Tags

India’s rice export boom: How India became the world’s grain powerhouse

India is leading the global rice market, but it’s more than just a grain game—it’s a tale of trade wars, culinary diplomacy, and the art of balancing supply and demand.

Anushruti Singh

Imagine this: India and its neighbouring countries are locked in tense trade negotiations, but there is one thing that unites them all—rice. India’s export of Basmati rice, a staple in biryani across South Asia, becomes the unexpected peacekeeper. As India ramps up its exports to meet the insatiable demand for biryani in Pakistan, the UAE, and beyond, rice transforms into an instrument of “rice-diplomacy.” When all else fails, a plate of aromatic biryani (made from India’s finest grains) does wonders in soothing frayed nerves at high-stakes trade summits!

That’s why, India’s role in the global rice market has never been more significant. While China may be the world’s largest producer of rice, it is India that has emerged as the global leader in rice exports. Over the past few years, India has leveraged its agricultural capacity to strengthen its presence on the international stage, making rice a cornerstone of its export strategy. However, this journey is not without its complexities and challenges, reflecting broader trends in global trade, domestic policy, and market dynamics. Let’s have a look at how India is important in the rice sector.

A stronghold of rice production and export

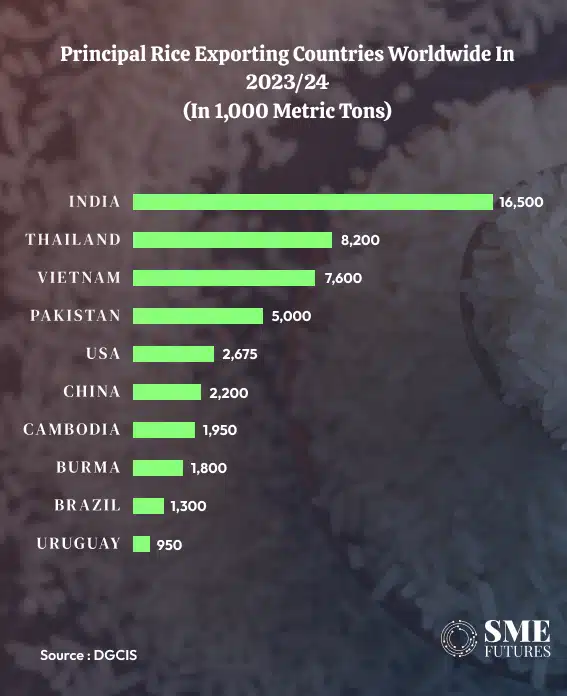

India’s rice production has shown a consistent upward trend, moving from 129.4 million tonnes in FY 2021-22 to an impressive 137 million tonnes in FY 2023-24, says a DGCIS analysis. This increase has enabled India to not only meet its domestic demands but also expand its export footprint. In fact, India is responsible for nearly 40 per cent of the world’s total rice exports between 2021 and 2023, surpassing competitors like Pakistan and Thailand.

Basmati vs. Non-Basmati: How’s the market

When it comes to rice, India has a two-pronged approach: Basmati, the aromatic “crown jewel,” and non-Basmati, the everyday hero.

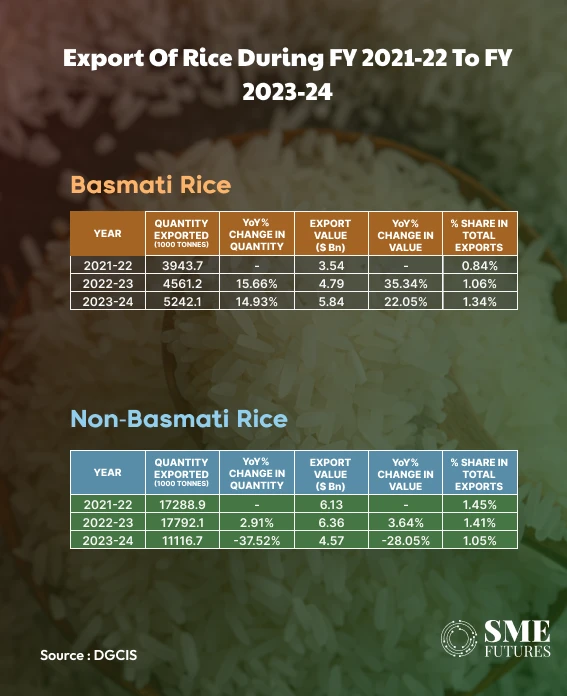

Exports of Basmati rice have shown steady growth both in quantity and value. In FY 2023-24, India exported over 5.24 million tonnes of Basmati rice, up from 3.94 million tonnes in FY 2021-22. This represents a 14.93 per cent year-over-year increase in quantity and a 22.05 per cent rise in export value, contributing 1.34 per cent to India’s total export basket. This growth reflects the rising demand for aromatic and premium-quality Basmati rice, especially in key markets like Saudi Arabia, Iraq, and the UK.

Non-basmati rice: Challenges and opportunities

Conversely, non-Basmati rice has faced headwinds, especially in FY 2023-24.

Its export quantity fell by 37.52 per cent, while its export value dropped by 28.05 per cent compared to the previous year. This steep decline wasn’t due to a lack of demand but rather due to India’s sudden decision to slam the brakes on non-Basmati rice exports in July 2023. Consequently, non-Basmati rice saw its share of total exports slip from 1.41 per cent to 1.05 per cent. This decision, aimed at stabilising domestic prices amid concerns of supply shortages, illustrates the delicate balance India must strike between domestic needs and international market opportunities.

Interestingly, even with the export ban in place, non-Basmati rice still outsized its fancy cousin, Basmati, in terms of sheer volume. In 2023-24, India exported a hefty 111.16 lakh tonnes of non-Basmati rice compared to 52.42 lakh tonnes of Basmati. Put together, both categories of rice made up around 12 per cent of the country’s total rice production that year—proving that while non-Basmati rice might have been kept home, it was far from forgotten on the global stage.

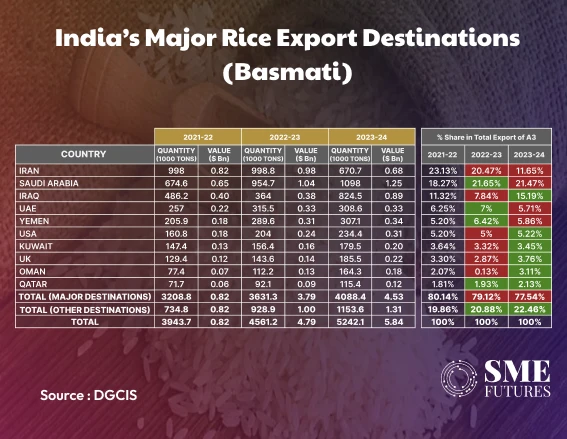

Expanding horizons: Diversification in export destinations

India’s major export destinations for rice, particularly Basmati, have remained relatively stable with a concentration in the Middle East and South Asia. Countries like Iran, Saudi Arabia, and Iraq continue to be top buyers. However, a notable shift is occurring: The share of rice exports to the top 10 destinations has been gradually declining from 80 per cent in FY 2021-22 to 77.5 per cent in FY 2023-24. This diversification reflects India’s strategic push to expand into new markets, which could mitigate risks associated with dependency on a limited number of countries.

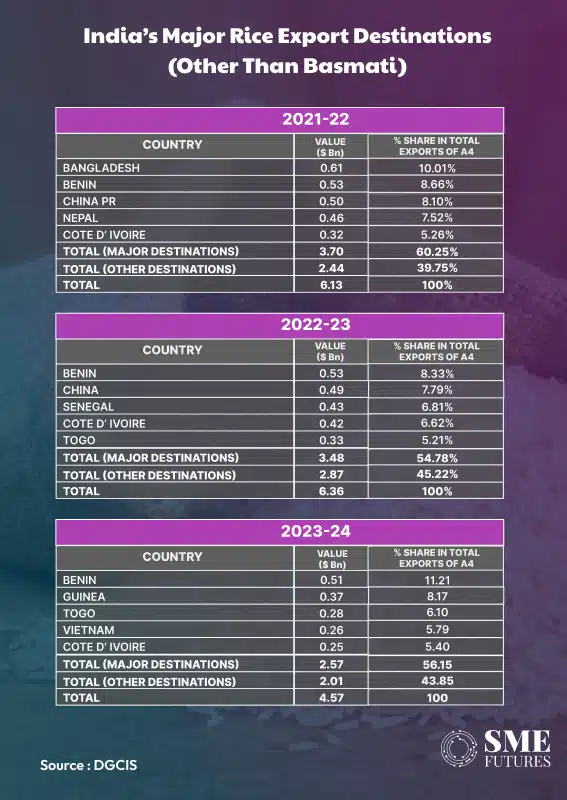

Interestingly, non-Basmati rice has seen an even more pronounced diversification. Traditional markets like Bangladesh, China, and Nepal have reduced their imports, while new players such as Somalia, Djibouti, and the UAE have emerged as significant importers. Meanwhile, the shares of Benin, Guinea, Togo and Vietnam have substantially increased in FY 2023-24 vis-à-vis FY 2022-23 and FY 2021-22 as regards to export of rice-other than Basmati. This shift suggests that despite challenges, there remains a robust demand for Indian rice globally, provided the right markets are targeted.

Global market dynamics: India’s competitive edge

So far, India’s share in world exports of rice has increased from nearly 36 per cent in 2022 to nearly 46 per cent in 2023. This impressive dominance in the rice export market can be attributed to several key factors:

- Competitive pricing and quality: Indian rice, particularly Basmati, is renowned for its quality. Competitive pricing, coupled with its strong reputation for aromatic and long-grain varieties, has enabled India to secure a leading position in both traditional and emerging markets.

- Policy support and trade infrastructure: The Indian Government’s policies, such as subsidies on agricultural inputs, enhanced warehousing capabilities, and investments in port infrastructure, have strengthened the export value chain. However, policies like the export ban on non-Basmati rice reflect the balancing act needed between supporting farmers and maintaining food security.

- Strategic partnerships and trade agreements: India’s ability to negotiate favourable trade agreements has further bolstered its position. The country has proactively sought to open new markets and strengthen relationships with existing ones, enhancing its export potential even amidst global trade tensions.

Despite this impressive feat, India’s rice export landscape is not without its challenges: To begin with, climate risk is one of the major hurdles. Rice production is highly vulnerable to climatic variations such as monsoons and droughts. Extreme weather events could disrupt supply and lead to price volatility, affecting export stability. Policy volatility is another area that India needs to work on. While protective measures such as export bans are sometimes necessary, they can also create uncertainty in international markets, potentially driving buyers to seek more stable suppliers. Trade barriers and competition also impact rice exports. Countries like Pakistan, Thailand, and Vietnam remain strong competitors, often benefitting from lower production costs and tariff advantages in certain markets.

Strategies for sustained growth

To maintain and grow its global market share, India must adopt a multi-pronged approach:

Enhancing production resilience: Investments in climate-resilient agriculture, including drought-resistant rice varieties, are essential to safeguard against unpredictable weather patterns.

Improving export infrastructure: Expanding port capacities and streamlining logistics can reduce costs and increase the efficiency of rice exports, enhancing India’s competitive edge.

Leveraging digital platforms: Utilising digital tools for real-time market intelligence, demand forecasting, and direct-to-market strategies can help Indian exporters better navigate global trade dynamics.

Bright yet complex future for Indian rice exports

India’s position as the world’s leading rice exporter is a testament to its agricultural strength and strategic market positioning. However, sustaining this leadership will require adaptive strategies that address both domestic constraints and global opportunities. As India continues to expand its reach, its ability to balance policy decisions, invest in resilient infrastructure, and diversify its export base will determine its future success in the global rice market.

This dynamic environment presents both opportunities and challenges. By navigating these effectively, India can continue to capitalise on its status as a global rice powerhouse, reinforcing its position in world trade and contributing significantly to its agricultural economy.

https://smefutures.com/indias-rice-export-boom-how-india-became-the-worlds-grain-powerhouse/Published Date: October 14, 2024