Tags

India: Rice vessel freight rates remain mixed w-o-w as risks persist

- Africa remains the key demand anchor for Indian rice exports

- Container availability and destination-side risk cap freight upside

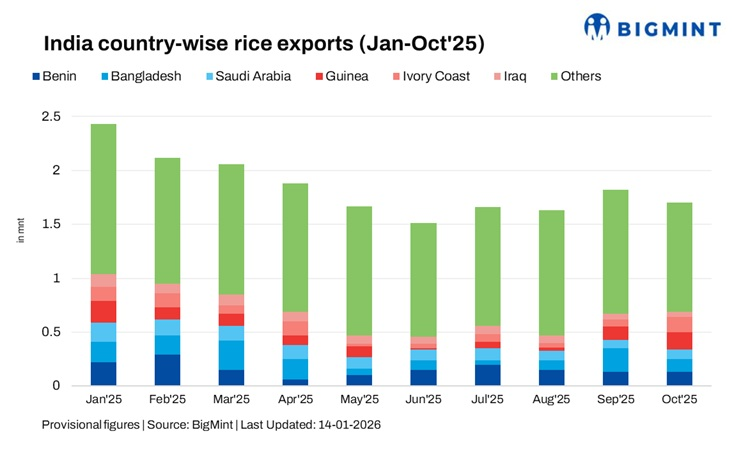

India’s rice export freight sentiment remained mixed in the current week, supported by consistent buying interest from West Africa and select Middle Eastern destinations, while container-side constraints, cautious liner pricing, and destination payment risks limited further upside in rates. Export flows continued to be dominated by Africa-bound shipments, with Benin, Guinea, and Ivory Coast together accounting for a sizeable share of India’s rice exports so far in 2025. According to data, maintained with BigMint, Benin (1.57 mnt), Bangladesh (1.44 mnt), Saudi Arabia (1.17 mnt), Guinea (0.99 mnt), and Ivory Coast (0.86 mnt) emerged as key destinations, reinforcing Africa and the Middle East as the primary demand centres for Indian rice.

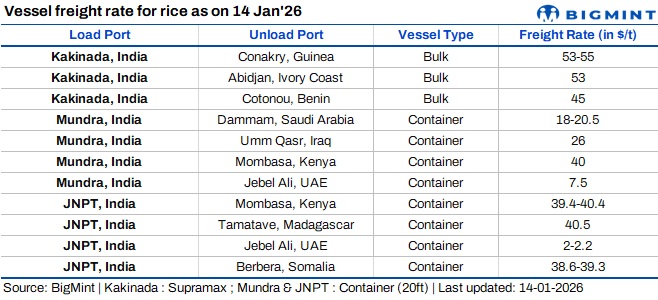

Bulk shipments from India’s east coast, Kakinada, remained active for African destinations, supported by stable parcel formation and regular buying programmes. However, spot freight gains were capped as buyers resisted higher offers amid competitive CIF negotiations and ample availability of Supramax tonnage in the Indian Ocean. On the container side, shipments from Mundra and JNPT to the Middle East and East Africa saw rangebound freight levels, with liner operators maintaining disciplined pricing. While cargo readiness remained healthy, exporters continued to face space management issues, selective blank sailings, and port-specific congestion, particularly on Africa-facing routes.

“The market remains under pressure, with limited cargo availability”, mentioned a source to BigMint.

Another source told, “The market remained largely quiet during the Makar Sankranti/Pongal holidays across regions, with limited activity keeping overall sentiment subdued.”

Meanwhile, India’s rice exports have strengthened following the easing of export restrictions, improving cargo availability and sustaining higher shipment volumes. The increase in seaborne flows, particularly to Africa and the Middle East, has supported steady vessel and container demand, reinforcing freight activity despite competitive pricing and cautious chartering behaviour.

Additionally, payment risk and currency considerations also influenced sentiment. Trade to destinations such as Iraq and parts of Africa remained selective due to LC confirmation timelines and counterparty risk. In addition, uncertainty around Iran-bound trade, amid geopolitical tensions and payment-related challenges, has added caution to Middle East-facing shipments, prompting exporters to prioritise established buyers and adopt a more selective approach despite steady underlying demand.

Why rice vessel freight remained supported?

- Africa-led demand supports rice freights: Despite easing global container congestion, liner operators-maintained rate discipline through space control and selective blank sailings, preventing sharp freight corrections.

- Soft BDI limits bulk rice freight upside: Current softness in the Baltic Dry Index reflects ample vessel availability across the Indian Ocean, which continues to limit upside on bulk rice freight rates. Despite steady cargo demand, comfortable tonnage supply has kept Supramax rice freights largely rangebound on Africa-bound routes.

- Bunker stability limits freight upside: Bunker prices have remained relatively stable in the current period, helping contain overall voyage costs for both bulk and container operators. This has reduced immediate cost-push pressure on rice freight rates, though any near-term rise in fuel prices could translate into higher freight offers, particularly on longer-haul Africa trades.

- Seasonal supply supports steady trade: Seasonal shipment flows remain supportive, with post-harvest availability and regular export programmes sustaining steady cargo readiness. However, buying remains phased rather than aggressive, resulting in consistent volumes but limiting sharp freight rate appreciation.

Outlook

Looking ahead, Indian rice export freight rates are expected to remain largely stable with a mild upward bias. While geopolitical developments and potential tariff risks linked to Iran have introduced caution – particularly due to payment delays and contractual uncertainty – steady demand from Africa and parts of the Middle East, along with continuity in India’s export policy, should provide underlying support.

However, upside potential is likely to be capped by container-side capacity constraints and destination-specific payment risks. Bulk routes into Africa may see selective firmness if parcel availability tightens, but overall freight sentiment is expected to remain neutral to slightly firm in the near term.

https://www.bigmint.co/insights/detail/india-rice-vessel-freight-rates-remain-mixed-w-o-w-as-risks-persist-714370Published Date: January 15, 2026