Tags

An end of an era

BR Research

Pakistan’s rice export industry is at a crucial juncture as it navigates FY25 following a record-breaking FY24, where exports reached over 6 million metric tons (MMT) and generated $4 billion in foreign exchange earnings. However, the outlook for this year indicates a potential decline due to both external and internal challenges.

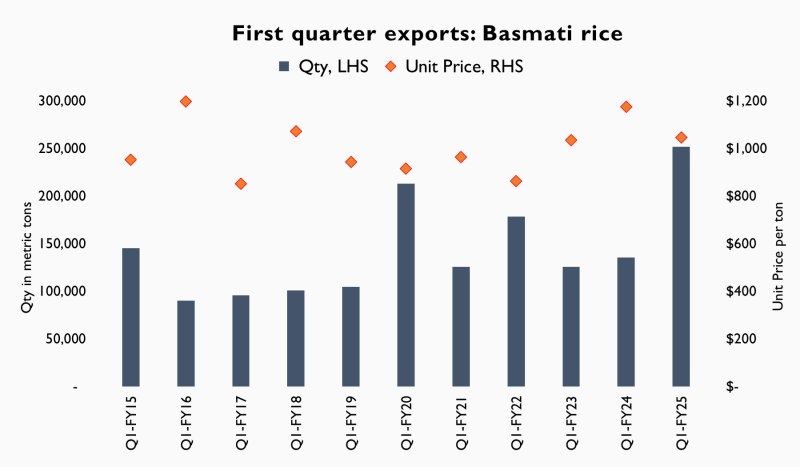

The beginning of FY25 appears promising, with the first quarter’s rice exports totaling nearly 1 MMT and generating $725 million, both record highs for this period. However, this early surge is misleading, as it largely consists of carryover stock from the previous year’s bumper crop. This abundant output was a result of favorable growing conditions and high global rice prices, which allowed Pakistan to temporarily secure a higher market share. During this period, Pakistan’s rice industry also benefited from India’s export restrictions. These restrictions were implemented by the Indian government to stabilize domestic prices ahead of their 2024 elections, impacting the world’s largest rice exporter and creating a gap that Pakistan successfully filled.

India’s dominance in the rice export market is substantial, with exports typically three times larger than Pakistan’s. Now that India’s political situation has stabilized and it has lifted export restrictions, Pakistan faces intensified competition. This change allows India to resume its influence over pricing in major markets like the Middle East, East Africa, and Europe. In response, Pakistan has removed its minimum export price (MEP) to remain competitive, but this will likely force exporters to sell at lower prices, resulting in a projected 10% decrease in export prices compared to the previous year. Even if Pakistan managed to match last year’s export volume of 6 MMT (which is unlikely due to India’s return), a 10% price drop would reduce revenues by about $400 million.

Global rice prices are also beginning to level off after peaking in the past year, suggesting that Pakistan’s rice export revenues may face a significant decline even if export volumes remain stable. Projections indicate a potential revenue reduction of at least $500 million in FY25, even if production targets are met. This is especially concerning given that the previous year’s high rice export revenues played a crucial role in stabilizing Pakistan’s trade deficit, compensating for underperformance in the textile sector—historically Pakistan’s primary export earner.

As Pakistan confronts these challenges, policymakers must reconsider their approach to the agriculture sector and the broader export strategy. With the ongoing weakness in textile exports and limited growth prospects in other export sectors, relying heavily on rice exports to sustain foreign exchange earnings may not be sustainable. Diversifying exports and improving competitiveness across multiple sectors are essential. Additionally, as climate risks increasingly impact crop yields, investing in climate-resilient agricultural practices will be critical for the rice sector’s long-term stability.

The FY25 outlook for Pakistan’s rice export sector suggests a shift from the exceptional growth of FY24 toward more subdued performance, underscoring the need for strategic planning to address evolving market dynamics.

https://www.brecorder.com/news/40327648Published Date: October 19, 2024