Tags

Global milled rice imports regain momentum after sharp contraction in 2023-24

- China’s return steadies global trade after policy-driven pullback

- Middle East demand anchors market, Africa shows selective recovery

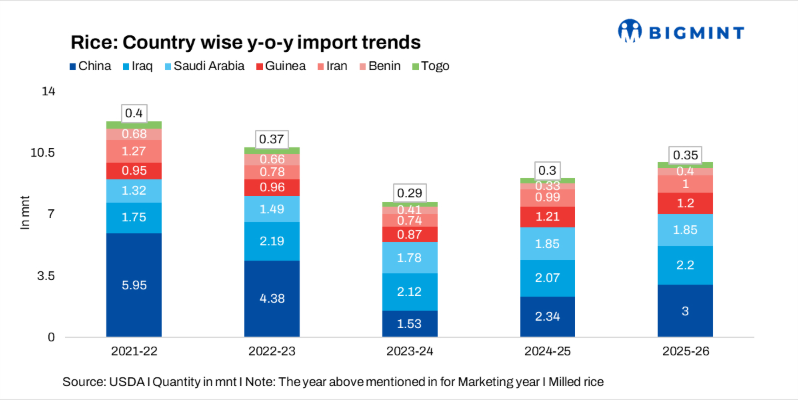

Global milled rice imports across key consuming countries are projected to rebound to 10 million tonnes (mnt) in 2025-26, recovering from a sharp contraction in 2023-24, when volumes slipped to 7.74 mnt, according to US Department of Agriculture (USDA) data. The recovery reflects renewed buying from China and continued structural demand from the Middle East, even as African imports remain uneven.

The import cycle over the past four years has been shaped less by price sensitivity and more by policy interventions, stock management, and food security priorities, resulting in pronounced volatility rather than a steady demand trend.

China’s import volatility drives market swings

China remains the dominant swing factor in global milled rice trade. Imports collapsed from 4.38 mnt in 2022-23 to 1.53 mnt in 2023-24, as authorities leaned on domestic inventories and curtailed discretionary buying. The pullback was a key driver behind the global contraction that year.

The trend reversed in 2024-25, with imports rising to 2.34 mnt, and are forecast to reach 3 mnt in 2025-26, signalling a gradual re-entry into the international market. Trade participants view the rebound as inventory-driven rather than consumption-led, suggesting China will continue to influence price direction through episodic procurement rather than sustained demand.

Middle East demand remains structurally firm

The Middle East continues to provide stability to global rice trade flows. Iraq, the second-largest importer in the region, has maintained imports above 2 mnt for three consecutive seasons, despite minor year-to-year adjustments. Volumes are expected to rise to 2.2 mnt in 2025-26, reflecting steady government-led procurement and population-linked consumption growth.

Saudi Arabia has shown consistent expansion, with imports increasing from 1.32 mnt in 2021/22 to 1.85 mnt in 2024-25, a level expected to hold in 2025-26. The country’s demand profile remains largely insulated from short-term price fluctuations, reinforcing its role as a reliable destination for exporters.

Africa shows mixed signals amid shifting trade routes

African import trends remain fragmented. Guinea stands out as a growth market, with imports rising to 1.21 mnt in 2024-25, supported by domestic supply gaps and steady consumption growth. Volumes are expected to remain broadly stable in 2025-26.

In contrast, Benin and Togo have seen sustained declines from earlier peaks, reflecting weaker re-export demand and tighter port-led trade flows. Benin’s imports are projected to recover modestly to 0.4 mnt in 2025-26, while Togo is expected at 0.35 mnt, still well below historical highs.

Outlook: Demand recovery with policy risks intact

The projected rise in imports to 10 mnt in 2025-26 suggests global demand is stabilising after the 2023-24 downturn. However, the recovery remains policy-sensitive, particularly in China, where procurement decisions continue to outweigh market pricing signals.

For exporters, the outlook points to selective opportunities rather than broad-based expansion, with the Middle East offering volume stability, China driving episodic demand spikes, and Africa requiring cautious market-by-market engagement.

Overall sentiment in the global milled rice market remains cautiously firm, underpinned by food security demand, but tempered by the risk of abrupt policy shifts in major importing nations.

https://www.bigmint.co/insights/detail/china-rice-import-rebound-global-trade-2025-26-711748Published Date: January 7, 2026