Tags

How Basmati in India is reaping the rewards of research

India’s basmati rice exports of nearly $5 billion are testimony to what good public sector breeding and collaboration with industry can achieve.

IARI director AK Singh (left) with farmer Satyavan Sehrawat at his Pusa Basmati-1847 field in Delhi’s Daryapur Kalan village. (Express photo by Harish Damodaran)

The work of scientists, especially in publicly-funded research institutions, is seen to seldom produce results on the ground. Not for nothing that when the Indian Space Research Organisation’s Chandrayaan-3 lander touched down on the moon’s surface, it fired the national imagination.

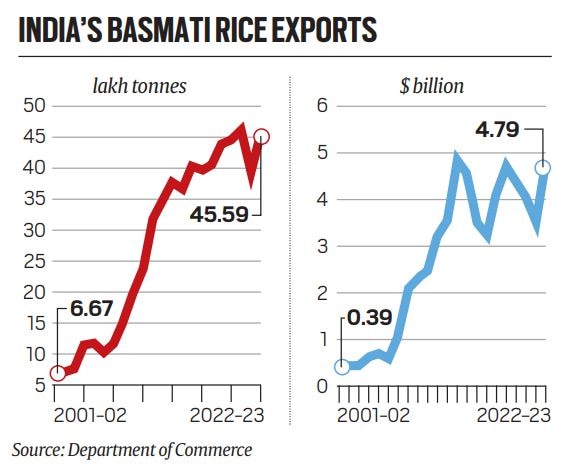

But there are also less heralded success stories of research with tangible impact. Among them is basmati rice, whose annual exports from India have soared, from 0.3-0.35 million tonnes (mt) valued at $200-250 million to 4.5-4.6 mt worth $4.7-4.8 billion, in the past three decades.

Much of this has been courtesy of scientists at the Indian Agricultural Research Institute (IARI) in New Delhi.

The first revolution

Till the late 1980s, Indian farmers grew traditional basmati varieties having tall plants (150-160 cm), prone to lodging (bending over when heavy with well-filled grains) and yielding barely 10 quintals of paddy an acre over 155-160 days from nursery sowing to harvesting. These included Taraori (also called Karnal Local or HBC-19) and Dehraduni (Type-3).

The breakthrough happened with Pusa Basmati-1 (PB-1), an improved variety released in 1989. Bred by a team of IARI scientists led by E.A. Siddiq, it was a cross between Karnal Local and Pusa-150, a high-yielding non-basmati line. With a plant height of 100-105 cm, PB-1 didn’t lodge, yielded 25-26 quintals grain per acre and matured in 135-140 days.

IARI scientists, from the late 1960s when the legendary M.S. Swaminathan was its director, had sought to combine traditional basmati’s unique grain attributes (aroma, non-stickiness and elongation upon cooking) with the high-yielding background of modern dwarf varieties. PB-1 grains had only mild aroma, but scored over Taraori in average milled rice kernel length (7.38 mm versus 7.15 mm) and elongation ratio on cooking (2 versus 1.95 times).

At the turn of the century, India was exporting 0.6-0.7 mt of basmati rice fetching $400-450 million annually, with PB-1’s share at roughly 60%.

ADVERTISEMENT

India’s basmati rice exports.

India’s basmati rice exports.

The second revolution

PB-1 delivered a yield revolution and helped double India’s basmati exports. But the real revolution came in 2003, with the release of Pusa Basmati-1121 (PB-1121).

PB-1121 yielded less (20-21 quintals/acre) with a slightly longer maturity (140-145 days). However, its USP was the grain quality: The kernel length averaged 8 mm that elongated 2.7 times to about 21.5 mm on cooking. A cup of milled PB-1121 grains gave 4.5 cups of cooked rice, as against 4 for PB-1 and 3.7 for Taraori.

The new variety’s true potential was realised by KRBL Ltd. The company not only sourced PB-1121’s seeds from its lead breeder Vijay Pal Singh for further multiplication and contract cultivation, but also created a special ‘India Gate Classic’ brand for what was billed as the world’s longest rice grain. Since a few kernels could fill up whole plates, giving extra volume for the dollar, overseas buyers also lapped it up. KRBL did for PB-1121 what United Riceland had for the traditional Taraori variety, which it was exporting since the 1980s under the ‘Tilda’ brand.

PB-1121’s impact can be seen from the accompanying charts. Between 2001-02 and 2013-14, India basmati rice exports surged from 0.7 mt to 3.7 mt, and from $390 million to $4.9 billion in value terms. Over 70% of that was from PB-1121.

The third revolution

In 2013, the IARI, this time under its current director Ashok Kumar Singh, released Pusa Basmati-1509 (PB-1509). It yielded just as much as PB-1, with the milled rice length before and after cooking comparable to PB-1121’s. But PB-1509’s seed-to-grain duration was just 115-120 days.

Being an early-maturing high-yielding variety made PB-1509 advantageous for farmers, as they could now take an extra crop.

Satyavan Sehrawat, a farmer from Daryapur Kalan village in Northwest Delhi, sows the nurseries for PB-1509 in mid-May and transplants its seedlings a month later. After the mature paddy is harvested in mid-September, he plants a 70-75 day crop of either cauliflower or fodder maize yielding 125-150 quintals and 180-200 quintals per acre respectively. That still gives him the flexibility to sow wheat by early-December.

Other crop combinations being adopted by farmers after harvesting of PB-1509 include planting of a three-month potato crop in the first week of October, followed by sunflower, sweet corn or onion in early-January and maturing in 90-100 days.

Breeding for disease resistance

In the last few years, IARI scientists have focused on preserving the yield gains from their improved basmati varieties by incorporating genes for disease resistance.

PB-1121, for instance, has become susceptible to bacterial leaf blight. To control it, the scientists have sought to transfer genes from landrace cultivars and wild relatives of paddy that are resistant to this bacterial disease. Such genes have been identified through a technique called marker-assisted selection.

In 2021, IARI released Pusa Basmati-1885 and Pusa Basmati-1847. These were basically PB-1121 and PB-1509 having “in-built resistance” against bacterial blight as well as rice blast fungal disease. Both of them incorporated two bacterial blight resistant genes Xa21 and xa13, derived from a wild rice species (Oryza longistaminata) and a traditional indica landrace (BJ1) respectively. They also carried two other genes Pi2 and Pi54 against blast, similarly sourced and transferred from an indica rice cultivar (5173) and landrace (Tetep).

In-built resistance to bacterial blight and blast through such marker-assisted backcross breeding means farmers no longer have to use streptomycin or tetracycline combinations and fungicides such as tricyclazole, azoxystrobin and picoxystrobin. Minimising the spraying of crop protection chemical also helps protect the premium value of Indian basmati in the global market.

Risk factors

There’s no minimum support price (MSP) for basmati paddy. Also, its rice is mostly exported with only a limited domestic market.

Thanks to the work of IARI scientists, basmati grain yields, at 25 quintals per acre, are only marginally below the 30 quintals for normal Parmal (non-basmati) varieties. At a market price of Rs 3,000/quintal (against the Rs 2,203 MSP for Grade A non-basmati paddy) and corresponding cultivation costs of Rs 30,000 per acre (Rs 25,000), basmati growers probably make more money.

But these farmers are also more exposed to the vagaries of the market and government policy with regard to exports. The recent restrictions – not allowing basmati shipments priced below $1,200 per tonne – are only a pointer to that.

https://indianexpress.com/article/explained/explained-economics/how-basmati-in-india-is-reaping-the-rewards-of-research-8944481/Published Date: September 18, 2023