects on the poultry and animal husbandry sectors, exacerbating the food shortage.[45] Notably, India has taken measures to ensure foodgrains are available to countries especially vulnerable and largely dependent on Indian rice, regularly sending out consignments to African and Asian countries.[46]

Figure 6: Top 30 Importers of Non-Basmati White Rice from India in 2021-22

Source: Department of Commerce[47]

The Backdrop

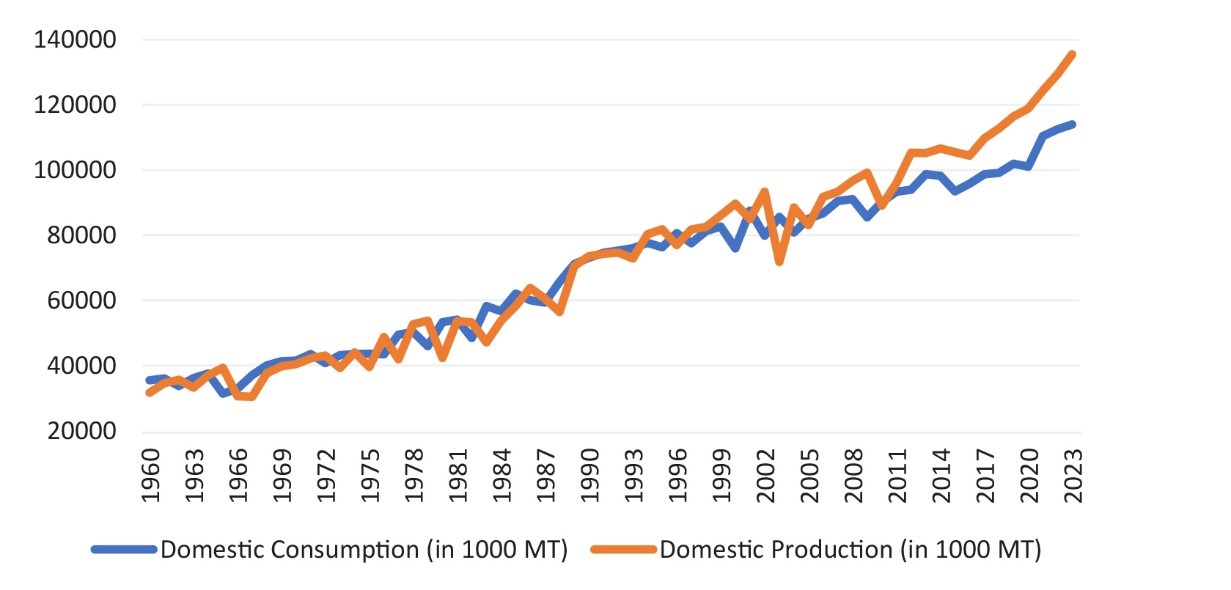

Since 2010, India has been self-sufficient and produced a paddy surplus (see Figure 7). For the 2023-24 kharif marketing season, 52.12 million metric tonnes of paddy are expected to be procured; 49.6 million metric tonnes were procured in the same season in the previous year.[48] Following the export ban, a dampening of domestic inflation is expected to boost consumption, taking annual rice consumption and residual use to a record 115 million metric tonnes in 2023-24.[49]

Figure 7: Production and Consumption of Rice in India (in 1000 Metric Tonnes, 1960-2023)

Source: India Stat[50] and IndexMundi[51]

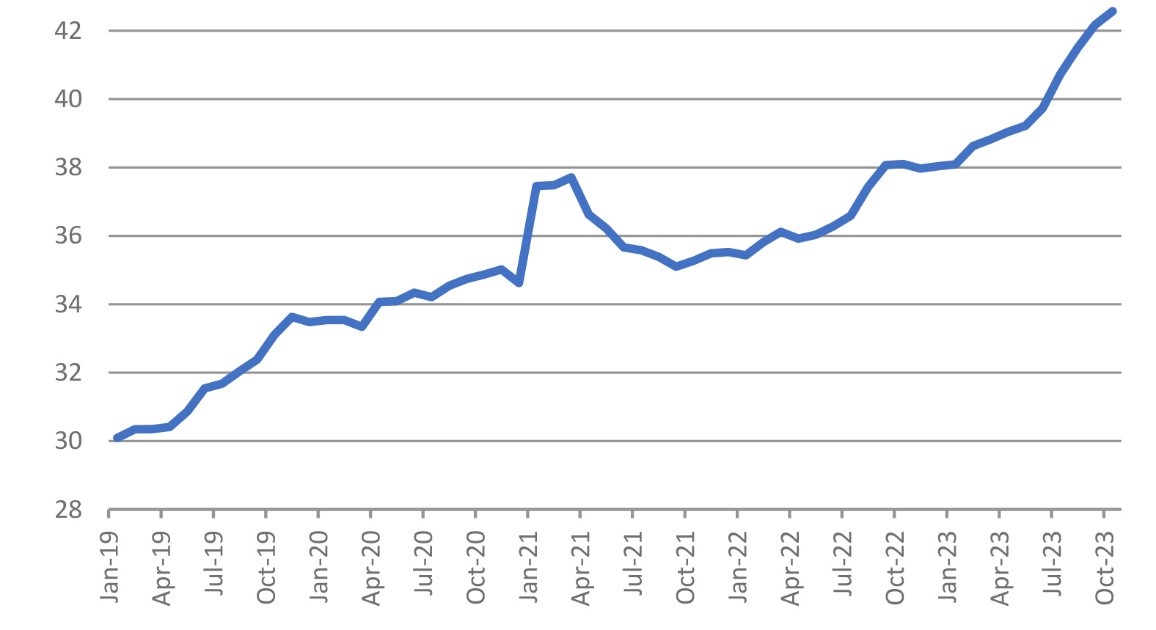

Of the average 130 million tonnes of rice produced in India, around 55 million is procured by the government for welfare schemes (see Table 3). Over 20 million tonnes are exported by the country, leaving another 55 million tonnes for domestic sale and reserves. Since domestic consumption estimates stand at around 110 million tonnes, there is no severe rice shortage in the country. Despite India’s abundant supply and record paddy production, prices have been increasing since September 2021 (see Figure 8). Prices increased by almost 20 percent within two years and, as of October 2023, were at a record high of INR 42.57 per kg. This can be interpreted as because of the spike in procurement volume since 2019-20 (see Table 3). While production also increased, an abrupt 17-percent increase in procurement put some pressure on the open market rates by inducing a supply shortage.

Figure 8: All-India Average Retail Price of Rice (INR/kg)

Source: Department of Consumer Affairs[52]

Retail prices increased despite record rice crop production and no apparent domestic shortage. While this could be attributable to increased procurement, global events and the pandemic also played a crucial role.

Possible Outcomes

In the aftermath of the export ban, there will be an excess domestic supply of non-basmati rice, lowering the free market prices. Farmers will be inclined to sell to FCI and secure the MSP if the price falls below the MSP. However, government procurement faces certain limitations in the form of inadequate procurement infrastructure and facilities, which might cause a segment of the farmers to turn to the mandi (open market), where the price will be lower than the MSP, thus lowering the value of producers’ surplus. Irrespective of the relationship between market price and MSP, consumers emerge as winners in this arrangement as they pay lower prices.

On the other hand, if domestic prices remain above the MSP, farmers will tend to sell at the mandi, only going to the FCI when the mandi offers a lower price than the MSP. However, as exports are prohibited, there is excess supply in the mandi, lowering the prices and making producers lose again. Thus, while consumers of non-basmati white rice unambiguously benefit from lower prices, farmers face a reduction in welfare irrespective of the degree of price reduction.

Although cross-price elasticity between the different varieties of rice is low due to separate consumer groups, an increase in the international price of non-basmati white rice will seep in to raise the demand for basmati rice. As India stops exporting non-basmati white rice, there could be a significant reduction in global supply, which eventually affects the basmati rice market. Moreover, Indian farmers continue to export basmati rice to the worldwide market, allowing them to enjoy trade benefits. Thus, as the price of basmati rice increases due to anticipated global shortages and disruptions in the overall rice value chain, Indian farmers enjoy gains from trade through higher demand and higher prices. The price rise occurs due to the negative shift in market expectations, both from an increase in non-basmati prices and the anticipation of future export restrictions. However, globally and in India, consumers will face higher prices and lose a share of their surplus to producers. In the case of basmati rice, welfare is redistributed from consumers to producers.

The redistribution of welfare due to trade can be interpreted as transferring a share of the economic pie from non-basmati producers to basmati producers, further skewing the balance. Non-Basmati consumers unambiguously benefit, whereas basmati consumers lose a portion of their surplus to producers. This causes an egalitarian transfer of welfare from basmati consumers to non-basmati consumers. In effect, the export ban levies a disproportionate burden on the marginalised non-basmati farmers. The theoretical model presented in the subsequent section of this paper delves deeper into this issue and provides policy suggestions to overcome the effects of the export ban.

As a result of the export ban, the global market will face a shortage, leading to price rises. This will cause the international consumer surplus to shrink under higher prices and lower supply. However, as prices increase, producers might become the beneficiaries of the gains from trade. Sub-Saharan Africa is one of the largest importers of Indian non-basmati white rice,[53] given its lower price and economic quality. For these nations, which are, on average, net importers of rice, this gain from trade is unlikely and, in most cases, will reduce aggregate welfare. While this was anticipated, the claims that India’s ban is causing a global food crisis are unfounded.

Some preliminary calculations establish that the ban will have welfare implications for developing nations, but the repercussions will not be significant enough to push them into a distressed state of food insecurity. Global trade comprises only 10 percent of rice production, with India accounting for 40 percent of exports.[54] However, basmati rice comprises the largest share of India’s rice exports, while non-basmati white rice accounts for 20 percent.[55] As such, the export ban alone cannot cause a significant food security crisis.

The non-basmati price surge might seep into basmati markets, allowing basmati farmers to enjoy higher profits but deflating the consumers’ surplus. Premium-quality basmati rice, mostly imported by more prosperous countries in West Asia and consumed by high-income households, poses no serious threats to food security. Gains from trade will be redistributed from prosperous consumers to large-scale producers.

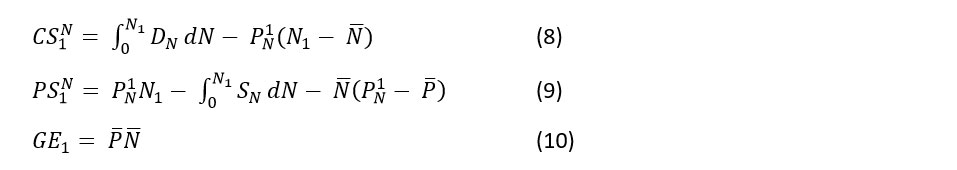

A Theoretical Model for Trade Policy

A simple demand and supply framework is used to analyse the effects of the export ban and the increase in global demand. This exercise aims to intuitively study the relative changes in producers’ surplus and consumers’ surplus in the basmati and non-basmati markets, respectively. Consumers’ surplus is the difference between consumers’ willingness to pay and the market price at the margin. Producers’ surplus denotes the excess of the price over the marginal cost of producing a unit of rice. Only the welfare aspects of domestic consumers and producers have been considered for this analysis.

Assumptions:

- Markets are perfectly competitive, i.e., rice producers receive remunerative prices from the global market. In other words, the domestic and international prices are the same.

- The demand for rice is relatively inelastic, i.e., price changes have a less than proportionate effect on the demanded quantity. This assumption is based on rice being a staple and necessary food. Various studies have also found rice demand to be inelastic.[56],[57],[58],[59]

- There is no procurement framework in place, i.e., only market forces are at work for the basmati rice market. On the other hand, non-basmati rice is procured from the market at MSP.

- Domestic demand is unaffected by global developments, i.e., following any external supply or demand shocks, there is no change in the Indian demand pattern since there is no import dependency.

The notations used in the model are as follows:

B: Output in basmati market

NB: Output in non-basmati market

Di: Demand curve for market i (i = B, NB)

Di*: Global demand curve for market i (i = B, NB)

Si: Supply curve for market i (i = B, NB)

CSi: Consumers’ surplus in the market i (i = B, NB)

PSi: Producers’ surplus in the market i (i = B, NB)

Pij: Price in market i under condition j (j = 0,1,2)

The minimum support price of non-Basmati rice

X*: Total demand for X (X=B, NB), i.e., domestic demand + foreign demand

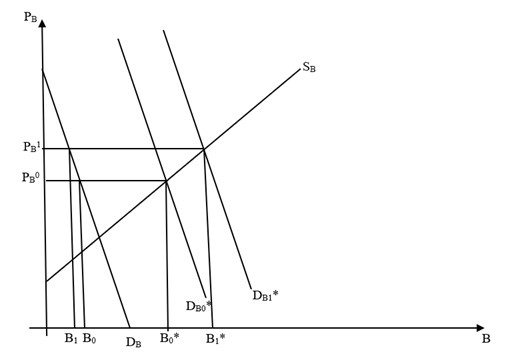

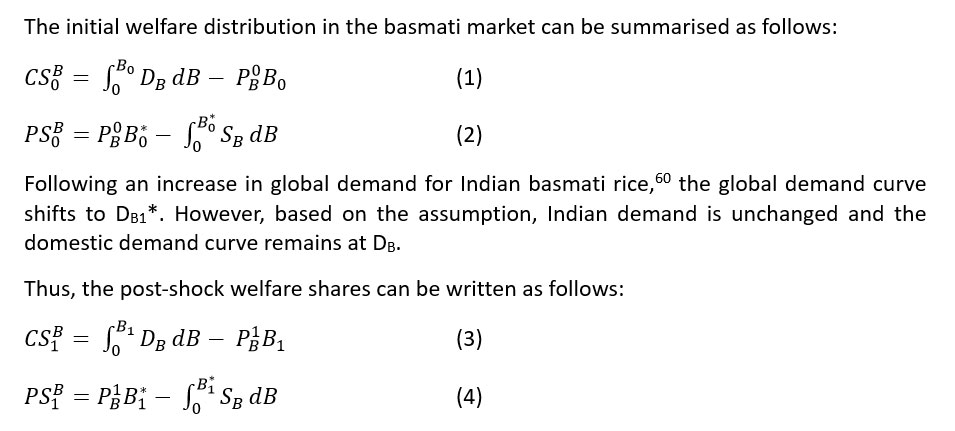

The baseline scenario in Figure 9 shows an increase in global demand for the basmati market. The initial global demand curve is DB0*, and the domestic supply curve is represented by SB. Given the free structure of the market, the domestic price is the same as the international price (PB0).

Figure 9: Basmati Rice Market

Source: Author’s own

There is an unambiguous shift of welfare from basmati consumers to the producers. Producers enjoy higher global prices and increased demand, while domestic consumers decrease their consumption due to rising prices. However, this analysis is concerned with the relative gains from trade between basmati and non-basmati producers.

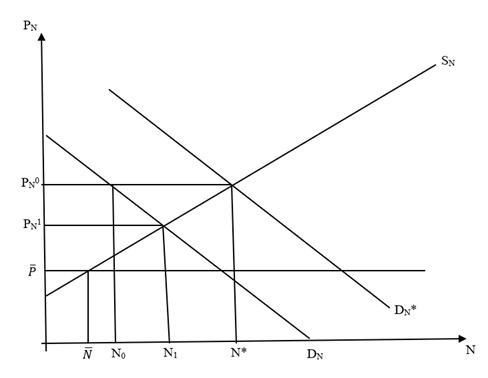

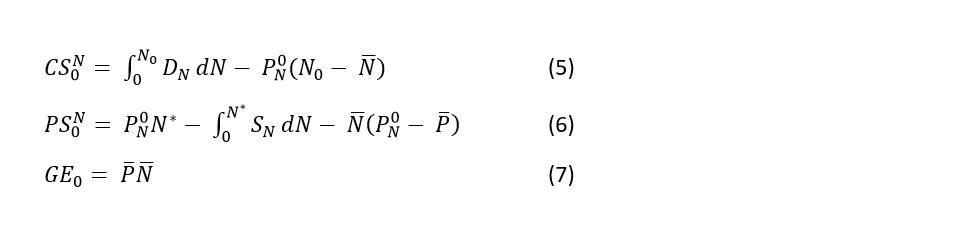

Consider the non-basmati market, where the government procures a share of the produce at the MSP (.

Figure 10: Non-Basmati Rice Market

Source: Author’s own

The producers face the global demand DN* as well as the government procurement price, . In the baseline scenario, the welfare shares were as follows:

The government procures units of rice at the MSP. Under the current NFSA scheme, where grains were provided at zero cost for the year 2022-23, this entire quantity adds to the consumers’ surplus. However, farmers receive a lower price than the open market rate and lose a share of their surplus, while the government incurs a significant expenditure. Beyond the procurement quantity, the market operates freely.[b]

Following the prohibition of exports, farmers only contend with the domestic demand curve. There is an immediate drop in prices from PN0 to PN1, diminishing the producers’ surplus and transferring it to the consumers. In this scenario, we assume that the government does not increase its procurement activities. The post-ban welfare shares are as follows:

The definite outcomes are an increase in consumers’ surplus, and a decline in producers’ surplus. There is no change in government expenditure.

This model aims to address the inter-market redistribution of welfare. The outcomes can be alternatively interpreted as a transfer of surplus from basmati consumers to non-basmati consumers, which is an egalitarian shift. On the other hand, the gains from trade accrue to the basmati farmers, reducing the share for non-basmati farmers. This further perpetuates the inequality in the incomes of the two farmer groups. The following discussion aims to reconcile this disparity.

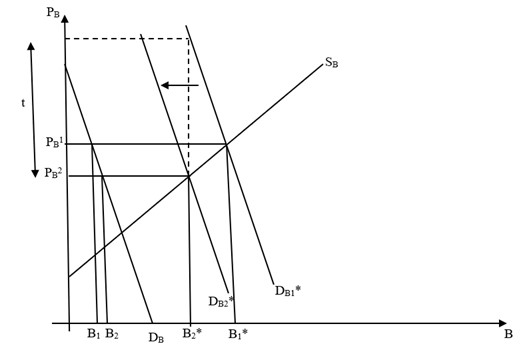

The aim is to curb the income and wealth inequality between basmati and non-basmati farmers while reducing water scarcity in the sector. The solution to the Indian government’s distortionary measure will likely be another quantitative measure, levied on the basmati rice market this time. Consider a specific tariff, at the rate of t per unit, imposed on the exports of basmati rice. This will drive up the price of Indian basmati rice in international markets, lowering global demand and driving a wedge between domestic and international prices. A vital characteristic of the rice market is the high inelasticity of demand. In other words, a high tariff revenue can be generated without significantly reducing the export demand. Figure 11 shows the reduction in demand due to the export tariff and the consequent change in domestic consumption. As demand shifts from DB1* to DB2*, a divide is created between domestic and international prices—domestic markets operate at PB2, while foreign consumers end up paying (PB2 + t).

Figure 11: Post-intervention Basmati Market

Source: Author’s own

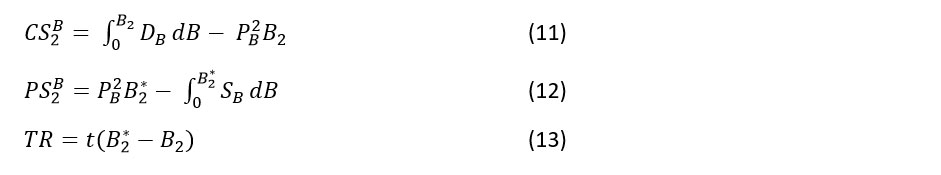

The post-tariff welfare shares are as follows:

There is an unambiguous increase in consumers’ surplus, while producers’ surplus is reduced due to lower prices and weaker foreign demand. The government also collects a tariff revenue. Exports have reduced and domestic consumption has increased, allowing consumers to enjoy the gains from trade.

The government can consider a policy mix that will allow non-basmati producers and millet farmers to enjoy a greater surplus in the market. It can increase the MSP on millets to make the crop more remunerative. Crop substitution by shifting land from paddy to millet production will have two significant implications—in terms of water usage and agricultural employment. Increasing the MSP on millets will also shift the terms of trade in favour of millet production. However, a series of institutional policies are also required to reduce the demand-supply divide prevalent in the millet market.

Crop Substitution: A Possible Extension

An export tariff on basmati to fund the non-basmati procurement process could be a short-term solution, but more is needed to directly address the underlying problems. The uncertainty in the rice sector originates from the lower yield and poor quality of inputs used in the production process. Moreover, water utilisation in the paddy production process could be more sustainable and this needs to be considered in agricultural policy design.

Rice is a highly water-intensive cereal, requiring about 1250 mm of water,[61] which puts excessive pressure on groundwater sources and causes irrigation costs to shoot up. Following the Green Revolution, rice- and wheat-oriented food security measures have worsened the water scarcity situation in the country, establishing a trade-off between food security and water availability. To meet the growing population’s cereal demand, India has increased the acreage under paddy and wheat, driving up the scarcity value of water. This scarcity value has also been interpreted as the basis of transboundary water disputes,[62] highlighting the need to maintain sufficient levels of water reserves in the economy.

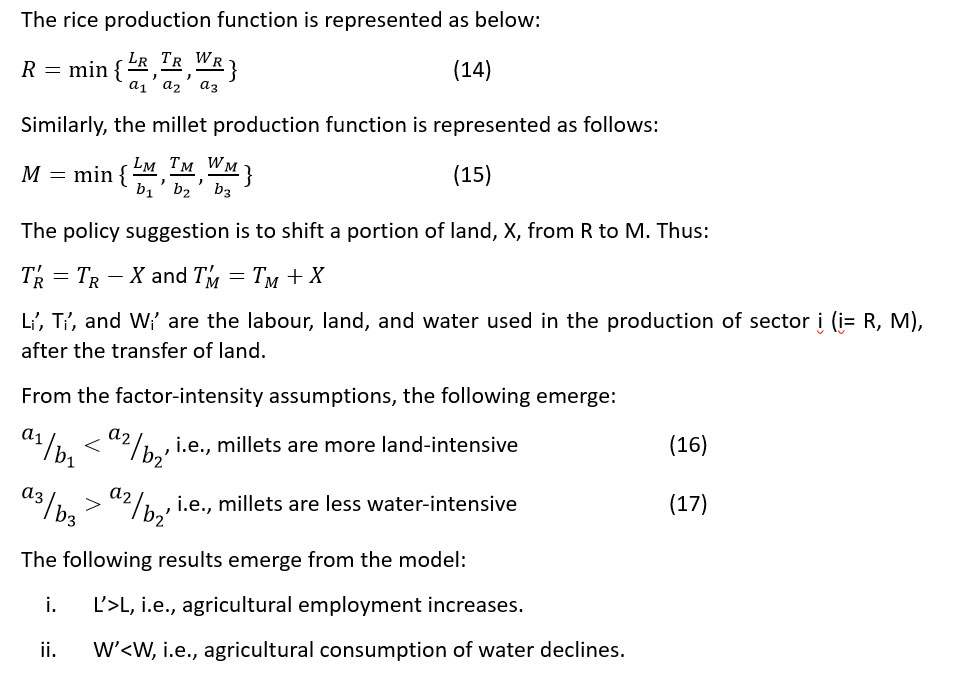

Raising the MSP of rice will incentivise farmers to gear up cultivation, which will immediately increase the water demand, worsening the trade-off that emerges between food security and water scarcity. This trade-off can be circumvented by focusing on drier, drought-resilient crops such as millets, which are also richer sources of nutrition. Although millets are more land- and labour-intensive, their water requirement is significantly lower than that of rice (for example, 310 mm per hectare for ragi).[63] Increasing millet production can simultaneously address nutrition security and alleviate the problem of water scarcity. As a long-term measure, this paper proposes a crop diversification policy where land under basmati production is gradually shifted to millet production.

The paper presents a simple theoretical framework to formulate the results of the policy. It considers the basmati market and a consolidated millets market. Rice is highly water-intensive whereas millets are relatively more land- and labour-intensive.[64] It assumes that, in the long run, inputs are used in a fixed proportion with fixed input coefficients. Thus, it uses a Leontief production function.

Assumptions:

- In the long run, factor-intensity ratios are constant, i.e., factors are used in a fixed proportion. Moreover, per-unit requirements of all factors are constant.

- Production is constrained by land availability, i.e., the land’s endowment is fixed, and other factors are used based on land utilisation.

- The agricultural sector has an excess labour supply, so an increase in labour demand will not lead to a wage hike. Agricultural employment can be increased at the constant wage level.

- Water has an upward-sloping supply curve, i.e., despite water scarcity, more water can be brought into the production process at higher prices (till the point of complete water depletion). This raises the scarcity value of water.

The notations used in this framework are as follows:

R: Amount of rice produced

M: Amount of millets produced

Li: Labour employed in sector i (i = R,M)

Ti: Land employed in sector i (i = R,M)

Wi: Water consumed in sector i (i = R,M)Ther

ai: Per unit requirement of factors of production in the rice sector (i= 1,2,3)

bi: Per unit requirement of factors of production in millets sector (i= 1,2,3)

X: Amount of land shifted under crop-substitution policy

On the supply side, millet farmers and non-basmati farmers face identical problems in terms of their access to the value network. Given the smaller scale of the farmers[65] and the disconnect between producers and consumers, they do not get complete access to the market prices. A significant share of the cost is appropriated in the midstream, allowing only a fraction to seep into farmers’ households. The highly positive correlation between size and access to price impedes the production of millets. The export ban policy on rice can be manoeuvred into a tool to boost the production of millets in India.

The government had indirectly implemented the policy suggestion of imposing an export tariff on basmati in the form of a minimum export price (MEP) in August 2023. While the objective of the MEP was to reap the benefits of high demand, it was seen that basmati traders could not find buyers at such a high markup. The MEP was later lowered from US$1200 to US$950 per tonne.[66] Alternatively, an equivalent tariff that will have the same effect on foreign demand will allow the government to generate a profitable tariff revenue. This opportunity of reduced basmati demand can be used as a catalyst to shift basmati acreage towards millets production by transferring the excess share of land (B2*-B1*, in the case of the model presented in the previous section) and allowing larger farmers to enter the millets value network. While an increase in production can be incentivised and driven by government programmes, consumer preferences need to be reshaped to facilitate a self-sustained market.

Although the MSP for major millets (jowar and bajra) is higher than that of rice,[67] the farmers do not have access to these prices. A significant share is lost due to transport costs, processing costs, and, to an extent, corruption. However, as basmati farmers engage in millet production, they can utilise their networks and scale advantages to extract the maximum possible share of the surplus and make the crop remunerative, incentivising entry into the market. Moreover, making Indian consumers aware of the benefits of millets, both in terms of nutrition and their role in conserving water, can increase domestic demand. This will also encourage farmers’ entry into the market and drive up prices. Another possible method to increase consumption is through the NFSA, which procures millet and partially replaces them with rice distribution. This would also involve bringing minor millets such as proso, foxtail, and small millets under the ambit of procurement. An MSP with a higher mark-up on the cost of cultivation will incentivise farmers to enter the millets market.

Policy Recommendations

This paper presents policy recommendations emerging from the theoretical model and institutional policies required to push markets in the desired direction.

Following the export ban, the following welfare changes can be expected:

- An increase in basmati producers’ surplus

- A fall in domestic basmati consumers’ surplus

- A fall in domestic non-basmati producers’ surplus

- An increase in domestic non-basmati consumers’ surplus

To amend the reduction in welfare and inequitable distribution of gains due to the trade policy, this paper recommends imposing an export tariff on basmati rice and using the proceeds to fund the procurement of millets while shifting acreage from basmati to millets. This policy mix can potentially increase farmers’ profitability and ensure greater nutritional security.

The suggested crop substitution policy will shift the excess land under Basmati production towards millet production. This will raise agricultural employment and significantly reduce agrarian water consumption while increasing the Indian populace’s nutrition consumption. However, this policy needs Indian consumer preferences to shift in favour of millets, which can be initiated through the increased procurement of millets and distribution under the NFSA.

This policy mix can safeguard consumers and producers from agricultural price volatility and climate uncertainties. Although simple, the policies need to be implemented in stages. Abrupt changes in the agricultural value chain can have severe consequences for the marginal farmers and might drive them out of operation. Therefore, a bottom-up approach is required where crop substitution is also encouraged among small farmers. Leakages from the value chain should also be minimised, giving farmers the maximum possible access to market prices.

The irrigation of cereal crops is responsible for 50 percent of India’s total water consumption.[68] The demand for irrigation water for cereal crops has increased significantly in states that have experienced a decrease in rainfall, leading to water shortages.[69] Millets only require 30 percent of the water needed in rice production and can grow with little to no irrigation.[70] Additionally, rice is also a significant greenhouse gas emitter, with there also being other climate-sensitive concerns related to its calorie output.[71]

The revival of millets necessitates both supply- and demand-side strategies.[72] On the supply side, rice can be replaced from certain regions with millets, or millets can be implemented as a gradual crop by intercropping with pulses, oilseeds, and rice. However, the first alternative requires various inputs, including the rice area to be liberated, the efficiency of millets in liberated rice areas, and the availability of sufficient post-production infrastructure and facilities to promote millets economically for the farmer.

The government can consider the following institutional policies to promote millet production and consumption:

- Awareness programmes: Both consumers and producers need to be made cognisant of the benefits of millets. Farmers need to be informed about the environmental cost of growing rice and wheat, which renders their land less productive and depletes the share of water available for domestic consumption. They must be educated about the benefits of growing millets, their resource efficiency, and their sustainability in the long run. At the same time, households should also be made aware of the social costs of traditional cereals and how they pose a significant threat to their water security. Moreover, the nutritional advantage of millets over rice and wheat will motivate them to shift their diets towards millets.

- Market intervention: Awareness alone cannot drive farmers to take up millet production. The government needs to undertake price actions to incentivise the desired change. First, increasing the MSP on millets will ensure that there is a safety net for farmers’ produce and encourage them to increase the acreage under millets. Second, inputs should be priced in line with the required shifts in production. Given the low requirement for water and fertilisers in millets, the subsidies on them should be proportionately reduced to indicate the change towards drier crops. This will push farmers to reduce their production of rice, wheat, and other water-intensive cereals to bring more land under climate-smart millets. Third, the increased distribution of millets under the NFSA will shape consumers’ preferences in favour of millets and gradually decrease the demand for traditional cereals. This will also reduce the demand and supply divide prevalent in the millet market.

- Increased research and development: Indian research on millets in recent decades has developed a wide variety of cultivars that have higher yields and lower associated losses. Making the research outcomes replicable will allow the global farmers’ community to realise the potential of millets as climate risks heighten. Research around the production and consumption benefits of smaller millets such as pearl, foxtail, proso, and finger millets should be promoted to acclimatise the global community to adopt millets as a diet staple. Moreover, an influx of investment in the research sector can catalyse the development of high-yield variety inputs, which can significantly increase the yield (and overall profitability) of millets.

- A sustainable value chain: Investment should be made in frameworks that allow millet farmers full access to the market. The demand and supply divide in the absence of sufficient procurement programmes makes millet cultivation unprofitable. To tackle this problem, necessary incentives and initial funding should be provided to farmers. In addition, the value chain should become more transparent, minimising leakages from the midstream. This can be achieved through increased government intervention in the procurement and distribution mechanisms. Bolstering the industry with initial subsidies will enable farmers to acquire the required access to markets and allow them to reap the benefits of the drier crop.

Conclusion

This paper shows that the export ban on non-basmati rice, targeted at protecting domestic consumers from global price shocks, will also have a negative effect on the incomes of non-basmati farmers. Non-basmati farmers, primarily producing in states with smaller farm sizes, receive lower prices than basmati farmers. A further demand shortage in the non-basmati market will only cause a welfare loss for these farmers and widen the income divide between basmati and non-basmati farmers. To address this disparate result of the policy, this paper suggests levying an export tariff on basmati exports, which could be used to raise the MSP of drier millets.

Basmati producers who are expected to bear the cost of this shift can be compensated through a simultaneous policy of crop substitution. Switching from basmati to millets will also significantly reduce water demand and make the sector sustainable. Basmati farmers who already have greater access to markets can exploit their scale advantage to reap the remunerative benefits of millets. Increasing the MSP on millets and bringing all varieties of millets under the procurement process will gradually shape consumers’ preferences, in addition to incentivising farmers’ entry into the market. As the millets market is established as profitable, non-basmati farmers will be inclined to switch crops. Thus, this policy mix will entail both broadening and deepening the market, leading to a more sustainable agricultural sector in an increasingly climate-uncertain world.

https://www.orfonline.org/research/leveraging-the-rice-export-ban-for-crop-substitution-in-indiaPublished Date: March 20, 2024