Tags

Can Cambodia’s agri products overcome market challenges

Nhean Chamrong / Khmer Times.

As an agrarian nation, Cambodia has made remarkable progress in the last decade in propelling its agriculture industry with exports now representing 22 percent of the nation’s GDP. Rice and paddy remain among the most significant agricultural exports, with annual production exceeding 11 million tonnes. But there’s more than meets the eye. What’s actually bogging down is the high production costs, limited infrastructure and cutthroat competitiveness in the global market. Trade disruptions have also upset supply chain issues, further challenging farmers who are already grappling with high production costs and fluctuating incomes. This dire situation underscores the need for more stable and diverse export markets to shield farmers from external economic pressures. Is there a way out? According to an avid observer of the Kingdom’s progress, Cambodia can transform itself into an agricultural export powerhouse much like its neighbours with substantial upside in agricultural export value, but for that, the Royal Government should revamp some of its policies

Of Cambodia’s approximate 17 million population, 13 million reside in rural areas where agriculture is the predominant economic activity.

The agricultural sector is critically important, far beyond what the percentage of farmers in the population might suggest contributing about 22 percent of the Kingdom’s gross domestic product (GDP).

Agriculture is a lifeline for food security, supplying over 90 percent of domestic rice needs, and albeit fewer people farm today than decades ago, its role in keeping Cambodia fed, employed and connected to its roots remains vitally important.

Rice, paddy prices

Early this month, the Ministry of Water Resources and Meteorology (MoWRAM) reported that while the official farmland for dry rice cultivation was around 535,000 hectares, actual implementation has expanded to over 900,000 hectares.

According to the Ministry of Agricultural, Forestry and Fisheries (MAFF), rice and paddy remain among Cambodia’s most significant agricultural exports, with annual production exceeding 11 million tonnes in recent years, of which only 10 percent is exported.

Despite its vital role as an economic backbone, supporting downstream industries such as food processing and trade, rice exports face numerous challenges.

High production costs, limited infrastructure and inconsistent quality standards hinder competitiveness in the global market. Additionally, trade barriers and fluctuating international demand further complicate export efforts.

While urbanisation and industrial growth have reduced agriculture’s share of employment and Gross Domestic Product (GDP), enhancing the efficiency and quality of rice exports remains essential to securing its long-term economic impact.

Sidet (30), a farmer in Banteay Meanchey province, shared the challenges he and his fellow farmers face in rice cultivation due to high costs and inconsistent market demand.

Talking to Khmer Times, Sidet said water supply expenses during dry rice cultivation amount to around 40,000 riels (approximately $10) per hectare for the entire four-month cultivation period.

However, because many farmers struggle financially, the payment is typically collected by the village chief only after the harvest season.

Sidet explained that rice prices have been fluctuating, particularly for the OM5154 variety, a type from Vietnam, which has dropped to around six baht or roughly 700 riels per kilogram.

Meanwhile, Cambodian fragrant rice sells for as much as 7.7 baht or approximately 900 riels per kilogram.

He noted that rice and paddy exports to Vietnam and Thailand have recently slowed, partly due to reduced demand and market access challenges. Instead, domestic rice mill factories are buying larger quantities to supply the local market. However, the shift in demand has not significantly improved farmers’ incomes.

Sidet emphasised that despite the importance of rice cultivation, farmers continue to face significant financial burdens.

“They spend between $30-$40 per sack of fertiliser, which is used around three times during each cultivation period, further reducing their profitability,” he said.

These expenses combined with fluctuating rice prices restrict the farmers’ profit margins. As a result, many farmers struggle to make a sustainable income, facing financial strain each season.

Climate & global challenges

On the other hand, cultivation of crops faces distinct challenges during the dry season and harvest season, shaped by the climate, limited infrastructure and reliance on traditional farming methods.

These challenges impact productivity, income and food security, particularly for smallholder farmers who dominate the agricultural sector.

The dry season from November to April is marked by a sharp drop in rainfall, testing farmers’ ability to sustain crops and livestock in the predominantly rain-fed agricultural system where about 80 percent of farmland depends on rainfall rather than irrigation.

Meanwhile, the harvest season coincides with the end of the wet season, when rice and other crops ripen. While it’s a critical time for income; it’s fraught with risks tied to weather, logistics and market dynamics.

In short, during the dry season the focus is on survival keeping crops alive with scarce water while during the harvest season, it’s about securing the yield and income against nature and market forces.

Despite the odds, Cambodia faces additional challenges due to the emerging global trade tension and economic uncertainty. Although farmers could survive the water shortage in the dry season and maintain their income against market forces, they are unlikely to benefit from the trade war.

The trade war especially following the tensions caused by the Trump administration has had a significant impact on Cambodian farmers. As export markets like Vietnam face uncertainty, the cashew farmers struggle with reduced demand and lower prices.

Trade disruptions have also led to supply chain issues, further challenging farmers who are already grappling with high production costs and fluctuating incomes. This situation underscores the need for more stable and diverse export markets to shield farmers from external economic pressures.

Anthony Galliano, Group CEO of Cambodian Investment Management Holdings (CIM) told Khmer Times that the Kingdom has made significant progress in the last decade in propelling its agriculture industry with exports now representing 22 percent of the nation’s GDP.

Galliano said, “While the contribution to the national economy has been critically important in the last three years, given the depressed real estate, construction sector and tourism sectors, growth remains stagnant. In 2022, Cambodia’s total agricultural export volume was approximately 8.6 million tonnes at a value of $4.3 billion in revenue.

In 2023 agricultural export volume rose to 8.82 million tonnes at a total export value of $4.8 billion. While volume increased to 11.66 million tonnes in 2024, marking a 3.21 percent rise compared to 2023, total agricultural export value slightly decreased to $4.792 billion,” he added.

He continued that neighbouring Thailand’s total agricultural export value in 2023 was $49 billion, and was $52 billion in 2024. Vietnam total agricultural export value in 2023 was $53 billion and was $62 billion in 2024, exponentially higher than Cambodia. Fresh, frozen and dried fruits and rice dominate Thailand’s agricultural exports followed by rubber, processed chicken and pet foods.

Vietnam’s main exports are fruits, vegetables, rice, cashew and presently Vietnam is now the second-largest coffee exporter, boasting an export value of $5.48 billion in 2024. Its main markets are China, US and EU.

Galliano pointed out that Cambodia can also transform itself into an agricultural export powerhouse and be as successful as its neighbours with substantial upside in agricultural export value. The country has an arable land area of approximately 4,110,000 hectares compared to Vietnam’s approximate 6,697,000 hectares.

While Vietnam has 61percent more arable land it has 13 times more agricultural export value and has a 100 million population to feed versus Cambodia’s 17 million. The upside for the Kingdom is enormous and the Royal Government is driving the opportunity by implementing several key agricultural policies to modernise and enhance the sector’s productivity, sustainability and resilience.

“Notably the National Agricultural Development Policy (NADP) 2022-2023, the Agricultural Extension Policy and the Pentagonal Strategy. The Kingdom is making strides in improving agricultural productivity and value-added processing, expanding market access and trade agreements and improving logistics and infrastructure,” he said.

The CIM CEO said that Cambodia can capitalise on the high quality and desirability of its premium and organic rice, cassava, cashew, fruits, rubber products, unique spices and the high potential of developing a coffee industry.

With the government focus and policies and the improvements achieved, the agricultural sector is now more than ever a critical part of the national economy and one of its greatest future opportunities with exponential growth potential, he added.

Rise and fall of cashew

The ‘Cashew Emperor’ initiative launched by former Prime Minister Hun Sen is vital for national economic growth as it aims to position the country as a global leader in cashew nut production.

The initiative seeks to boost farmers’ income and foster sustainable growth in the cashew sector by improving agricultural practices and processing capabilities as well as expanding export markets.

However, the initiative is currently facing challenges due to slow demand from key export markets, especially Vietnam. This decline in demand is partly linked to the trade war triggered by the Trump administration earlier this year which caused each country to focus on maximising its local productivity outputs.

As a result, prices for raw cashew nuts have dropped significantly affecting farmers’ profits. Many farmers are already struggling with high production costs and low incomes and the drop in prices has made it even more difficult for them to make a living.

To address these issues, there is a pressing need to diversify export markets and strengthen the value chain. These efforts are essential for stabilising the cashew industry and ensuring its long-term viability.

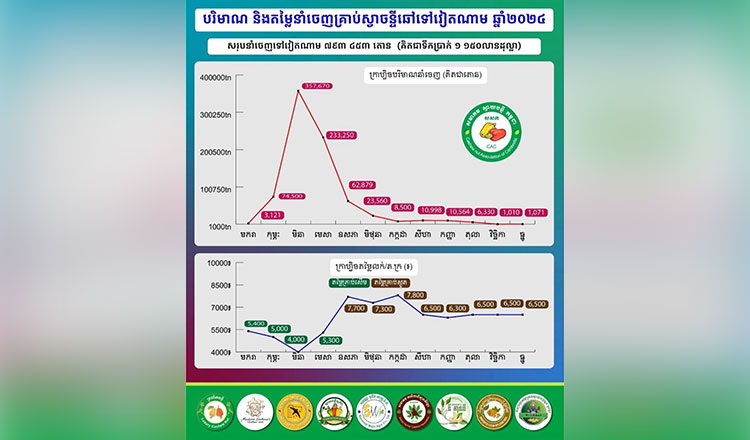

Speaking to Khmer Times, Uon Silot, President of the Cashew Nut Association in Cambodia (CAC), explained that March marks the peak harvesting season for cashew nuts a period that typically sees a decline in market prices. However, CAC is actively collaborating with partner companies to mobilise financial support aimed at stabilising prices during this crucial time.

“This year, the price has dropped from 6,000 riels to 4,400 riels per kilogram, which is approximately $1. Nevertheless, thanks to our collaboration with partners, we successfully pushed the price back up to 5,500 riels within just three days,” Silot noted.

He highlighted the lessons learned from the previous year, stating, “In 2024, prices plummeted to 3,200 riels per kilogram and remained at that low for nearly three weeks before we managed to restore them to 5,000 riels.

From that experience, we have refined our approach and can now resolve price issues much faster. Additionally, cashew nut production remains relatively small compared to rice and cassava, making it easier to manage.”

The CAC President emphasised that a fair price for raw cashew nuts stands at around 5,000 riels per kilogram, a rate considered acceptable for both farmers and processing factories. He cautioned, however, that if prices rise too high, only farmers benefit, as processing factories would struggle to maintain profitability.

Silot detailed several strategies aimed at effectively maintaining stable prices. “We must curb the outflow of cashew nuts from Kampong Thom, the largest cashew-producing province in Cambodia, with approximately 150,000 hectares yielding around 220,000 tonnes annually. This accounts for nearly 30 percent of the nation’s total productivity.”

He stressed that preventing the cashew nuts from Kampong Thom from being sold to other provinces helps elevate prices in those areas due to the limited supply. To effectively manage this, CAC has been working closely with four major processing factories in Kampong Thom, holding three significant meetings over the past year.

“Our discussions have focused on ensuring that prices never fall below 4,500 riels (about $1.1) per kilogram. We have established this threshold as the red mark which should not be crossed under any circumstances,” Silot explained.

He elaborated on the cost structure, indicating that when factoring in overall expenses such as fertilisers, farming supplies and irrigation, the baseline cost amounts to approximately 3,800 riels per kilogram.

Additionally, labour costs around 700 riels per kilogram for workers who gather the cashew seeds. As a result, CAC determined that 4,500 riels per kilogram is the lowest acceptable price that can still offer a fair profit to farmers.

Silot continued by noting that during the harvest season, buyers naturally seek the lowest prices. By limiting the flow of cashew nuts from Kampong Thom and Preah Vihear provinces, supply is reduced in the marketplace, thereby driving prices upward.

CAC’s efforts to maintain stable prices have proven successful over the past two years, according to Silot. He also acknowledged the financial backing from the Agricultural and Rural Development Bank (ARDB) and various microfinance institutions that work closely with CAC to support price stabilisation initiatives.

However, in cases where financial support is not forthcoming, CAC employs an alternative strategy that involves working with local farmers who possess large storage facilities and have the capacity to hold their cashew nuts for extended periods.

“This unified approach allows ordinary farmers to sell their products at favourable prices during the early stages of the harvest season. Once their supplies are exhausted, other farmers with storage capabilities can release their products to the market at higher prices,” he stated.

Silot further explained that farmers with larger storage facilities also benefit from the ability to dry their cashew nuts more effectively. Drier cashews command a higher market price compared to wet ones, enhancing overall profitability.

This strategy relies heavily on trust between CAC and local farmers. If CAC fails to secure buyers as promised, farmers will release their products simultaneously, triggering a sharp decline in prices. Such challenges were experienced last year, resulting in a price reduction of approximately 30 percent.

Despite these obstacles, Silot remains optimistic about the current strategies being employed to stabilise prices noting that the collaborative approach involving farmers, factories and financial institutions offers a resilient framework for the cashew nut industry’s growth and sustainability.

https://www.khmertimeskh.com/501658684/can-cambodias-agri-products-overcome-market-challenges/Published Date: March 24, 2025