Tags

Rice bonanza: tread smartly!

Pakistan’s rice sector has probably never before been so upbeat (For more, read: ‘Rice export: don’t get stupid’ –published in this section on Sep 07, 2023). Reportedly, Indian ban on export of select types of rice has put international prices of subcontinental varieties on steroids, with prices rising by as much as 50 percent over last year in dollar terms.

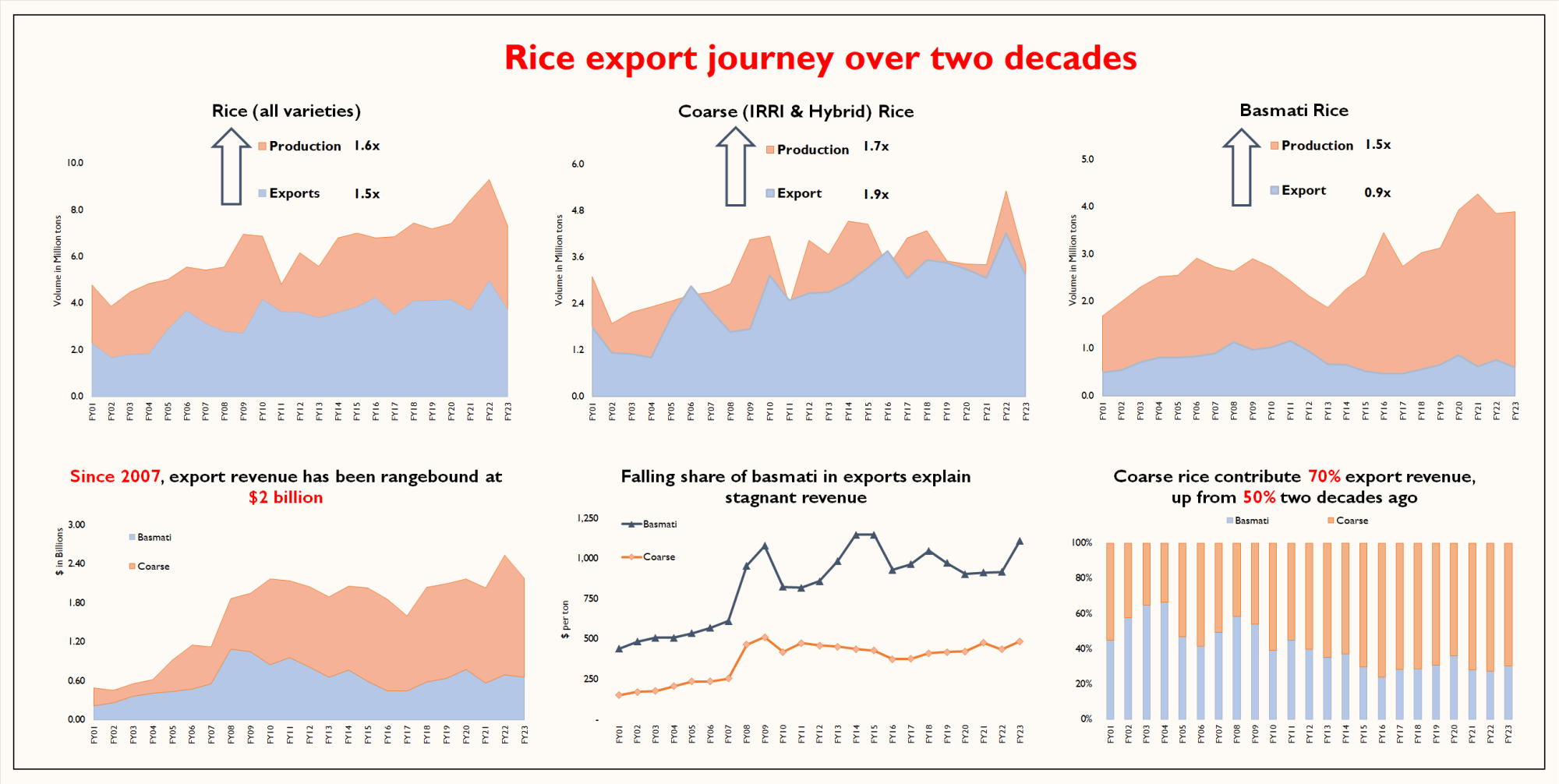

Earlier this week, this newspaper reported that the Rice Exporters Association of Pakistan (REAP) expects export revenue to breach $3 billion mark during the current fiscal year, which would be a first in Pakistan’s history. Regular readers would note that Pakistan’s rice export revenue touched $2.2 billion for the first time in 2009-10 but has since remained rangebound around $2 billion mark for the last odd 14-15 years.

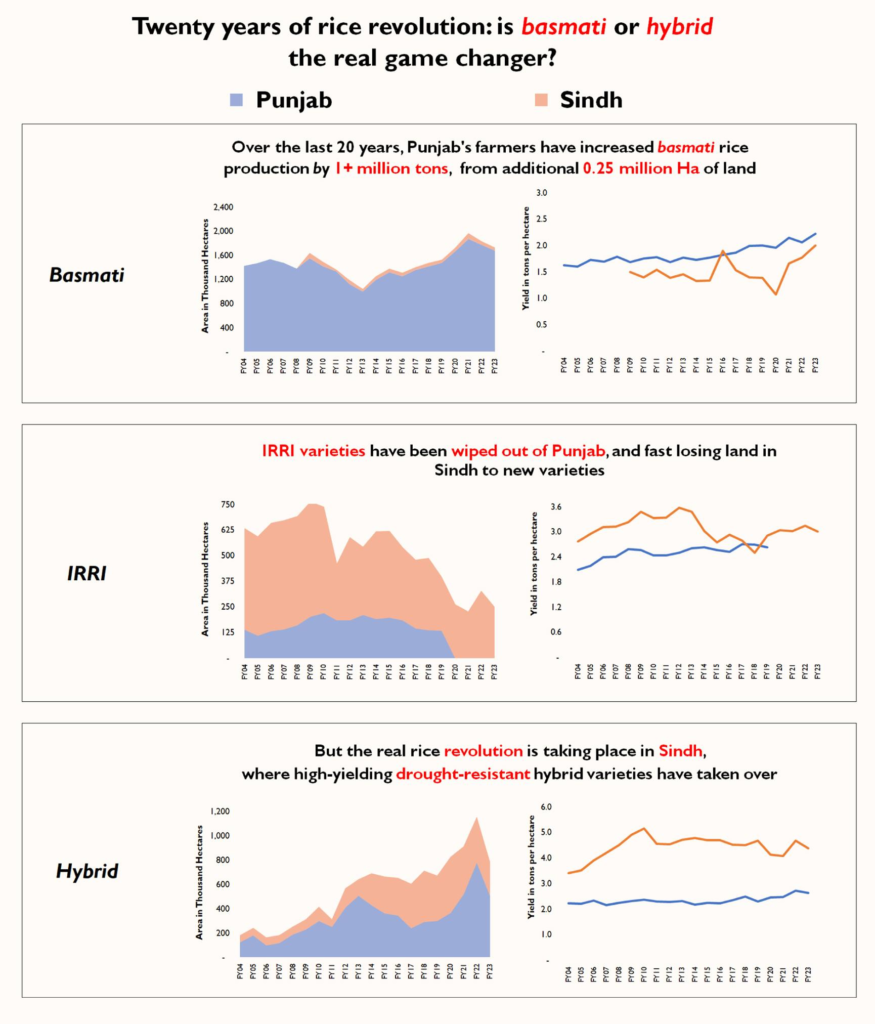

Weak and stagnant rice export revenue over the past decade has been a result of a host of factors, from low international market prices, loss of export competitiveness due to overvalued currency, and a change in export mix. Exports finally breached the $2.5 billion barrier during FY22, but the surge was not driven so much by higher unit value so much as volume, with export volume climbing to 5 million metric tons (MMT), which put Pakistan on the map as world’s fourth largest rice exporter after India, Thailand, and Viet Nam(note: fourth largest exporter, not producer. Pakistan is only ninth in the list of top producers of rice, with less than two percent share in global production. However, restrictive export regimes in large producing nations such as China, Bangladesh, Indonesia etc leaves the export market open for smaller players such as Pakistan).

But Pakistan’s rice export potential now faces multiple threats, some external, but many from within. Crossing the $3 billion barrier would be a cakewalk if exporters manage volumes already reached once before two years ago. Export prices have surged some 25 percent on average compared to FY22, while local production has made a sharp V-shaped recovery from the monsoon floods last year, with production expected to breach 9 million metric tons (MMT) during the kharif 2023, an increase of at least 50 percent from last year’s reported output. Higher dollar prices have sent local currency (LCY) prices in a frenzy, with prices at the retail level rising by as much as 75 percent for many varieties. Higher LCY prices shall help manage domestic demand and consumption, ensuring a generous surplus for exporters.

However, the optimism could prove to be short lived. India is the dominant player in the export market, with a 40 percent share of global rice trade. Once the kharif harvest season comes to an end by November 2023 and India has more clarity over its domestic stock position, it could restore export permissions, which could bring the international prices down crashing beginning H2-FY24, at least for subcontinental varieties. Two, although higher dollar prices and unhinged currency depreciation over the last year has definitely made export orders lucrative, local prices have also escalated, as has cost of inventory financing due to rise in interest rates from an average of 11 percent during FY22 to an average of 23 percent during the current fiscal. Rice exporters face significant risk of inventory losses, unless the industry has locked in water-tight contracts.

Which brings us to the challenges created from within. Last week, the ministry of commerce implemented the minimum export price (MEP) regime for rice, setting MEP of $550 for coarse varieties, and $1,100 for basmati rice. Although the rice exporters association has celebrated the imposition of MEP, the move reeks of bureaucratic ingress and bad optics viz international buyers.

Remember, administrative controls such as MEP or export duties that raise effective price for buyers are no strangers to agricultural markets world over, and are implemented by commodity trading countries as diverse as Argentina, India, and Russia. MEP has also been previously implemented in rice export from Pakistan, with not a lot of opposition from market players.

Ideally, measures such as minimum export price are taken to safeguard domestic farmers and offer them export-competitive returns in markets where bargaining power of farmers is extremely constraint compared to millers. Reportedly, the commerce ministry has imposed MEP to discourage rampant under invoicing in the rice exporting industry, especially at a time when faith in local currency has been lost, and exporters have the incentive of withholding export proceeds abroad.

However, the move smells of foul play. The phenomenal rise in rice prices in the international market since Indian ban means rice exporters face potential loss on exports against contracts already reached with international buyers before July 2023 (or Indian ban). Because international trading giants (buyers) exercise significant influence, smaller Pakistani rice exporting firms have no choice but to fulfill these contracts, unless they can claim force majeure. And an official ban on exports below a minimum price set by the state of Pakistan offers precisely that.

Which explains why an excessive show of regulatory power by a caretaker minister has been welcomed so vigorously by the industry association, at a time when Pakistan has an opportunity to claim a major share of international trade by capturing lost Indian exports. Maybe, rice exporters believe that forgone Indian contracts would more than make up for defaulting on existing contracts reached with long term buyers. But what if India suspends export ban, flushing the international market with a significant exportable surplus?

Industry associations using the regulator to get out of international contracts is dealing in bad faith. And for a small player such as Pakistan which already faces very severe non-tariff barriers in developed markets such as EU and North America, the short-termism could backfire in a big way.

2024 could be the year that makes or break Pakistan as a major player in international rice trade. Is additional 20 percent in export revenue really worth the risk?

https://www.brecorder.com/news/40264136Published Date: September 20, 2023