Tags

Rice: Basmati prices rise w-o-w as key markets continue purchases

- Domestic non-basmati weakens on slow paddy movement and margin pressure

- Basmati remains highly bullish on tight supply and sustained export demand

The rice market presented a divergent trend during the week ended 13 February, with non-basmati prices easing in central India while basmati continued to firm on tight crop availability and steady demand from key importing regions. Export parity across major ports remained largely stable, but underlying sentiment differed as procurement patterns, arrivals and destination demand shaped trade behaviour.

Non-basmati softens on slow paddy movement

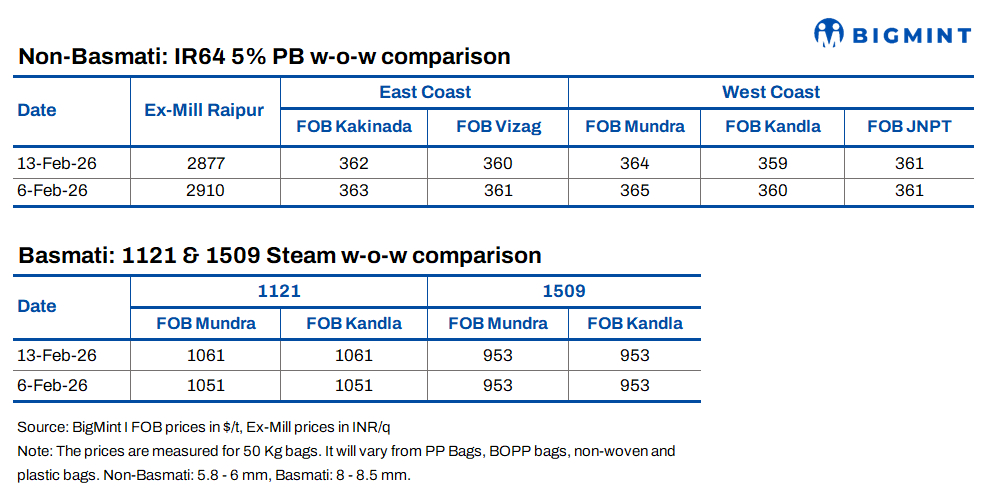

The non-basmati market softened during the week as paddy circulation remained slow in Raipur, Chhattisgarh, affecting mill operations and trade activity. Ex-Raipur prices declined from INR 2,910 per quintal on 6 February to INR 2,877 per quintal on 13 February, down INR 33 or about 1.13%, with the weekly range recorded between INR 2,861 and INR 2,910. Millers and traders continued to face operational stress due to thin crushing margins and rising labour, electricity and land costs, while several mills operated selectively or remained shut and relied largely on government custom milling for survival.

Export parity for IR64 5% parboiled rice remained largely stable across ports, reflecting steady demand but cautious buying. FOB Kakinada moved marginally from $363 per tonne to $362 per tonne, down 0.28%, within a $361$363 band, while FOB Visakhapatnam slipped from $361 to $360 per tonne, also down around 0.28%, trading between $359 and $361. On the west coast, FOB Mundra Port eased from $365 to $364 per tonne, down roughly 0.27%, and FOB Kandla Port declined from $360 to $359 per tonne, down about 0.28%, while FOB Jawaharlal Nehru Port remained unchanged at $361 per tonne throughout the week.

Export demand from West Africa continued and trades are active from Kakinada and Mundra ports, though buyers remained price-sensitive and sought lower offers. Sellers resisted deeper cuts due to already weak milling margins. Currency movements also influenced buying decisions, with importers initially waiting for dollar strength before the trend reversed. Weather-related disruptions in parts of East Africa, including Madagascar, were reported to have affected inventory positions held by some exporters, influencing shipment planning.

Basmati stays firm on strong demand

The basmati segment moved higher and remained highly active, supported by tight arrivals, controlled selling by large millers and sustained buying from key destinations. FOB prices for 1121 steam increased from $1,051 per tonne on 6 February to $1,061 per tonne on 13 February at both Mundra and Kandla, marking a rise of $10 or about 0.95%, while 1509 steam held steady at $953 per tonne. Supply remained restricted as paddy stocks were concentrated with large processors and mandi arrivals stayed limited, with farmers holding inventory in anticipation of higher realisations, an exporter told BigMint.

As per market sources, demand from Iran and Iraq remained consistent, while expectations of stronger buying from Saudi Arabia ahead of Ramadan supported sentiment. Trade activity also benefited from deal closures during the Gulfood event in Dubai earlier in the season. Demand is currently strong and is unlikely to ease in the near term, keeping the market in an uptrend. The basmati market remains extremely bullish, with prices reacting quickly to supply cues and trade enquiries, often changing within hours as buyers secure volumes and millers release limited stocks.

Outlook

Non-basmati rice prices are expected to remain muted, with domestic weakness offset by steady export demand and stable port parity. Much will depend on the pace of paddy circulation and milling activity in central India, along with currency movement and African buying trends. In contrast, the basmati segment is likely to maintain a firm tone as tight crop availability, stock concentration with large millers and continued demand from West Asia support prices. Short-term corrections may occur, but the broader direction remains upward unless arrivals improve significantly or demand slows.

https://www.bigmint.co/insights/detail/rice-basmati-prices-rise-w-o-w-as-key-markets-continue-purchases-723172Published Date: February 14, 2026